Payroll in India is no longer a simple “salary in, salary out” routine. In 2025, HR and finance teams juggle central and state-level compliance (TDS, PF, ESIC, Professional Tax), statutory payouts (bonus, gratuity), multi-branch operations, remote and hybrid work, and growing expectations for self-service and mobile access. Meanwhile, many companies are bracing for changes under the new labour codes while, at the same time, continuing to meet existing obligations under the Income Tax Act, EPF & MP Act, and ESI Act.

Manual spreadsheets creak under this complexity errors lead to unhappy employees and penalties. That’s why adopting Payroll Software in India has become mission-critical for SMEs, startups, and fast-growing enterprises. The right software eliminates repetitive work, keeps you compliant by design, and delivers a modern experience with e-payslips, employee portals, and one-click filings. If you’re aiming to run payroll faster, safer, and smarter in 2025, this guide is for you.

Table of Contents

- What is Payroll Software in India?

- Types of Payroll Software in India

- Benefits of Payroll Software in India

- 7 Best Payroll Software Solutions in India (2025)

- How to Choose the Right Payroll Software in India

- Feature and Pricing Comparison Table

- Future of Payroll Software in India 2025 and Beyond

- Streamline Your Payroll Workflow with Asanify’s Localized Solution

- Conclusion

- FAQs

What is Payroll Software in India?

Payroll software in India is a dedicated system that calculates salaries and applies statutory deductions like TDS, PF, ESIC, and Professional Tax according to Indian regulations. It typically includes:

- Automated calculations for earnings, deductions, arrears, overtime, variable pay, and reimbursements.

- Compliance workflows to generate returns/challans (e.g., EPF ECR, ESIC contributions, PT statements) and Form 16 for employees.

- Payslip generation and delivery via email, portals, or mobile apps.

- Document capture and employee data fields aligned to Indian norms (Aadhaar, PAN, UAN, ESIC number, bank details).

- Integrations with attendance/leave systems, accounting tools, and banking rails for salary disbursement.

Localized solutions reflect Indian salary structures CTC breakdowns, HRA/LTA rules, FBP, investment declarations and often support regional languages for wider adoption.

Types of Payroll Software in India

From agile cloud-based tools to on-premise systems, Payroll Software in India spans options for every size and sector. Many firms prefer HRMS suites with integrated payroll for seamless onboarding, attendance, and payouts, while others choose outsourced payroll with software access to minimize in-house effort. Enterprise-grade platforms add multi-entity control, advanced analytics, and ERP integrations. Your best fit depends on headcount, TDS/PF/ESIC/PT complexity, data residency needs, and required integrations.

Cloud-Based Payroll Software

Delivered as SaaS, these solutions push real-time compliance updates, offer anywhere access, and integrate easily with HRIS, time & attendance, accounting, and banking. They’re scalable and affordable, making them ideal for SMEs, startups, and hybrid teams.

On-Premise Payroll Software

Installed on your own servers for maximum data control popular with large enterprises, legacy environments, or regulated sectors. You’ll shoulder higher upfront costs and ongoing IT maintenance, but gain tight control over data residency and customizations.

HRMS with Payroll Integration

A unified HR + payroll stack that connects onboarding, attendance, leave, performance and more with payroll. This reduces duplication, ensures consistent employee data, and enables end-to-end workforce analytics.

Payroll Software with Outsourcing Services

A hybrid model: a provider’s team runs payroll operations while you retain portal access for visibility and approvals. Great for companies wanting minimal in-house effort with strong SLA-backed compliance.

Enterprise Payroll Solutions

Built for multi-entity, multi-location operations with complex salary structures, expat payroll, intricate policies, and advanced analytics. Often integrates with ERP suites (SAP/Oracle) and supports elaborate approval hierarchies and audits.

Benefits of Payroll Software in India

- Lower compliance risk: Automated TDS/PF/ESIC/PT calculations, filings, and due-date reminders reduce penalties.

- Faster processing: Close monthly payroll in hours instead of days with bulk actions and templates.

- Fewer errors: Rule-based engines and validation checks eliminate manual mistakes.

- Happier employees: Self-service portals for payslips, tax proofs, investment declarations, and queries.

- Seamless integrations: Connect to HRIS, time & attendance, accounting, and banking.

- Mobile-first workflows: Managers approve on the go; employees access payslips and tax docs anytime.

- Audit-ready: Centralized records, version history, and exportable reports for internal and statutory audits.

7 Best Payroll Software Solutions in India (2025)

Discover a curated shortlist of 7 best Payroll Software in India (2025) spanning local leaders and global suites trusted by SMEs to large enterprises. Each tool is vetted for TDS, PF, ESIC, PT compliance depth, Form 16 workflows, payslip delivery, self-service, and mobile access. We also factor in usability, integrations, pricing transparency, and the quality of India-based support.

Asanify

Asanify automates the heavy lifting – TDS, PF, ESIC, Professional Tax, bonus, gratuity, and investment declaration workflows. It supports multi-state compliance, smart validation checks, and payroll calendars to ensure nothing slips through. One-click salary disbursements via bank integrations and instant e-payslips keep paydays smooth. Employees use self-service to submit proofs, download Form 16, and track reimbursements from mobile. Finance teams get role-based approvals, audit-ready registers, and seamless integrations with HRIS and accounting.

Salary Disbursement and Payslip Delivery

- One-click salary disbursements via secure bank integrations

- Instant digital payslips for every pay cycle

- Finance-ready reports: clean registers, ledgers, and challan summaries

- Employee self-service: access payslips and tax documents on web or mobile

All-in-One Payroll and HR Management with EOR Capability

- Onboarding workflows

- Document collection & secure storage

- Leave & attendance management

- Employer of Record (EOR) to hire in India without a local entity

- Ideal for global firms hiring in India and Indian companies expanding abroad

Keka

Keka combines an easy, employee-friendly design with strong payroll features. It automates TDS, PF, ESIC, and Professional Tax (PT), handles investment proof (POI) submissions, and supports flexible Indian salary structures. Built-in HR tools—like performance, timesheets, and attendance make it a solid pick for mid-size companies that want one connected system. Pricing is usually per employee per month, with optional add-ons.

You also get a mobile app for payslips and POI, clear payroll dashboards, and automatic Form 16 and e-challans (even for multi-state PT). Keka connects to attendance, accounting, and ERP systems through APIs so data stays in sync. Setup is guided with migration templates and India-based support teams, helping you go live quickly.

GreytHR

A long-time favorite among SMEs, GreytHR emphasizes compliance confidence: PF/ESIC/PT filings, Form 16, ECR generation, and a comprehensive library of reports. The employee self-service app simplifies leave, attendance, and payslips. Expect affordable plans and quick implementation.

You also get investment declaration (POI) workflows, automated reminders/compliance calendars, and maker–checker approvals to reduce errors. GreytHR integrates with attendance systems and accounting tools (e.g., Tally/ERPs) to keep data consistent. Onboarding is smooth with migration templates and India-based support for fast go-live.

Zoho Payroll (India Edition)

Zoho Payroll integrates natively with the Zoho ecosystem (Books, People, etc.). Its India edition supports TDS, PF, PT, and standard payroll cycles with a familiar UI. For businesses already on Zoho apps, it offers an efficient path to centralized operations. Pricing follows SaaS-based models with tiers.

You also get investment declaration (POI) workflows, auto-generated Form 16/e-challans, and support for multi-state PT. Tight links to Zoho Books and Zoho People sync attendance/expenses and post payroll journals for clean month-end closes. APIs, webhooks, and guided onboarding/migration templates help teams go live quickly with minimal disruption.

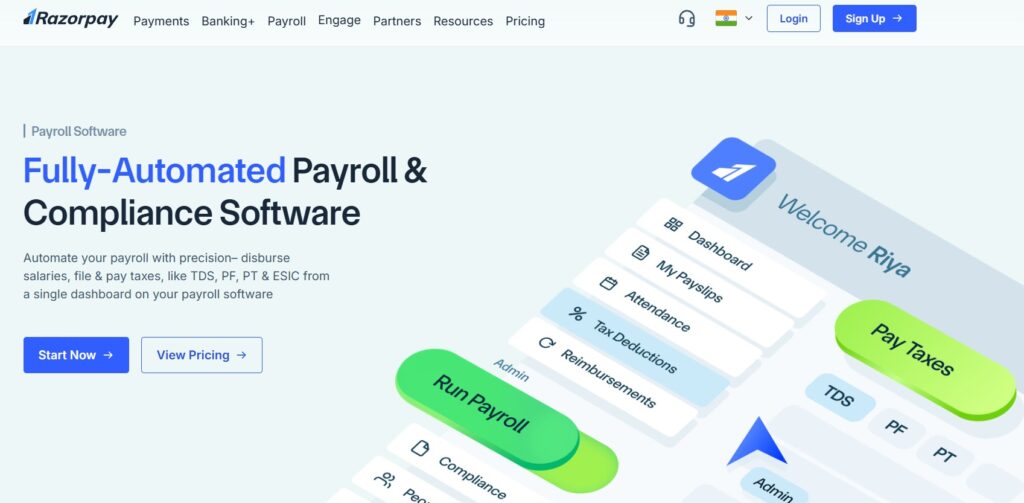

RazorpayX Payroll

Geared toward startups and tech-first firms, RazorpayX Payroll connects payroll to banking rails for smooth salary disbursement. It handles TDS, PF, ESIC and offers dashboards for founders/finance teams. If you’re already using Razorpay for collections/payouts, this is a natural extension. Pricing tends to combine subscription + usage components.

You also get investment declaration (POI) workflows, auto-generated Form 16 and PF/ESIC e-challans, plus maker–checker approvals for audit readiness. Native banking rails enable instant/scheduled salary payouts, reimbursements, and contractor payouts from a single dashboard. API integrations (attendance/accounting) and guided migration help startups go live quickly with minimal lift.

PeopleStrong Alt

An enterprise-grade HR and payroll platform, PeopleStrong excels in multi-location, multi-entity complexity, configurable policies, and advanced analytics. It suits organizations seeking deep HR modules with strong payroll governance, role-based access, and ERP-grade integrations. Pricing is typically custom.

You also get POI (investment declaration) workflows, auto-generated Form 16/e-challans, compliance calendars, and maker–checker approvals. Native connectors/APIs for SAP/Oracle, attendance, and accounting keep records in sync, while SSO, RBAC, and audit logs meet enterprise security expectations. Implementation is phased with migration tooling, sandbox testing, and India-based success teams operating under SLAs.

Saral PayPack

A trusted on-premise option noted for statutory depth and configurable rules. Saral PayPack fits organizations that prefer in-house hosting or have stringent data residency needs. It covers the essentials TDS, PF, ESIC, PT with extensive reporting. Expect a license-based pricing model and IT-managed deployment.

You also get POI (investment declaration) workflows, auto-generated Form 16/e-challans, multi-branch payroll, and maker–checker approvals for tighter control. Integrations with Tally/ERPs via file or API connectors plus batch imports (attendance, masters) keep data in sync. Role-based access, backup/DR options, and on-prem ESS via intranet/VPN are common, with vendor-led migration and admin training during rollout.

Feature & Pricing Comparison Table

| Software | TDS/PF/ESIC/PT Support | Multi-State Compliance | Self-Service | Mobile App | Best For | Pricing Model |

| Asanify | Yes | Yes | Yes | Yes | SMEs & Global (EOR) | Subscription-based |

| Keka | Yes | Yes | Yes | Yes | Mid-size firms | Tiered plans |

| GreytHR | Yes | Yes | Yes | Yes | SMEs | Affordable plans |

| Zoho Payroll | Yes | Limited | Yes | Yes | SMEs, Zoho users | SaaS pricing |

| RazorpayX | Yes | Yes | Partial | Yes | Startups | Subscr. + usage |

| PeopleStrong | Yes | Yes | Yes | Yes | Enterprises | Custom pricing |

| Saral PayPack | Yes | Yes | Limited | No | Compliance-heavy, On-prem | License-based |

Note: Feature availability and pricing vary by plan. Confirm specifics during vendor evaluation.

How to Choose the Right Payroll Software in India

Use this quick, scannable checklist to narrow your options and avoid buyer’s remorse.

- Assess headcount & workforce mix: SMEs (≤250) usually thrive on cloud payroll; large, distributed teams may prefer enterprise HRMS or on-prem for control.

- Evaluate payroll complexity: If you manage multi-state PT, frequent variable pay, overtime, or shift differentials, pick engines that natively model your pay rules (no hacks).

- Check compliance coverage: Must-haves: TDS, PF, ESIC, PT, bonus, gratuity, and Form 16 with timely statutory updates.

- Confirm language & document support: Look for investment declarations (POI), proofs, Aadhaar/PAN, UAN, ESIC capture, and regional language options if needed.

- Compare pricing models: Weigh subscription (PEPM) vs license-based; include setup/migration and support costs in total ownership.

- Demand local support & reputation: Prefer India-based support teams, SLAs, and references in your industry.

Use-case playbook

- Startup (~40 employees, 2 states): Cloud payroll + RazorpayX or Asanify → speed, banking rails, self-service

- SME (~200 employees, 5 states): GreytHR or Keka → HRMS depth + multi-state compliance

- Enterprise (2,000+ employees, multi-entity): PeopleStrong or hybrid ERP integration; consider on-prem → complex policies, RBAC, audit trails

- Global expansion: Asanify EOR → hire in India without setting up a local entity

| Company Profile | Recommended Approach | Why It Fits |

|---|---|---|

| Startup (~40 employees, 2 states) | Cloud payroll + RazorpayX or Asanify | Fast go-live, banking rails, self-service, low admin lift |

| SME (~200 employees, 5 states) | GreytHR or Keka | Strong HRMS + deep compliance for multi-state operations |

| Enterprise (2,000+ employees, multi-entity) | PeopleStrong or hybrid ERP integration; consider on-prem | Complex policies, RBAC, audit trails, ERP-grade controls |

| Global expansion | Asanify EOR | Hire in India compliantly without setting up a local entity |

Future of Payroll Software in India (2025 and Beyond)

- AI/ML validation: Flag anomalies (misapplied allowances, atypical deductions) before payout.

- Real-time compliance syncing: Deeper connectivity with EPFO/ESIC/IT systems for status checks and auto-filled filings.

- On-demand & instant payout: Salary advances and milestone-based payouts via UPI/IMPS rails.

- Gig & contractor payroll: Streamlined payments, TDS on contractors, and automated invoicing.

- Mobile-first everything: Employees manage proofs, declarations, and queries from their phones.

- Compliance dashboards: Heatmaps of risk, due-date calendars, and automated alerts.

- Aadhaar e-sign & eKYC: Faster onboarding, paperless compliance, and secure document flows.

Streamline Your Payroll Workflow with Asanify’s Localized Solution

Asanify brings payroll, HR, and global hiring into one clean platform ideal if you want Indian compliance without the complexity. It automates TDS, PF, ESIC, PT, bonus, gratuity, and Form 16, supports one-click salary disbursements via bank integrations, and generates instant e-payslips with audit-ready registers. Policies are fully configurable for overtime, shifts, variable pay, and complex salary structures, while employees get mobile self-service for declarations, proofs, and payslips anytime. It’s also EOR-ready, so you can hire in India (or beyond) without setting up a local entity fast and compliant.

Standout differentiators of this Payroll Software in India include India-first compliance with multi-state PT, rapid implementation with migration assistance, role-based approvals with granular audit logs, and a friendly UX that works for both employees and finance teams.

Conclusion

In India’s evolving regulatory landscape, payroll software is the safest, fastest path to accurate paydays and consistent compliance. By automating TDS/PF/ESIC/PT, digitizing proofs and declarations, and enabling self-service, the right tool frees HR and finance to focus on strategy. Shortlist 2–3 vendors, take demos with your actual paysheet scenarios, and choose the platform that best fits your headcount, complexity, and growth plans.

FAQs

For SMEs, expect ₹20–150 per employee/month depending on modules (attendance, HRMS, onboarding). Enterprises typically see custom quotes, plus implementation/migration fees. Many vendors offer free trials or pilot programs.

Yes. Platforms like Asanify, GreytHR, and Keka automate TDS, PF, ESIC calculations and generate filings/challans. Always verify the exact forms and e-filing integrations during your demo.

Most leading tools support multi-state PT with state-specific rules and due dates. Confirm states you operate in and test sample runs.

Yes. Asanify, Keka, GreytHR, Zoho Payroll and others offer mobile apps/portals for payslips, leave, attendance, and declarations.

SMEs: 1–3 weeks including data migration and test runs.

Enterprises: 4–8 weeks (or more) depending on HRMS scope, integrations, and approvals.

Yes. Most solutions support full-time, part-time, interns, contractors, and even gig workers each with their own pay rules and TDS logic.

Yes. Many platforms capture and securely store Aadhaar, PAN, UAN, ESIC numbers, investment proofs, and bank details with access controls.

Vendors like Asanify, GreytHR, Keka, PeopleStrong provide India-based support with SLAs and onboarding help. Check for regional language support if relevant.

Track time saved per cycle, reduction in errors/penalties, employee query volume, and first-pass accuracy. Finance teams often see tangible wins within 1–2 cycles.

Not to be considered as tax, legal, financial or HR advice. Regulations change over time so please consult a lawyer, accountant or Labour Law expert for specific guidance.