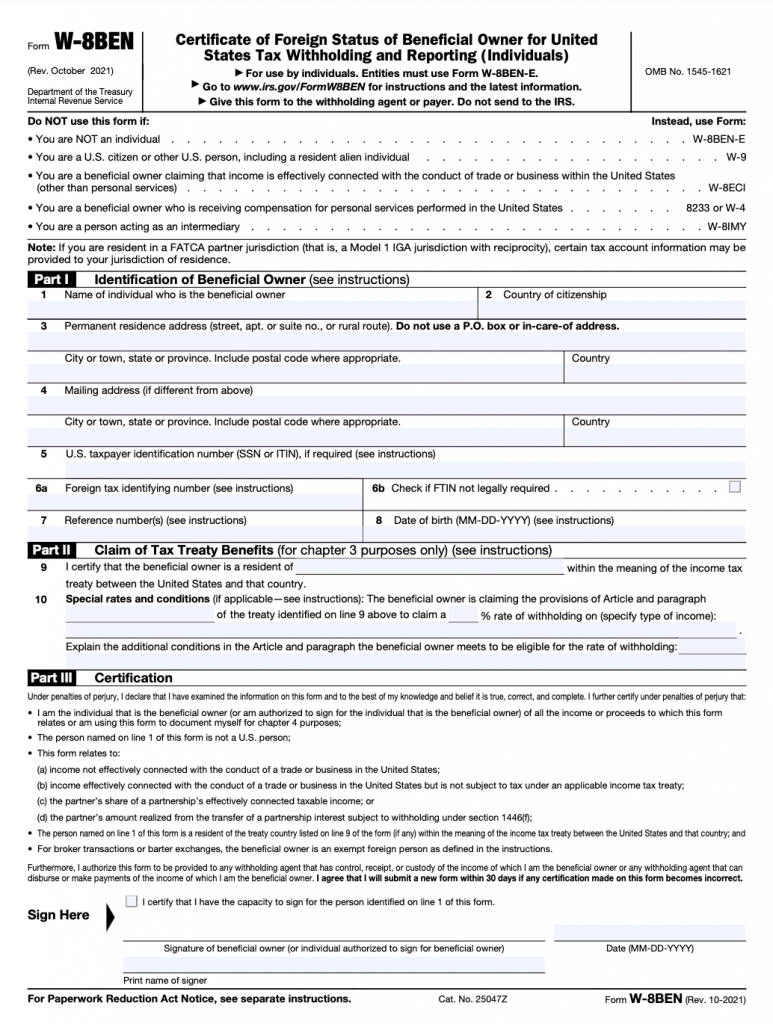

The W8 Ben is a compulsory tax form issued by an established Internal Revenue Service (IRS). It is used to acquire the right information about a Non-resident Alien (NRA) taxpayer.

The purpose behind W8 Ben certification is to legally verify the nation of residence of a foreign individual and business. People use it for claiming an exemption from definite withholdings.

Though IRS issues this form, you will have to submit it to payers or agents responsible for withholding operations, and not to IRS.

In order to fill the w8 ben form rightly it is crucial to know about the five most basic aspects:-

- What is the W8 Ben Form?

- Why is the W8 Ben Form important to fill?

- Who should fill W8 Ben Form?

- How to fill W8 Ben Form?

- Drawbacks of skipping to fill W8 Ben Form

In the following sections, we will explore each and every essential detail of the W8 ben tax form. Stay tuned!

Table of Content

- What is a W8 Ben Form?

- Who needs to fill out a W8 Ben Form?

- Common mistakes to avoid while you fill W8 Ben Form

- FAQs

- Conclusion

What is W8 Ben Form?

A W8 Ben tax form is a significant form filled by professionals and alien corporations who do not have U.S. citizenship for declaring that they are not native taxpayers. Indeed, it also gives them the authority for claiming exemption or reduction in withholding on some particular kinds of U.S. income sources.

A few relevant examples of these sources can be – capital gains, dividends, royalties, rents, premiums, and annuities.

It is helpful to legally claim tax withholding for non-native individuals who do not reside in the U.S. but earn an income from or in the U.S.

Information Required to Fill W8 Ben Tax Form

A foreign individual or business venture needs to enter a few basic details to fill out a w8 ben form. Keep the following information ready with you while filling out this form:-

- Name

- Address

- Country of origin

- Taxpayer Identification Number (TIN)

- Eligibility for exemption in withholding as per taxation laws

- Type of income earned

- Other requirements are specific and depend on the country of origin and type of income earned

Who Needs to Fill W8 Ben Form?

Before we get to know the steps of filling this form, it is important to know who should fill it out. Moreover, this form is designed to be used by foreign individuals and businesses to remark their alien status for the U.S. reduced tax or tax withholding causes.

Non-U.S. Professionals and Students

If you are not a native of the U.S. and receive income from a U.S. corporation or individual. In fact, this category includes – students, scholars, artists, and corporate professionals.

Non-native Individuals Wanting to Claim a Reduced Rate

If your country comes under the list of countries that benefit from a tax treaty, then you can claim to get an exemption in taxation on particular types of money generation by filling out the form.

How to Fill Out W8 Ben Form?

You must be wondering why it must be a tedious job to fill a W8 Ben Form. Consequently, we are here to guide you stepwise and make it seem as easy as it can be.

First things first, never miss out on the legal term that it is mandatory to fill in each and every detail that is true and valid. Any kind of discrepancies in the form can lead to unfavorable results which we shall be in an upcoming section.

In addition, you should consult with a taxation counselor or refer to the official IRS website for a better understanding of yourself. Besides, follow through the instructions for your form and you’re all done:-

Step 1: Enter Your Official Name

Enter your legal name that is present in all the official documents to avoid any kind of duplicates.

Step 2: Declare Your Present Citizenship

The next step is to input your citizenship. It should be current and you should have proof of your citizenship.

Step 3: Enter Permanent Address

The subsequent information you are should to put in is the permanent residence address that is present in an address proof.

Step 4: Enter Your Mailing Address

Do not miss putting an email ID to get important documents to correct address.

Step 5: Input U.S. TIN – Taxpayer Identification Number

It is supposed to be left unfilled for the majority of non-native U.S. individuals.

Step 6: Foreign Tax Identifying Number

This section is predominantly applicable to you if you are a foreign professional or business operations manager. FTIN is provided by your country of origin. For instance, in the case of Indian citizens, it is a PAN Card. However, if you do not know it, as an employee you can contact the organization’s HR department to know the FTIN for filling a w8 ben form.

Step 7: Reference Number Option

In case you are an individual/employee you can skip this section. Therefore, if you are in a partnership it is important to check the reference number in the type of dealings you do.

Step 8: Your Date of Birth

Make sure you enter your correct date of birth while filling up the form, to avoid rejections.

Step 9: Treaty Claim

The U.S. has definite tax treaties with many foreign nations. As per these treaties, residents (not compulsorily citizens) of foreign nations are subject to a certain amount of tax exemptions or may get entirely exempted from the U.S. tax payment when it comes to particular items of generating income from businesses situated within the U.S.

Hence, at this step, you will have to enter the residence nation if you wish to get reduced tax withholding.

If you are an Indian, you get the benefits of this treaty claim. To check the entire list of foreign countries which get tax treaties click here.

Step 10: Check for Special Rates and Terms

If you would like to ask for special withholding rates as per treaty norms applicable in your case, check out the latest IRS instructions here to fill out the W8 Ben Form. In the situation where you face problems, the HR department of your company is the right place to consult.

Step 11: Signature

Make sure to sign the form with your original signature. Usually, the current W8 Ben Form will remain in effect till date – 31st of December, followed by three years of time span after the date of signature.

Common Mistakes to Avoid While Filling W8 Ben Form

We are prone to mistakes as humans. But in official matters, it is always in your best interest to skip doing mistakes that will fetch you a doubtful response.

As we have seen the instructions for the W8 Ben form now it is high time to get through some common mistakes people do while filling out this form. Here, we will share them with you so that you can safeguard yourself against generic errors.

Entering wrong or incomplete details

It is one of the most common mistakes people make as they fill out the form, either they enter incorrect details or leave the form half filled. It is not like any other form that can be completed with false or incorrect information, at each and every step it will be verified.

So, you should to enter the right, complete, and latest information in every section of the form. As you finish, you should recheck all the details and avoid a form rejection.

Wrong form

It happens when people fill out the wrong form because the W8 Ben Form comes in different variations which depend on the tax condition. Be aware of your employment situation and the company, then proceed to get an applicable version of this form, or else all your efforts simply go into vain.

Omitting signature and date

Never leave the sign and date sections empty because both of them are proof of you being the authentic person filling the form and completing it before the deadlines. Your signature and date make the form valid and eligible for authorities to consider it.

Moreover, it is also mentioned in the general instructions for the W8 ben form filling for you to go through.

Giving a foreign TIN in place of a U.S. TIN

The foreign tax identification number and U.S. tax identification number are different so you cannot consider them as one and the same thing. If you carry a U.S. tax identification number, do not forget to enter it in the form.

Failing to produce a valid reason to claim tax benefit

If you claim a reduction in rate of withholding tax as per the tax treaty laws (if you are eligible) then you should definitely present a credible reason for doing it. Failing to give a valid reason, might lead to non-compliance with the legal pathway of filling the W8 ben form.

Entering a U.S. mailing address

You should not provide a U.S. mailing address in the form as this taxation document is present for foreign individuals.

Skipping to update when information modifies

If you change your address or tax status then it is mandatory to mention the same while filling out a new form. Only after updating the information, you should submit it to the authorities.

FAQs

1. Where do I get a W8 Ben Form?

It is easy to it via online medium. You can download the W8-BEN form through the official link. After downloading you need to read and follow the instructions carefully.

2. When should I fill a W8 Ben Form?

Usually, the this form remains effective for a time period that starts from the date this form is signed and ends on the last day of the third calendar year. You need to follow it until and unless a change in situations calls out the information you give in the form to be wrong.

3. What are the advantages of filling out a W8 Ben Form?

Filling out a W8 Ben Form ensures lucrative fruits for you as it is an important form to show that you are not a U.S. native and eligible to get an exemption on taxes applicable. It means that you can get a 15% reduced tax rate on dividends or 0% upon interest settlements.

Other significant advantages are:-

- Confirmation of you being a foreign individual or business in the context of the U.S.

- The income you generate belongs to you

- Eligible to get tax treaty benefit of your country is one of the nations acceptable to get a tax exemption

4. What are the drawbacks of not filing and submitting a W8 Ben Form?

Some of the major repercussions of not filling up the w8 ben form are:-

- Increase in tax withholding – The IRS will take you to be a U.S. taxpayer and that’s why withhold about 30% tax on any transactions you receive from a U.S. individual or business.

- Increased constraints in receiving your payment – If you do not fill W8 Ben Form, your payments may get delayed or refused. It is so because numerous U.S. organizations need foreign contractors to submit W8 Ben Form before releasing payments.

- Wrong tax report – Failing to fill a this form and not being a U.S. taxpayer, it becomes tough to create a proper report of your income and the taxes you pay in the country of origin. It will cause penalties from your country of citizenship.

- Audit risk – You may also have to go through an audit if you do not fill W8 Ben Form which may be a time-consuming and hefty process to go through.

5. W8 ben vs W8 eci – what is the difference?

When it comes to W8 ben vs w8 eci, it is important to note that the former is used by foreign individuals receiving non-business income in the U.S. It is a certificate of foreign status of beneficial owner for U.S. tax withholding.

Contrastingly, the latter is filled when you are a foreign individual and also the beneficial owner of income from a U.S. source that is functionally connected with the business conduct within the U.S. It is a certificate of a foreign individual’s claim that the income is related to trade in the U.S.

Do you want to read about filing form 1099. Click here to read.

Conclusion

The W8 Ben Form is an important form for individuals who do not have U.S. citizenship and earn an income from U.S. sources. It is essential to submit your w8 ben taxation form with correct details within time. By doing so, you will assure that you are eligible to claim a tax exemption or reduction.

The details you give in the form should be the latest and authentic as it will help the U.S. government to provide you with applicable tax benefits when it comes to earning income.

Therefore, you must ensure that the form is submitted without any delays to avoid facing constraints in tax payment. This signifies that you abide by the law and U.S. tax regulations as a foreign income receiver.

Not to be considered as tax, legal, financial or HR advice. Regulations change over time so please consult a lawyer, accountant or Labour Law expert for specific guidance.

![Read more about the article [Section 80JJAA] How to get Tax Deduction for Employment Generation](https://media.asanify.com/wp-content/uploads/2021/02/18173833/priscilla-du-preez-XkKCui44iM0-unsplash-300x200.jpg)