Tax optimization is an integral part of financial planning for salaried employees in India. By utilizing a variety of tax-saving...

Read MoreEmployer of record india

Employer of Record Services in India

Asanify’s all-inclusive EOR solutions simplify hiring, managing, and compensating employees in India, eliminating the need for a local entity. We oversee every aspect of employment, from regulatory compliance and payroll processing to employee benefits and administrative support. Our seamless approach ensures your business remains compliant while you concentrate on driving growth and achieving your goals.

Schedule a Consultation

Employer of Record in India | EOR India

An Employer of Record (EOR) in India serves as an official employer on behalf of a company, managing all employment-related responsibilities. This includes recruitment, onboarding, payroll processing, and adherence to Indian labor laws and tax regulations. By partnering with an EOR, companies can efficiently hire and manage talent in India without the complexities of setting up a local entity, ensuring a seamless and compliant expansion into the Indian market.

At Glance

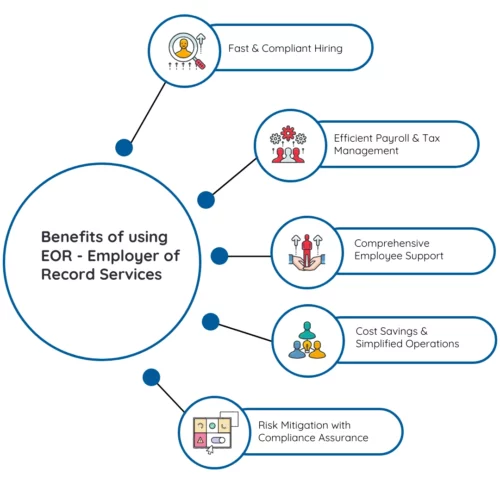

Benefits of using Employer of Record services in India

Consolidate all your contractor payments, and Execute payroll in just one-click. What’s more, you can do a single transfer for multiple contractors, across the various countries and currencies.

Easily hire top talent in India while ensuring full compliance with local labor laws. Asanify’s EOR service simplifies onboarding, contracts, and payroll management without the need for a local entity.

Streamline payroll processing and tax compliance for your Indian workforce. Asanify ensures accurate salary disbursement, tax deductions, and filings in accordance with Indian regulations.

Save time and resources by outsourcing HR and administrative tasks. Asanify handles everything from employee benefits to statutory contributions, reducing overhead costs.

Provide your employees with full support, including health benefits, leave management, and seamless communication. Asanify acts as a local HR partner for your remote team.

Avoid any delays in paying your contractors. With Asanify, it literally takes just 24 hours to make the payments reach your contractors in their local bank account.

Important considerations for hiring in India

Consolidate all your contractor payments, and Execute payroll in just one-click. What’s more, you can do a single transfer for multiple contractors, across the various countries and currencies.

Hiring in India requires adherence to complex labor regulations, including the Shops and Establishments Act, Payment of Wages Act, and Minimum Wages Act. Employers must ensure contracts, working hours, and employee rights comply with both central and state-specific laws.

Indian payroll processing involves mandatory contributions like Provident Fund (EPF), Employee State Insurance (ESI), Professional Tax (PT), and Gratuity. Accurate calculation, timely payments, and filing of returns are essential to avoid penalties.

Clear, legally compliant employment contracts outlining salary structure, benefits, and termination conditions are crucial. Indian law mandates notice periods and, in some cases, severance pay when ending employment.

Employers must deduct Tax Deducted at Source (TDS) from employee salaries and ensure proper reporting. Additionally, offering competitive benefits like health insurance, paid leave, and wellness programs can attract top talent.

India’s diverse workforce operates across multiple states with varying local regulations and cultural expectations. Understanding regional differences in holidays, languages, and workplace norms is vital for effective employee management.

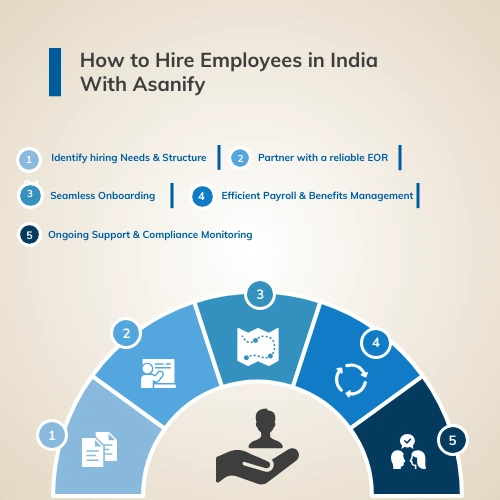

How to Hire Employees in India: A Simplified Approach with Asanify

Consolidate all your contractor payments, and Execute payroll in just one-click. What’s more, you can do a single transfer for multiple contractors, across the various countries and currencies.

- Define job roles, required skill sets, and the type of employment (full-time, part-time, or contract).

- Decide whether you want to establish a legal entity in India or partner with an Employer of Record (EOR) like Asanify for hassle-free hiring.

- Asanify ensures 100% compliance with Indian labor laws, including EPF, ESI, TDS, and gratuity.

- We handle employment contracts, background checks, and documentation while you focus on finding the right talent.

- Our streamlined onboarding process ensures employees are set up with contracts, tax forms, and benefits from day one.

- We provide a dedicated account manager to ensure a smooth transition for both the employer and employee.

- Asanify manages salary disbursement, tax deductions, and statutory filings, ensuring timely and accurate payments.

- Employees also get access to health insurance, paid leave, and other essential benefits.

- We continue to support your business with regular compliance updates, HR assistance, and employee engagement strategies.

- Exit formalities, full-and-final settlements, and experience certificates are managed seamlessly when an employee leaves.

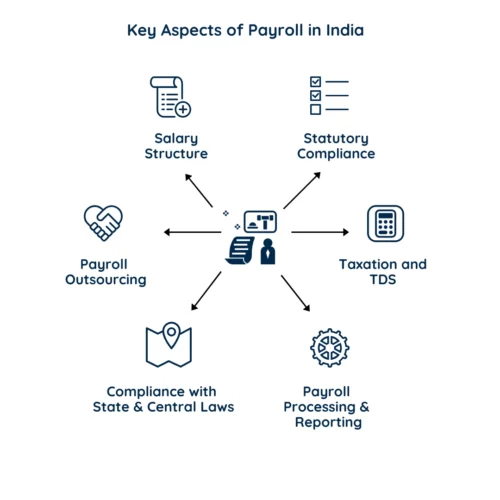

Key Aspects of Payroll in India

Payroll management in India involves more than just salary disbursement. It includes statutory compliance, tax calculations, and employee benefits. Here’s a breakdown of the essential components:

- Salary Structure

- Statutory Compliance

- Taxation and TDS

- Payroll Processing and Reporting

- Compliance with State and Central Laws

- Payroll Outsourcing Options

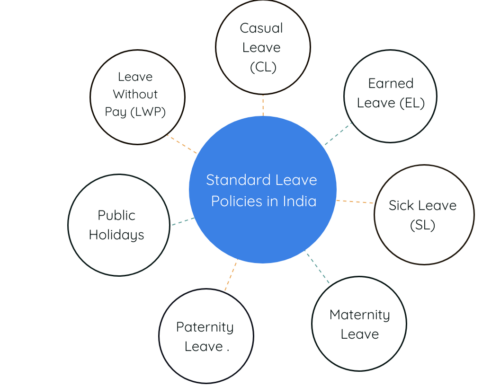

Standard leave policies in India

Leave policies in India are governed by the Shops and Establishments Act of each state, along with company-specific policies. The types and number of leaves can vary based on industry, company policies, and state regulations. Here’s a breakdown of the common types of leaves in India:

- Casual Leave (CL)

- Earned Leave / Privilege Leave (EL/PL)

- Sick Leave (SL)

- Maternity Leave

- Paternity Leave

- Public Holidays / Festival Holidays

- Leave Without Pay (LWP)

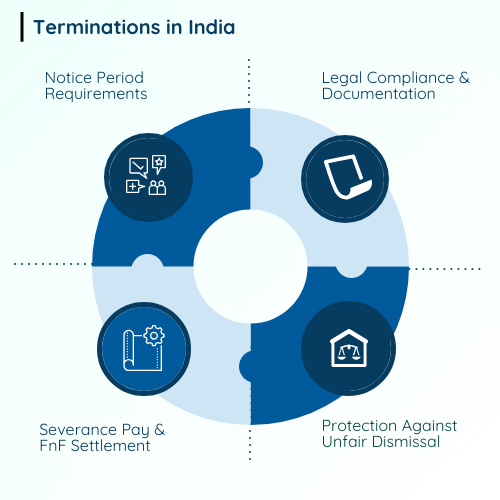

How Terminations are Handled in India

Terminating an employee in India is governed by both central and state labor laws, ensuring fair treatment and adherence to due process.

- Voluntary Resignation: When an employee resigns by choice.

- Termination by Employer: Can be due to performance issues, misconduct, or redundancy.

- Retrenchment: Layoffs due to business closure, downsizing, or restructuring.

- End of Contract: Automatic termination after a fixed-term contract expires.

- Asanify ensures 100% compliance with Indian labor laws, including EPF, ESI, TDS, and gratuity.

- We handle employment contracts, background checks, and documentation while you focus on finding the right talent.

- Our streamlined onboarding process ensures employees are set up with contracts, tax forms, and benefits from day one.

- We provide a dedicated account manager to ensure a smooth transition for both the employer and employee.

- Asanify manages salary disbursement, tax deductions, and statutory filings, ensuring timely and accurate payments.

- Employees also get access to health insurance, paid leave, and other essential benefits.

- We continue to support your business with regular compliance updates, HR assistance, and employee engagement strategies.

- Exit formalities, full-and-final settlements, and experience certificates are managed seamlessly when an employee leaves.

We are proud partners for some of the finest global companies

Cost-to-Company (CTC) Calculator for Hiring in India

Understanding the true cost of hiring an employee in India goes beyond just the take-home salary. Employers need to consider statutory contributions, allowances, and other benefits while calculating the total Cost-to-Company (CTC).

Our CTC Breakup Calculator simplifies this process by providing a detailed salary structure based on the annual CTC you enter. This tool helps both employers and employees get a clear picture of how salary components are distributed.

CTC Breakup Calculator

Enter the total Cost-to-Company (CTC) to view the detailed salary breakup.

Read some of our useful Blogs on EOR India

A Guide to Employer of Record (EOR) vs. Entity Establishment in India

Well, let’s start by imagining that you are one of the CEOs of a thriving startup that is trying to...

Read MoreStep-by-Step Guide: Creating and Sending Job Offer Letters for Remote EOR Employees in India

Preparing job offers letter for the work-from-home employee in India requires legal compliance, clear communication, and the concept of how...

Read MoreWhat our happy customers of EOR Services have to say

Asanify's, should be the number 1 choice for companies looking to pay their overseas employees and contractors. I have a team of 40 people in India and not for a single month have i experienced any delays in the payment process.

In my business, things happen fast, and requirement for new employees is sudden. In such a situation a trusted partner like Asanify comes in handy as I know I can quickly ramp with onboarding and employee formalities diligently taken care of.

As a global company, we go through M&As in countries where we do not have presence. In India, we quickly onboarded ~30 employees as part of a takeover. With Asanify's turnaround time the overall change was managed brilliantly.

Asanify’s expertise when it comes to Local Compliances is something I have benefitted extensively from. Whether its Employee-Contractor classification, or the local laws for employee benefits and working hours - I trust the guidance provided.

Apart from using EOR services, I find a lot of value in the fully automated Asanify HRMS. For me, it makes it absolutely comfortable that I can access all my HR inforation anytime, anywhere and on any platform - Slack, Whatsapp etc.

My employees are in India, while I am based in Dubai and the co. in the US. Managing time zones is a huge challenge for us. Working with global partners like Asanify ensures that all my payments, and query resolutions are done in time.

It is paramount that my employees are well taken care of. Asanify goes above and beyond In terms of employee benefits, salary structuring to make it more tax friendly and constant guidance. For over a year with Asanify’s EOR, I have had no reason to feel disappointed.

Ready to expand your team in India? Talk to our team about EOR India services today!

Some Frequently Asked Questions on EOR India

What is Asanify’s Employer of Record (EOR) service?

Asanify’s EOR service helps businesses hire and manage employees in India without setting up a local entity. We handle payroll, compliance, taxes, and benefits, so you can focus on growth.

How does Asanify’s EOR service work in India?

We act as the legal employer for your workforce in India while you manage their daily tasks. Asanify handles employee contracts, salary processing, tax compliance, and benefits administration.

Why should I use an EOR instead of setting up a local entity?

Setting up a legal entity in India can be time-consuming and expensive. An EOR allows you to hire quickly, remain compliant, and avoid complex regulatory hurdles while testing the Indian market.

- Managing payroll

- Establishing a legal relationship

- Withholding and paying of contributions

- Filing of tax returns

Can Asanify’s EOR service help with remote employee hiring in India?

Yes! Whether you’re hiring full-time employees or contractors, Asanify ensures smooth onboarding, payroll processing, and local compliance for remote teams in India.

How does Asanify ensure compliance with Indian labor laws?

We handle PF, ESI, TDS, PT, LWF, gratuity, and statutory deductions while keeping up with the latest regulatory updates, ensuring your business remains compliant in India.

How are employee salaries processed under Asanify’s EOR?

We manage payroll processing, tax deductions, and salary disbursements in INR. Employees receive on-time payments with a legally compliant payslip, including statutory deductions.

What employee benefits can I offer through Asanify’s EOR?

Asanify provides mandatory benefits like PF, ESI, and gratuity, along with optional perks like health insurance, bonuses, and performance incentives to help you attract top talent.

How quickly can I onboard employees in India with Asanify?

With Asanify’s streamlined onboarding, you can hire and onboard employees in India within days, ensuring a smooth and compliant hiring process.

- Reduced liability

- Contractual obligations

- Intellectual property protection

Can I convert EOR employees to direct hires later?

Yes! If you decide to establish your own entity in India, Asanify seamlessly transitions EOR employees to your payroll, ensuring continuity and compliance.

Who should use Asanify’s EOR service in India?

Startups, SMBs, and global companies looking to expand into India, hire remote teams, or test the market without setting up a legal entity benefit the most from Asanify’s EOR.

- Hidden costs and fees

- Losing control over your HR processes and policies for employees that are hired through an EOR

- Goals and standards set are different.