Compare Employer of Record vs Contractor in 2025. Learn the key legal, tax, and compliance differences to choose the right model for global hiring success.

Table of Contents

- Introduction

- What is an Employer of Record

- Who is an Independent Contractor?

- Key Differences: EOR vs Contractor

- When to use an Employer of Record

- When to Hire Independent Contractors

- Compliance Risks of Misclassifying Contractors

- Cost Comparison: EOR vs Contractors

- Legal & Tax Considerations

- Use Cases: EOR vs Contractor by Company Type

- Choosing the Right Option: EOR vs Contractor

- Why Global Employers Prefer EOR in 2025

- Partner Highlight

- FAQs

- Conclusion

Employer of Record vs Contractor: 2025 Compliance Guide

Introduction: The Global Hiring Dilemma

If 2025 is a year of anything, then global recruiting certainly is at the top of list-a strategic necessity. A talent solutions provider offers recruitment into international talent pools to fill shelter gaps, to curb costs at home, or to remain in competition. Yet, with such global hiring, compliance seems to be the greatest hurdle of all.

If one is trying to build a remote team across borders-of here-and-there niche talent-let’s have a clear executive record of distinctions between an Employee of Record and an Independent Contractor. Choosing wrongly might bring on penalties for misclassification, trouble with taxes, and even some reputational harm.

The guide goes into differences, benefits, and compliance concerns-of EOR and contractor crimes-to help you make smarter and safer hiring decisions in 2025 and well beyond.

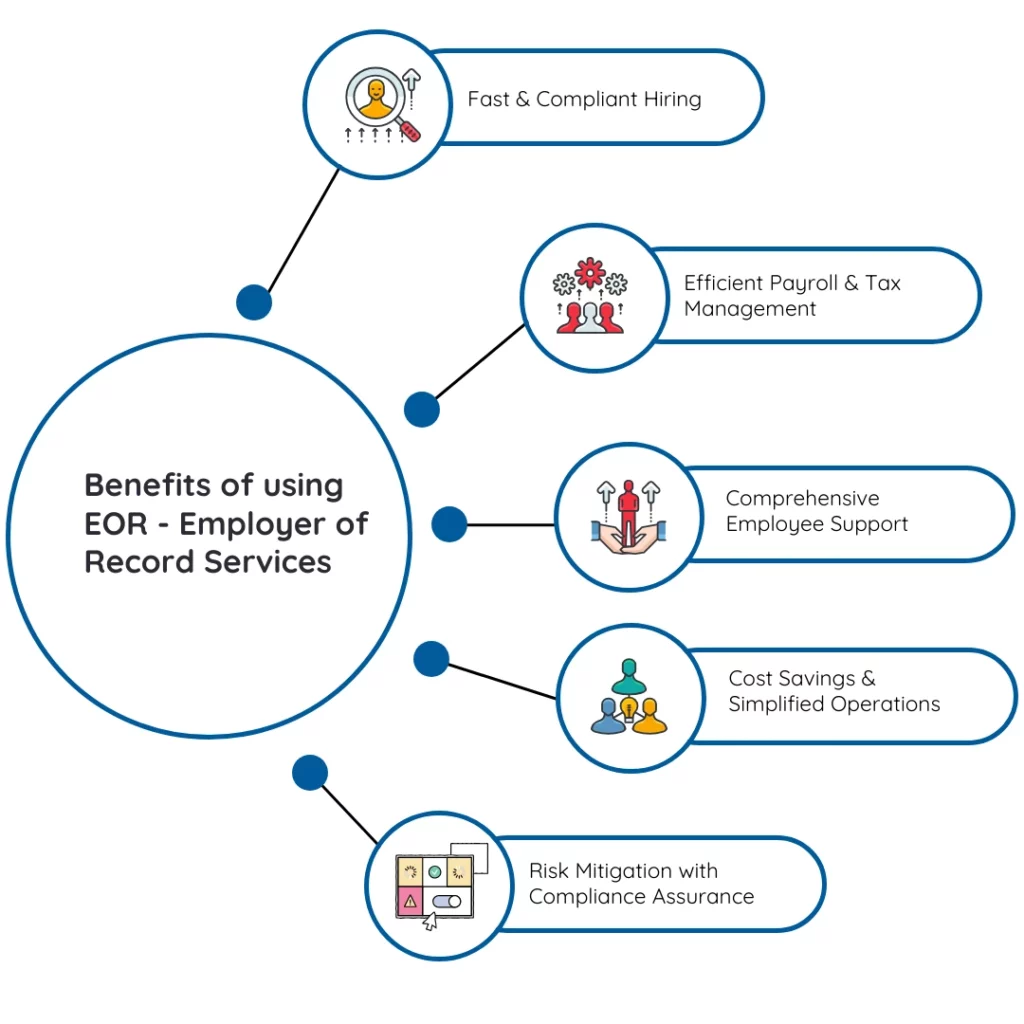

What Is an Employer of Record (EOR)?

An Employer of Record is a third-party company that practically serves as a legal employer for your international hires. This allows you to create full-time employment arrangements for people in countries where you do not have a legal presence of your own, and thus, you do not go through the administrative or legal hassles.

What the EOR Does:

- It legally employs persons for you

- Pays wages and taxes; manages benefits

- Acts on compliance with the local labor laws and work regulations

- Makes payments for social security, health insurance, and so forth, in keeping with statutory requirements

- Lessens the risk of disputes relating to employee misclassification and disputes among labor parties

Example:

The U.S. SaaS company wants to hire a full-time software engineer in Brazil but has no entity there. Instead of setting up one (which could take a couple of months), they use the EOR to employ the engineer legally within weeks.

Who Is an Independent Contractor?

In modern times, one is usually called a contractor when self-employed persons offer services to companies on a project or freelance basis. Contractors, hence, must work on their own with no benefits, paid leave, or perks offered by the company.

Characteristics of a Contractor:

- Works independently, sometimes with multiple client

- Payments made after completion of work or hourly

- Using his own tools, equipment, and manner of work

- Not considered part of the company and thus has to realize his own taxes

- Can choose when to work, where, and how

Suggested Read: What is an Employer Of Record? A Complete Guide

Key Differences: EOR vs Contractor

| Feature | Employer of Record (EOR) | Independent Contractor |

| Legal Employment | Yes (through EOR) | No |

| Payroll & Tax Handling | Managed by EOR | Contractor handles their own |

| Benefits (Health, PTO, etc) | Provided by EOR | Not provided |

| Risk of Misclassification | Low | High if treated like an employee |

| Ideal For | Long-term, full-time roles | Short-term or project-based work |

| Compliance Responsibility | EOR takes care of it | Contractor is responsible |

| Cost | Higher (due to benefits, social taxes) | Lower (no statutory costs or benefits) |

| Control Over Work | More (within employment laws) | Less (contractor has autonomy) |

When to Use an Employer of Record

An Employer of Record is the optimal solution for organizations seeking to expand internationally with less legal and administrative complexity. The following are essential situations where an EOR is the optimal solution:

1. Global Expansion into New Markets without Establishing a Legal Entity

Establishing a foreign entity can take time, cost money, and involve red tape. With an EOR, you can hire talent in a foreign country without submitting to months of entity setup and legal registrations.

2. Recruiting Full-time Remote Workers

If you’re hiring full-time members of your team overseas, particularly those who work solely for your company under your direction- utilizing an EOR keeps you compliant with local employment regulations.

3. Managing Taxes, Local Compliance, and Benefits

From social security taxes to health care and paid time off, every nation has distinct statutory obligations. An EOR processes all of it, freeing your in-house HR and finance teams.

4. Cross-Border Payroll Simplification

Internationally paying employees can be complicated by differences in currency, tax codes, and banking systems. An EOR aggregates payroll across borders and makes timely, compliant payments.

When to Hire Independent Contractors

Hiring independent contractors is a great option when flexibility, speed, and cost-effectiveness are your priorities. Below are common scenarios where contractors are a better fit than full-time employees:

- Short-Term or One-Time Projects: Need a website redesign, product launch support, or a one-off campaign? Contractors can jump in quickly without long-term commitments.

- Access to Specialized Skills: From UI/UX designers to cybersecurity specialists, contracting specialized talent provides you with the skills without increasing your payroll base.

- Reduced Upfront Expenses: Contractors usually bill by the hour or by the project, and you are not required to pay benefits, taxes, or severance—so this model is perfect for cost-sensitive teams or startups.

- Perfect for Freelancers and Consultant: Many professionals prefer independent work due to flexibility. Hiring them as contractors allows both parties to maintain autonomy while collaborating effectively.

Compliance Risks of Misclassifying Contractors

Perhaps the most serious compliance headache in international hiring is misclassifying contractors as employees. Even if the worker is referred to as a freelancer in the agreement, governments will examine the character of the working relationship—not the terminology. If the contractor is working fixed time, having a manager to report to, using company tools, or only serving your company, they can be viewed legally as an employee.

It can result in severe repercussions such as back taxes, fines, and legal proceedings. Businesses might be required to pay retroactive employee benefits, leave pay, or statutory contributions. In certain situations, contractors can also bring lawsuits for wrongful dismissal or unpaid wages.

The danger is even greater since the laws of classification differ extremely across countries. For instance, the U.S. has behavioral and financial control tests, while the UK has IR35 rules, and others such as Germany and Australia follow predominantly how integrated the worker is in your business.

To remain compliant, companies need to accurately evaluate every role, not treat contractors as full-time employees, and ask local legal professionals or hire an Employer of Record if unsure. An EOR guarantees that employees are properly classified and fully compliant with local labor laws—keeping your business safe from expensive errors.

Cost Comparison: EOR vs Contractor

| Factor | EOR | Contractor |

| Upfront Cost | Higher – includes benefits, payroll tax, and admin fees | Lower – no benefits or payroll obligations |

| Long-Term Value | Higher – promotes retention, team integration, and legal security | Lower – short-term output, but limited loyalty |

| Risk Cost | Low – full compliance and protection from penalties | High – misclassification can lead to major fines |

Legal & Tax Considerations

Hiring abroad involves a labyrinth of legal and tax requirements, and the method differs sharply between employing through an EOR and a contractor.

- With an EOR:

The EOR is the employer of record, so they take care of everything—payroll, tax withholding, benefits, social contributions, and labor compliance. Your business is protected from liability, particularly in countries with complicated labor legislation like Brazil, France, or Germany.

- With a Contractor:

The contractor has the responsibility to report their own taxes and do their own legal compliance in their home country. But your company needs to make sure the contract specifically states the independent relationship, the scope of work, and terms of payment to minimize risk.

There are strict regulations in some countries, such as the UK and Canada, that might audit companies that have significant use of contractors. To remain secure, seek advice from local legal experts or utilize an international hiring platform that offers contract templates and compliance advice specific to every nation.

Use Cases: EOR vs Contractor by Company Type

The appropriate hiring model not only varies based on the position, but also your company type and maturity. Here’s how various companies generally employ EORs and contractors:

Startups

- EOR: Perfect for bringing in core full-time employees such as engineers, marketers, or country leads.

- Contractor: Excellent for one-off positions such as app designers, MVP developers, or part-time consultants.

Enterprises

- EOR: Helpful for expanding into new countries in compliance and establishing long-term distributed teams.

- Contractor: Good for short-term consultancy, audits, or country-specific legal or IT work.

Agencies

- Tend to favor contractors for flexible, project-based scaling—particularly with multiple clients and fluctuating workloads.

- Selecting the right model allows businesses to scale quicker, remain compliant, and optimize cost vs. capability.

Choosing the Right Option: EOR or Contractor?

When remote hiring, there isn’t a cookie-cutter solution. Your decision between an Employer of Record and a contractor depends on your business objectives, budget, compliance requirements, and timeline. Utilize this convenient checklist to inform your decision:

Select an EOR if:

- You want to hire full-time or extended-term employees

- You need to be compliant with local labor laws

- You plan to grow internationally without establishing entities

- Need payroll, benefits, and taxes taken care of

- Want to minimize legal risk and misclassification fees

Opt for a Contractor if you:

- Have short-term or project work requirements

- Need specialty skills for a specific scope of work

- Want lower upfront expenses and flexible arrangements

- Are comfortable with local contractor classification laws

- Are able to handle contractor contracts and compliance yourself

Still not sure? In a pinch, particularly for long-term or core positions—an EOR is typically the better bet.

Why Global Employers Prefer EORs in 2025

Global hiring in 2025 is quicker and more complicated than ever, and that’s why businesses are more and more relying on Employer of Record solutions. That’s why EORs are the new go-to choice for innovative employers:

- Hiring Speed: Bring talent onboard in days, not months, without dealing with local incorporation hassle.

- Complete Legal Compliance: EORs keep your employees in compliance with labor legislation, tax obligations, and statutory entitlements specific to your country.

- Scalable Framework: Whether you’re adding a single employee or developing a regional team, EORs offer a flexible platform for expansion.

- Reduced Legal Risk: By handling classification, contracts, and employment exposures, EORs reduce the risk of legal action or fines.

With increasing numbers of countries clamping down on worker classification legislation, EORs provide reassurance while facilitating international growth.

Partner Highlight

Once the prerogative of large corporations with law departments and international HR infrastructure, finding talent across borders is now accessible to businesses of all sizes. Employer of Record (EOR) providers are making it a level playing field, enabling businesses of all sizes to bring in the best global talent, legally and cost-effectively.

- Hire Without a Local Entity

Forget that months-long nightmare of setting up a new country corporation. An EOR is the legal employer, enabling you to begin hiring in days, not months.

- Quick, Compliant Onboarding

Have employees onboarded in 48–72 hours with locally compliant contracts, payroll arrangement, and benefits packages that comply with national laws.

- Integrated HR and Legal Expertise

From statutory leave management to labor law updates, your EOR partner keeps you compliant and helps address any legal or HR issues before they become major problems.

- Scalable Global Workforce Infrastructure

Whether you’re adding a single country or twenty, a quality EOR provides you with a centralized infrastructure to administer payroll, contracts, and employee assistance across locations.

- Risk Reduction and Peace of Mind

Prevent penalties, misclassification fees, and audit exposure. The EOR holds the legal responsibility, providing you with complete protection and assurance as you expand.

Suggested Read: Top Employer of Record (EOR) Service Providers in UAE (2025)

FAQs: Employer of Record vs Contractor

The EOR manages payroll, tax withholdings, benefits, and ensures full compliance with local labor laws on your behalf.

Yes, an EOR can help you compliantly transition a contractor to a full-time employee without setting up a local entity.

An EOR legally employs the worker and handles compliance, while a contractor is self-employed and works independently.

Choose an EOR for long-term, full-time roles where compliance, benefits, and employee integration matter.

It depends on the country. If the role functions like a full-time job, misclassification risks may apply.

You could face fines, back taxes, employee claims, or audits for non-compliance.

Conclusion

Hiring globally in 2025 requires more than just finding the right talent—it demands a compliance-first approach to classification, tax, and employment law. While independent contractors offer speed and flexibility, misclassifying them can result in costly consequences.

An Employer of Record is often the best solution for businesses looking to scale sustainably and legally, especially when hiring long-term or full-time roles abroad. By understanding the key differences between EORs and contractors—and choosing the right model for your needs—you’ll protect your business, support your global team, and set yourself up for successful international growth.

Not to be considered as tax, legal, financial or HR advice. Regulations change over time so please consult a lawyer, accountant or Labour Law expert for specific guidance.