Handling payroll in India isn’t just about admin anymore – it’s now tied to how well risks are managed. As...

Read MorePayroll Software in India

AI-Powered Payroll – Smarter,

Faster, and Stress-Free

Asanify effortlessly simplifies payroll processing with AI-powered automation, handling salary calculations, statutory compliance, and seamless bank transfers – all within a single platform!

- Complete your Payroll process in just 5 seconds.

- Zero Error in Payments and all Statutory Compliances

- Bank transfer of Salaries, and instant Payslip

Get Started for Free

At Glance

Be a Star with Asanify – Payroll That Works for You!

Managing payroll shouldn’t slow you down—it should empower you! With Asanify’s Payroll Outsourcing, you get

- Zero Payroll Stress: We handle everything—processing, compliance, and taxes—so you focus on what truly matters.

- Faster Payouts, Happier Teams: One-click payroll execution with timely, accurate payments every time.

- Compliance You Can Trust: Stay ahead of local and global tax regulations without lifting a finger.

- Global Reach, Local Expertise: Pay employees and contractors across 200+ countries with best-in-class FX rates.

- Smart Automation, Maximum Savings: Reduce manual work, cut costs, and make payroll a seamless experience.

India's #1Rated Platform for Payroll & all Statutory Compliances on G2

Seamless Payroll with Zero Errors

Consolidate all your contractor payments, and Execute payroll in just one-click. What’s more, you can do a single transfer for multiple contractors, across the various countries and currencies.

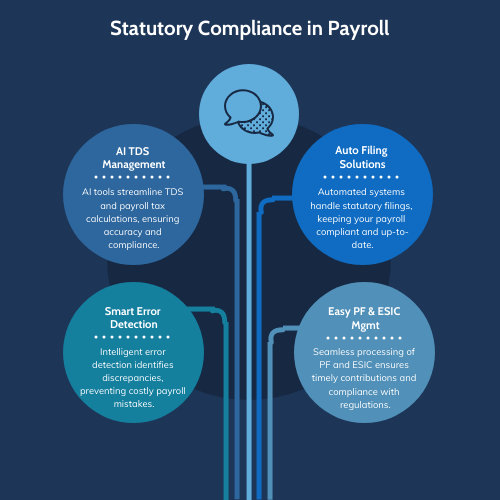

Statutory Compliance in Payroll

Effortless Payroll Compliance with AI – 100% Accuracy, 0% Penalties

Managing payroll compliance is challenging, but Asanify’s AI-driven system ensures accuracy, real-time updates, and hassle-free adherence to PF, ESIC, Professional Tax, and TDS—eliminating penalties and last-minute filings.

- AI-Powered TDS & Payroll Tax Computation

- Automated Statutory Filings & Updates

- Intelligent Error Detection & Prevention

- Seamless PF & ESIC Processing

Expense Management

Track, Control & Optimize Business Expenses with Ease

Managing expenses is time-consuming, but Asanify’s AI-driven system automates tracking, approvals, and reimbursements, ensuring error-free reports, real-time monitoring, and seamless payroll integration for complete control over spending.

- Automated Expense Tracking

- Smart Policy Compliance

- One-Click Reimbursements

- Real-Time Insights & Reports

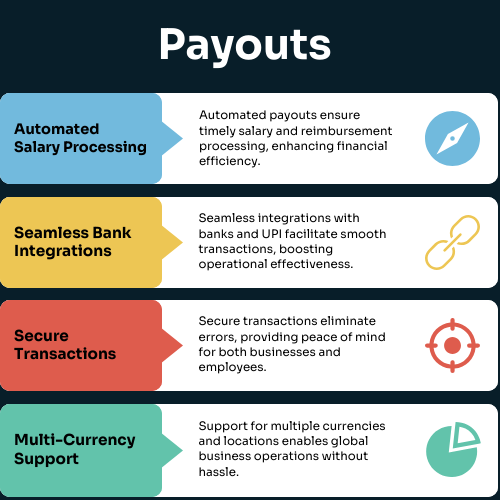

Payouts

Effortless Salary & Vendor Payments in One Click

Eliminate delays and errors with Asanify’s AI-powered payout system. Automate salary disbursements, reimbursements, and vendor payments with real-time tracking, bank integrations, and 100% accuracy—ensuring employees and partners are paid on time, every time.

- Automated Salary & Reimbursement Processing

- Seamless Bank & UPI Integrations

- Error-Free & Secure Transactions

- Multi-Currency & Multi-Location Support

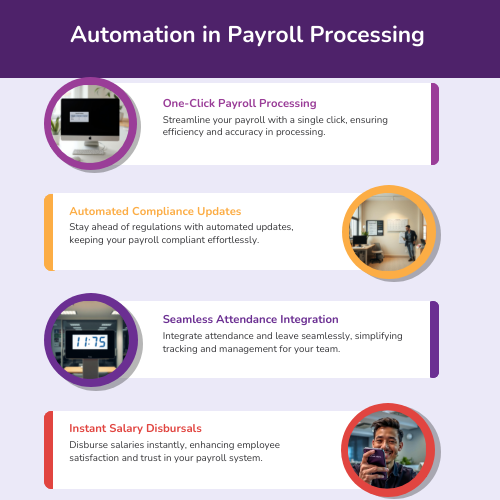

Automation in Payroll Processing

Automate Payroll & Focus on What Matters

Asanify’s AI-driven automation ensures instant salary calculations, compliance checks, and one-click disbursals, adapting to payroll trends, tax laws, and employee changes for accuracy and efficiency.

- One-Click Payroll Processing

- Automated Compliance Updates

- Seamless Attendance & Leave Integration

- Instant Salary Disbursals

Meet the clients who made us No.1

What our happy customers say

Asanify's, should be the number 1 choice for companies looking to pay their overseas employees and contractors. I have a team of 40 people in India and not for a single month have i experienced any delays in the payment process.

In my business, things happen fast, and requirement for new employees is sudden. In such a situation a trusted partner like Asanify comes in handy as I know I can quickly ramp with onboarding and employee formalities diligently taken care of.

As a global company, we go through M&As in countries where we do not have presence. In India, we quickly onboarded ~30 employees as part of a takeover. With Asanify's turnaround time the overall change was managed brilliantly.

Asanify’s expertise when it comes to Local Compliances is something I have benefitted extensively from. Whether its Employee-Contractor classification, or the local laws for employee benefits and working hours - I trust the guidance provided.

Apart from using EOR services, I find a lot of value in the fully automated Asanify HRMS. For me, it makes it absolutely comfortable that I can access all my HR inforation anytime, anywhere and on any platform - Slack, Whatsapp etc.

My employees are in India, while I am based in Dubai and the co. in the US. Managing time zones is a huge challenge for us. Working with global partners like Asanify ensures that all my payments, and query resolutions are done in time.

It is paramount that my employees are well taken care of. Asanify goes above and beyond In terms of employee benefits, salary structuring to make it more tax friendly and constant guidance. For over a year with Asanify’s EOR, I have had no reason to feel disappointed.

Read some of our useful Blogs on Payroll Software

Payroll Made Easy: 7 Best Payroll Software Solutions in Indonesia (2025)

Payroll in Indonesia entails more than merely transferring wages. It is a complex mechanism governed by strict labor laws and...

Read MoreTop 10 Payroll Companies in Pune (2025): A Complete Guide

Pune has rapidly transformed into one of India’s leading business cities, with thriving IT parks, automotive clusters, engineering industries, and...

Read MoreSome Frequently Asked Questions on Payroll Software

What is Asanify’s Payroll Software?

Asanify’s Payroll Software automates salary processing, tax compliance, and employee payments—ensuring fast, error-free, and compliant payroll for businesses of all sizes.

How does Asanify simplify payroll processing?

With Asanify, you can run payroll in just one click, automate tax calculations, generate payslips, and ensure on-time salary disbursements—without manual effort.

Does Asanify’s payroll software handle tax and compliance?

Yes! Asanify ensures 100% compliance with PF, ESI, TDS, PT, LWF, and other statutory laws, keeping you updated with regulatory changes automatically.

Can Asanify handle payroll for remote and global teams?

Absolutely! Asanify supports payroll processing in India and across 200+ countries, ensuring seamless payments and compliance for remote employees and contractors.

What payment methods does Asanify’s payroll software support?

Asanify integrates with major banks and supports direct bank transfers, batch payments, and automated disbursements, ensuring seamless and timely salary payments.

Can employees access their payroll details through Asanify?

Yes! Employees can use the Employee Self-Service (ESS) portal to view payslips, download tax documents, submit reimbursement claims, and track payroll details anytime.

Does Asanify provide payroll reports and analytics?

Yes! Asanify offers real-time payroll reports, salary breakdowns, tax summaries, and compliance tracking, helping businesses make informed payroll decisions.

Is Asanify’s payroll software secure?

Absolutely! Asanify uses bank-grade encryption and follows GDPR & SOC 2 standards to ensure secure payroll data handling and employee information protection.

How quickly can I set up payroll with Asanify?

Asanify’s payroll software is easy to set up and allows you to process payroll within days. Our team assists in onboarding and configuration for a seamless experience.

Who can benefit from Asanify’s Payroll Software?

Startups, SMBs, and enterprises looking for an automated, compliant, and cost-effective payroll solution benefit the most from Asanify’s software.