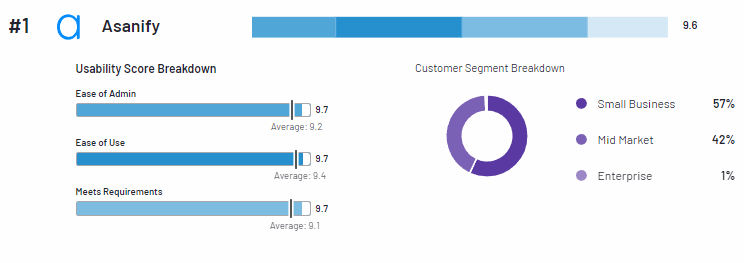

Highest Rated Platform and Service Provider Globally (by G2, Capterra & Software Suggest)

Asanify ranked #1 Professional Employer Organisation Company in India

At Asanify, we understand the challenges of managing human resources in today's dynamic business landscape. That's why we're here to simplify your HR operations and empower your business to thrive. Asanify is the best PEO company in India. With our comprehensive PEO (Professional Employer Organization) services tailored for the Indian market, we offer a one-stop solution for all your HR needs.

Consolidated payouts for all your employees. Transfer money in your local currency with the best-in-class FX Rates

Accurate, complete, and timely filing for all Statutory Compliances to ensure a zero-hassle experience for your employees

HRMS to track Attendance, Time-Offs, Expenses, Goals and Performance Management to maximise team productivity

Book a meeting with the #1 ranked PEO service in India

Asanify is trusted by 1500+ Clients across the world including Nasdaq, Bombay Stock Exchange listed companies and several YC and Sequoia-funded Startups

India's Highest-rated Payroll and HRMS platform on G2, Capterra, Software Suggest, and Google

Employee Benefits in India

In India, employee benefits are an essential component of the overall compensation package offered by employers to attract and retain top talent. Here are some common employee benefits made available to employees in India:

1. Health Insurance: Many employers offer comprehensive health insurance coverage to employees and their dependents, providing financial protection against medical expenses, hospitalization, and treatment costs.

2. Provident Fund (PF): The Employee Provident Fund (EPF) is a retirement savings scheme mandated by law for employees in India. Both employers and employees contribute a percentage of the employee's salary to the EPF account, which serves as a long-term savings fund for retirement.

3. Gratuity: Gratuity is a statutory benefit provided to employees as a token of appreciation for their long-term service to the organization. It is payable upon retirement, resignation, or termination and is calculated based on the employee's tenure of service and last drawn salary.

4. Employee Stock Options (ESOPs): Many companies offer ESOPs as a form of incentive and reward to employees, allowing them to purchase company shares at a discounted price or as part of their compensation package. ESOPs provide employees with an opportunity to share in the company's success and growth.

5. Leave Benefits: Employees are entitled to various types of leave benefits, including earned leave (annual leave), sick leave, and maternity/paternity leave, as mandated by law or company policy. These leave benefits ensure that employees can take time off from work when needed without loss of pay.

6. Transportation Allowance: Some employers provide transportation allowances or reimbursements to employees to cover the cost of commuting to and from work. This benefit helps ease the financial burden of transportation expenses for employees.

7. Meal Allowance: Employers may offer meal allowances or provide subsidized meals to employees during working hours, ensuring that employees have access to nutritious meals while at work.

8. Flexible Work Arrangements: Increasingly, employers are offering flexible work arrangements such as remote work, flexible hours, and telecommuting options to promote work-life balance and enhance employee productivity and satisfaction.

9. Training and Development: Employers may invest in employee training and development programs to enhance employees' skills and competencies, fostering career growth and advancement opportunities within the organization.

10. Wellness Programs: Wellness programs such as fitness memberships, yoga classes, health screenings, and counseling services are becoming more common in workplaces to promote employee health and well-being.

These are just a few examples of the employee benefits made available to employees in India. The specific benefits offered may vary depending on factors such as industry, company size, and organizational culture.

What our Customers have to say about us...

Managing state and central compliances in India can be a nightmare. With Asanify's PEO service in India, we literally got started in 1 Day with all our employees onboarded. Payroll execution for us is now a 5-minute job every month. Our employees are delighted to have the security of state compliances and payslips to show for their income. Truly elated with Asanify's global PEO services!

Bridget Martinez

United Healthcare Staffing, US

Asanify's hands-on support in the PEO India services is commendable. It is indeed one of the best PEO service providers in India. Their teams are available round-the-clock and this ensures that my employees are never stuck with any aspect of their Payroll / Taxes. The HRMS platform offered by Asanify makes it very easy to for us manage employees remotely.

Stella Jones

Pransform Inc.

PEO Services in India

Professional Employer Organizations (PEOs) in India offer a wide range of services aimed at simplifying and optimizing human resource management for businesses. Top PEO India service providers such as Asanify offers the following crucial services:

- Payroll Processing: Running payroll manually is a back-breaking task. On top of that, the risk of committing calculation errors looms large. That's where PEO services enter the scene. PEOs handle payroll processing tasks, including salary calculation, tax deductions, reimbursements, and statutory compliance. By outsourcing payroll, businesses can ensure accuracy, timeliness, and compliance with labor laws and tax regulations.

- Employee Benefits Administration: PEOs manage employee benefits programs, including health insurance, retirement plans, and leave policies. Starting from enrollment, communication, claims processing, and regulatory compliance to relieving businesses of administrative burden and ensuring employee satisfaction, a PEO service provider in India takes into account all these tasks.

- Compliance Management: Ensuring local compliances in a new country is surely going to be a complex task. However, with the help of an India PEO partner, you can easily navigate complex labor laws, regulations, and compliance requirements. PEO service providers help you stay updated on legal changes, ensure adherence to statutory obligations such as PF, ESI, PT, and Gratuity, and mitigate risks associated with non-compliance.

- HR Administration: PEOs provide comprehensive HR administration services, including employee onboarding, offboarding, record-keeping, and document management. They maintain employee databases, manage personnel files, and facilitate HR transactions to streamline administrative processes.

- Talent Acquisition and Recruitment: PEOs offer recruitment support to businesses by sourcing, screening, and hiring candidates for various positions. They leverage their networks, expertise, and recruitment tools to identify qualified talent, conduct interviews, and facilitate the hiring process efficiently.

- Training and Development: PEOs may provide training and development programs to enhance employee skills, performance, and productivity. They offer online training modules, workshops, and skill development initiatives tailored to the needs of businesses and their workforce.

- Employee Relations and Conflict Resolution: Partnering with a global PEO service provider is essential to handle employee relations matters, including grievances, disputes, and disciplinary actions. They provide guidance, mediation, and resolution strategies to maintain a positive work environment and foster healthy relationships between employers and employees.

- HR Technology Solutions: Many PEOs such as Asanify offer HR software platforms and technology solutions to streamline HR processes, enhance communication, and improve decision-making. These platforms include dedicated modules for payroll management, attendance tracking, performance appraisal, and employee self-service.

- Risk Management and Insurance Services: PEOs help businesses manage risks related to employee benefits, workers' compensation, and liability insurance. They offer insurance products, risk assessment, claims management, and safety programs to mitigate financial and legal risks associated with workforce management.

- Strategic HR Consulting: The best PEO service providers in India provide strategic HR consulting services to help businesses align their HR practices with organizational goals and industry best practices. They offer insights, recommendations, and customized solutions to optimize HR strategies and drive business growth.

Running payroll in India can be complex. It gets easier when you use PEO services in India.

Taking care of payroll processing while running a company can be quite difficult. This is because a salary structure comes with diverse components. Taking into account all these elements may turn out to be a tricky task if you are doing it single-handedly. However, partnering with a PEO India company will aid you in running payroll seamlessly.

A PEO India service provider streamlines payroll processing for client businesses by managing all aspects of salary calculation, tax deductions, reimbursements, and statutory compliance. They gather relevant payroll data, including employee attendance and wage rates, calculate salaries according to company policies and legal requirements, handle tax deductions, process reimbursements and deductions, generate pay slips, and ensure timely salary disbursal.

PEOs also stay abreast of evolving labor laws and tax regulations, ensuring compliance with statutory requirements such as Provident Fund (PF), Employee State Insurance (ESI), Professional Tax (PT), and Gratuity. By outsourcing payroll processing to a PEO, businesses can improve accuracy, reduce administrative burden, mitigate compliance risks, and focus on core activities essential for business growth.

Operating in India entails adhering to the statutory compliances. Failing to adhere to these can attract penalties and charges of violation of law. Therefore, partnering with a PEO India company such as Asanify is crucial to stay compliant.

Frequently Asked Questions About Hiring Through PEO India Partner

1. What is a PEO (Professional Employer Organization) and how does it work in India?

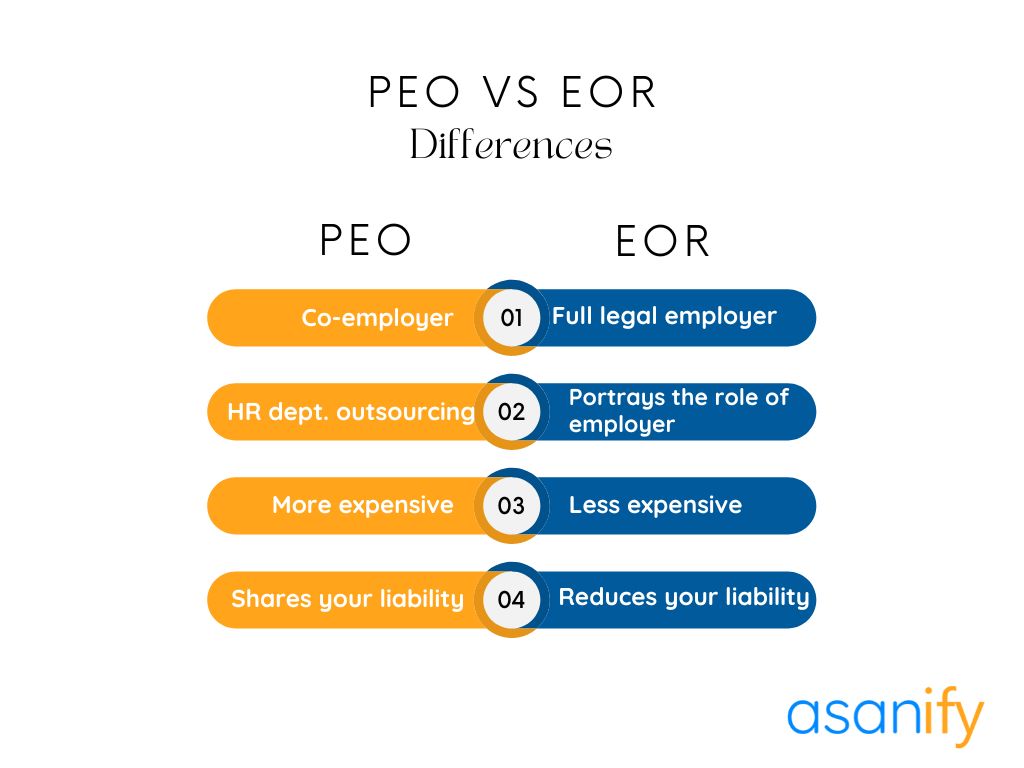

A PEO is a third-party organization that provides comprehensive HR services to businesses, including payroll processing, employee benefits administration, HR compliance, and risk management. PEO service providers in India act as co-employers, sharing certain employer responsibilities with the client company while handling day-to-day HR tasks on their behalf.

2. What are the benefits of using a PEO in India?

Using the services of a PEO company in India offers several benefits, including cost savings, access to expertise, streamlined HR processes, improved compliance, and enhanced focus on core business activities. PEOs help businesses manage HR-related tasks more efficiently and effectively, allowing them to scale and grow without the burden of managing an in-house HR team.

3. Is outsourcing HR functions to a PEO common in India?

Yes, outsourcing HR functions to a PEO is becoming increasingly common in India, especially among small and medium-sized businesses (SMBs) and multinational companies (MNCs) looking to expand their operations in the country. PEOs offer a cost-effective and hassle-free solution for managing HR tasks, allowing businesses to focus on their core competencies.

4. What HR services are typically offered by PEOs in India?

PEOs in India offer a wide range of HR services, including payroll processing, employee benefits administration, HR compliance, talent acquisition, performance management, employee relations, and HR technology solutions. These services are tailored to meet the specific needs of each client company and ensure compliance with local labor laws and regulations.

5. How does co-employment work with a PEO in India?

Co-employment is a key aspect of PEO services in India, where the PEO becomes the legal employer for certain HR purposes while the client company retains control over day-to-day business operations. Under co-employment, the PEO assumes responsibility for tasks such as payroll processing, tax withholding, and benefits administration, while the client company maintains control over hiring, training, and supervision of employees.

6. Are there any legal or regulatory considerations when using a PEO in India?

Yes, there are legal and regulatory considerations to be aware of when using a PEO in India. It's important for businesses to ensure that the PEO is compliant with local labor laws and regulations, including employment contracts, minimum wage requirements, statutory benefits, and taxation laws. Businesses should also clarify the scope of services, responsibilities, and liabilities outlined in the PEO agreement to avoid any legal disputes or compliance issues.

7. How can businesses select the right PEO partner in India?

When selecting a PEO partner in India, businesses should consider factors such as industry expertise, reputation, track record, service offerings, pricing, technology capabilities, and customer support. It's essential to conduct thorough research, ask for references, and evaluate multiple options to find a PEO India partner that aligns with the business's needs and objectives.