With remote work set up emerging as a viable option, employers have delved deep into maximizing the opportunities that it can bring for their business. After all, they won’t have to confine themselves to hiring domestic talent solely. Hiring international workers, irrespective of the country out of which they are based, has provided employers with the lucrative chance to engage top-notch global talent. However, recruiting employees based out of a country different from yours, may not be a bed of roses. To ensure that you don’t get bogged down by HR administrative tasks, having the support of a proper employment solution is crucial. Therefore, partnering with an Employer of Record (EOR) or Professional Employer Organization (PEO) stands out as the most effective solution to stay compliant. With PEO vs EOR standing at the two fronts, for which one should you opt?

Often, the acronyms- PEO & EOR are used interchangeably to refer to the same thing. This is technically wrong. While both are employment models, they have certain core differences that make them distinct from each other. This makes it all the more important to understand which one to choose and what differences does each of them make. Rather, knowing what sets them apart from one another is crucial in making a prudent choice for your business.

Exploring the intricate landscape of PEO vs EOR requires a strategic compass. Join us as we unravel the distinct nuances of EOR vs PEO, helping you chart a course towards the solution best tailored to elevate your business to new heights.

So, are you ready to dive into the details?

Table of Contents

- What does the PEO Stand for in HR?

- How Much Does a PEO Cost?

- Why are PEOs Used?

- What Kinds of Businesses Benefit from PEO Services?

- What is an EOR?

- What are the Benefits of Using an EOR?

- What is the Difference Between PEO and Payroll Service Provider?

- EOR vs PEO: What Services Do They Offer?

- Similarities: PEO vs EOR

- PEO vs EOR: Core Differences

- PEO vs EOR: How to Decide The Right One for Your Business?

- Frequently Asked Questions- PEO vs EOR

What does the PEO Stand for in HR?

A PEO service provider is a company that collaborates with small and medium-sized businesses (SMBs) to offer extensive HR services. PEO stands for Professional Employment Organisation. It will assist your business as a co-employer by serving the function of an outsourced HR department of your company. Availing PEO services while hiring full-time employees in the local area where the business is based out of, aids employers in delegating several crucial tasks to PEO partners:

- Processing of payroll

- Employee benefits administration

- Tax handling

- Ensuring compliances

- HR administration

- Co-employment

- Employee onboarding

Working with a PEO partner entails greater availability of time for companies to focus on core business-building activities. The tasks of people management, regulatory compliance, and tax filings will be taken care of by a Professional Employment Organisation.

A PEO can be a valuable partner for SMBs looking to:

- streamline HR operations

- reduce administrative burdens

- access cost-effective benefits

- ensure compliance

- focus on growing their business

Note: In a PEO arrangement, the business owner retains control over day-to-day operations and management decisions, while the PEO assumes responsibility for HR-related functions. This co-employment relationship allows the PEO to manage HR tasks on behalf of the business while still providing employees with access to benefits and services. Since PEO will just be your HR partner and not the legal employer of your workforce, you will be responsible for every kind of legal and day-to-day business operations. For instance, setting up a legal entity, registering your business in a new country, etc. are ought to be taken care of, by you. The PEO will just cater to the provision of HR, compliance and tax support.

Also read: Employer of Record India Cost- All That You Need to Know

How Much Does a PEO Cost?

The ROI of using a PEO is 27.2% on cost savings alone, reveals NAPEO.

The cost of partnering with a Professional Employer Organization (PEO) can vary widely depending on several factors, including:

- the size of the business

- the specific services required

- the level of customization

- and the industry in which the business operates

Generally, PEO fees are structured based on either a percentage of total payroll or a per-employee-per-month (PEPM) fee.

1. Percentage of Payroll: Some PEOs charge a percentage of the client company’s total payroll as their fee. This percentage typically ranges from 2% to 12% of total payroll, although it can vary based on factors such as the level of service and the number of employees.

2. Per-Employee-Per-Month (PEPM) Fee: Other PEOs charge a flat fee per employee per month for their services. This fee typically ranges from $100 to $200 per employee per month, although it can vary based on factors such as the scope of services and the complexity of the client’s HR needs.

In addition to the base fee structure, there may be additional costs associated with certain services or add-on features, such as:

– Onboarding and implementation fees

– Employee benefits costs (e.g., health insurance premiums, retirement plan contributions)

– Workers’ compensation insurance premiums

– HR consulting or project-based services

– Compliance services and support

Truth be told, using PEOs may not be a cost-effective choice because it is head-on expensive. Further, it may not encapsulate all your HR needs. Therefore, gaining insights into whether PEO can be the right option for you is essential.

Why are PEOs Used?

Professional Employer Organizations (PEOs) are used for several reasons, offering a range of benefits to businesses of all sizes. Let’s find out the common reasons why businesses choose to partner with PEOs:

1. HR Expertise: PEO companies offer access to a team of HR professionals with expertise in various areas of human resources, including payroll processing, benefits administration, compliance, risk management, and employee relations. Businesses benefit from this expertise without the need to hire dedicated HR staff, saving time and resources.

2. Access to Benefits: A wide range of employee benefits, including health insurance, retirement plans, dental and vision coverage, life insurance, and disability insurance are made available by PEO companies. By pooling together employees from multiple client companies, PEOs can provide access to benefits typically only available to larger employers, helping small and medium-sized businesses attract and retain top talent.

3. Risk Mitigation: PEOs help businesses mitigate risks associated with HR compliance, employment laws, and workplace issues. PEOs stay up-to-date on changes in legislation and provide guidance on HR best practices, reducing the risk of legal penalties, fines, and lawsuits for non-compliance.

4. Administrative Support: PEOs handle time-consuming administrative tasks such as payroll processing, tax filings, employee onboarding, and employee record-keeping, allowing businesses to focus on core operations and strategic initiatives. This administrative support improves efficiency and productivity in HR operations.

Companies having a PEO arrangement grow 7-9% faster, encounter 10-14% lower turnover, and are 50% less likely to go out of business.

For businesses aspiring to expand their workforce, tying up with a PEO partner can be a witty thing to do. However, using PEO services will restrict you from carrying out business smoothly if you are planning to venture into an area where you don’t own a legal entity. In such cases, choosing an EOR partner will prove to be fruitful. We will be discussing this in the following sections.

What Kinds of Businesses Benefit from PEO services?

Professional Employer Organization (PEO) services can benefit a wide range of businesses, regardless of size or industry. The types of businesses that can particularly benefit from PEO services are:

1. Small and Medium-sized Businesses (SMBs): SMBs often lack the resources and infrastructure to manage HR functions effectively. PEO services allow SMBs to access comprehensive HR solutions, including payroll processing, benefits administration, compliance assistance, and employee management, without the need to hire dedicated HR staff.

2. Startups: Startups face unique challenges related to rapid growth, limited resources, and complex regulatory requirements. PEO services provide startups with scalable HR solutions that can adapt to their evolving needs, allowing them to focus on innovation and business growth while outsourcing HR functions to a trusted partner.

3. Fast-growing Companies: Fast-growing companies need flexible HR solutions that can scale with their expanding workforce. PEO services offer scalability and flexibility, allowing companies to quickly onboard new employees, access cost-effective benefits, and ensure compliance with employment laws as they grow.

4. Companies with Limited HR Expertise: Companies with limited internal HR expertise or resources can benefit from outsourcing HR functions to a PEO. PEO services offer access to HR professionals with expertise in various areas of HR management, including payroll, benefits, compliance, and employee relations, allowing companies to leverage specialized knowledge and experience without hiring dedicated HR staff.

5. Companies Seeking Cost Savings: PEO services can help companies reduce administrative costs associated with HR functions such as payroll processing, benefits administration, and compliance management. PEOs leverage economies of scale to negotiate better rates on benefits and insurance, which are passed on to client companies, resulting in cost savings and improved efficiency.

Things to Keep in Mind Before Choosing a PEO Service

- Your business size, requirements and workplace needs

- PEO pricing and reviews

- Quality of customer support offered by a particular PEO service provider

- Efficiency of the PEO solution

What is an EOR?

An Employer of Record (EOR) is a crucial component in the realm of global employment and workforce management. Acting as a trusted intermediary, an EOR assumes responsibility for many employer-related tasks on behalf of a company, particularly in international settings where navigating local labor laws, regulations, and compliance requirements can be complex.

The global EOR market size is predicted to swell at a CAGR of 12.07%, reaching as high as USD 3745.43 million by 2030.

Essentially, an EOR serves as the legal employer for a business’s workforce, handling:

- Payroll administration

- Tax withholding and reporting

- Benefits administration

- HR compliance

- Other administrative functions.

By leveraging the services of an EOR, businesses can effectively expand their operations into new markets without the need to establish legal entities or navigate the intricacies of local employment laws independently. PEOs don’t offer this benefit to its users. Availing PEO services would entail the need to undergo the complex process of setting up legal entities in an alien country, and all the hurdles of business registration will roll your way. With an EOR, there is no need to worry about these things.

An EOR arrangement provides companies with the flexibility to scale their workforce globally while mitigating risks and ensuring compliance with local regulations. In essence, an EOR serves as a strategic partner, enabling businesses to focus on their core operations and growth objectives while entrusting critical HR and compliance responsibilities to a knowledgeable and experienced third party.

What are the Benefits of Using an EOR?

Utilizing an Employer of Record (EOR) offers numerous benefits for businesses expanding globally:

1. Simplifies Global Expansion of Businesses: EORs enable companies to enter new international markets quickly and efficiently without establishing legal entities. This streamlined process accelerates expansion and reduces administrative burden.

2. Compliance Assurance: EORs ensure compliance with local employment laws, regulations, and tax requirements in each market. They handle payroll, tax withholding, and reporting, minimizing the risk of non-compliance penalties.

3. Risk Mitigation: By transferring employer responsibilities to the EOR, businesses mitigate risks associated with international expansion, such as legal disputes and financial penalties. EORs assume liability for employment matters, providing peace of mind.

4. Cost Efficiency: Engaging an EOR eliminates the need to set up legal entities or hire local HR staff in every market. Outsourcing HR administration and compliance functions can result in significant cost savings in terms of time, resources, and overhead costs.

5. Flexibility and Scalability: EOR services offer flexibility to scale the workforce up or down quickly in response to market changes. Whether expanding or downsizing operations, companies can adapt their workforce without administrative burdens.

6. Focus on Core Business: Delegating HR administration and compliance tasks to the EOR allows companies to focus on core business activities. This enables greater efficiency, productivity, and alignment with strategic objectives.

What is the Difference Between PEO & Payroll Service Provider?

PEOs come with excellent employee benefits package with group policy rates. On the other hand, usual payroll service providers don’t offer users any kind of employee benefits package.

| Professional Employment Organisation (PEO) | Payroll Service Provider (PSP) |

| A PEO is an outsourcing partner that provides comprehensive HR services to businesses, including payroll processing, benefits administration, HR compliance, employee relations, and risk management.

|

Payroll services focus specifically on the processing of employee wages, taxes, and deductions. They handle tasks such as calculating gross wages, deducting taxes and benefits, processing payroll checks or direct deposits, and generating payroll reports.

|

| When a company partners with a PEO, the PEO becomes the employer of record for tax and insurance purposes. This means that the PEO takes on responsibilities such as payroll taxes, workers’ compensation, unemployment insurance, and benefits administration on behalf of the client company.

|

Payroll services may be provided by payroll processing companies, accounting firms, or HR software platforms. These services can be outsourced to streamline payroll administration and ensure accuracy and compliance with tax regulations. |

| PEOs can offer economies of scale by pooling multiple client companies together to negotiate better rates for benefits such as health insurance and retirement plans. Further, they provide users with HR expertise, guidance on compliance matters, access to HR technology platforms, and support for recruiting, training, and employee development. | Payroll services typically do not include broader HR functions such as benefits administration, employee relations, compliance management, or risk mitigation. They are specifically focused on payroll processing and related tax filings. |

EOR vs PEO: What Services Do They Offer?

While certain services offered by Employer of Record vs PEO often overlap, it is necessary to have clarity on the exact array of facilities offered by each model.

Core Services Offered by EOR

- Offers the scope of global expansion without requiring businesses to set up their own entity in the new country

- Administration of employee benefits

- Compliance and tax support

- Payroll run

- Serves as a legal employer for new employees

- Acts as a repository of compliant templates for every kind of crucial contracts

- Visa and work permit assistance

- End-to-end HR management

- Provision of legal knowledge about the changing labor laws, tax rules, HR policies and so on

- Serves as a bridge between new employees and the concerned authorities

Core Services Offered by PEO

- Compliance and tax support

- Overseeing employee benefits package

- Offers access to compliant employment contracts

- Payroll processing support

- HR administration and management

- Shares core employment liabilities with the official employer

Similarities: PEO vs EOR

Both Employer of Record (EOR) and Professional Employer Organization (PEO) are services that help businesses manage their human resources functions.

1. Employment Relationship

In both EOR and PEO arrangements, the service provider becomes the employer of record for the client’s employees. This means they handle payroll, taxes, and compliance, relieving the client of these administrative burdens.

2. HR Administration

EOR and PEOs handle various HR functions, such as employee benefits administration, compliance with labor laws, and risk management. This allows clients to focus on their core business operations while the service provider takes care of the HR aspects.

3. Cost Savings

Both models can provide cost savings for businesses. By outsourcing HR functions, companies can often reduce the costs associated with maintaining an in-house HR department.

4. Risk Mitigation

EOR and PEOs can help mitigate legal and compliance risks for their clients by staying up-to-date with labor laws and regulations. This is crucial for companies operating in multiple locations or dealing with complex employment laws.

5. Scalability

Both services are often chosen for their ability to scale with a business. Whether a company is expanding or downsizing, EOR and PEO arrangements can provide flexibility in managing workforce changes.

6. Access to Benefits

EOR and PEOs may offer access to a range of employee benefits, including health insurance, retirement plans, and other perks. This can be advantageous for attracting and retaining talent.

While these similarities exist, it’s important to note that there are also differences between EOR and PEO arrangements, particularly in terms of the level of control retained by the client over their employees and the scope of services provided.

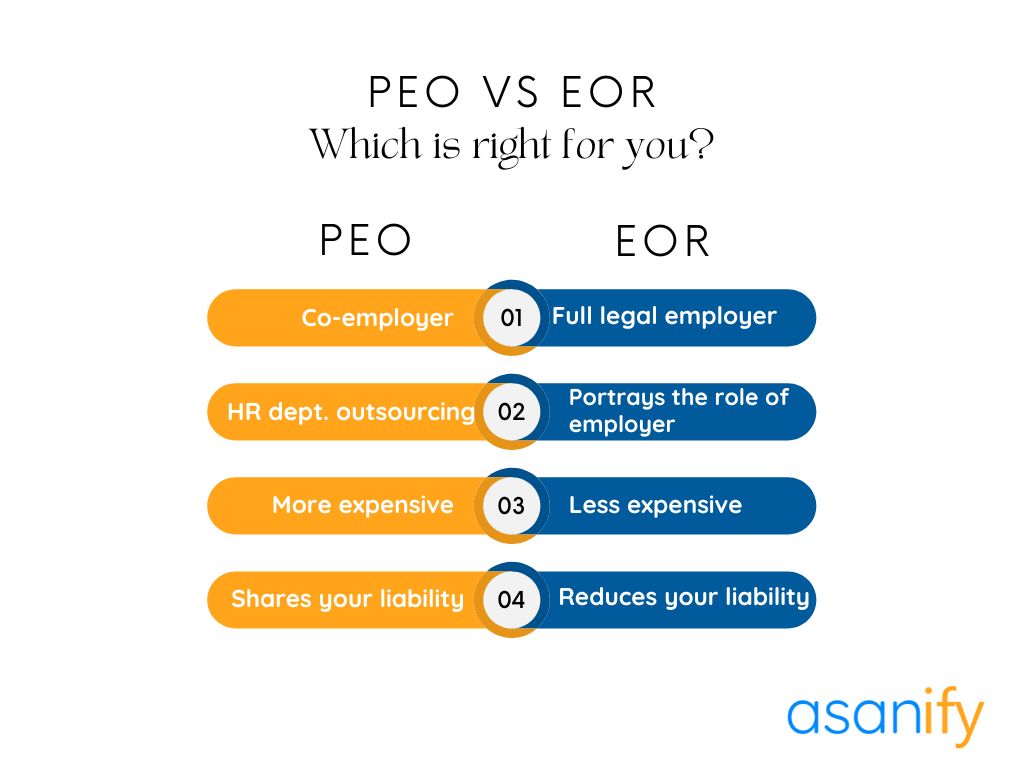

PEO vs EOR: Core Differences

Let’s now have an in-depth look into the core differences between the two employment models of PEO and EOR. It’s important to understand what sets PEO vs EOR different from one another, and why should you make the right choice- depending upon the needs of your business.

| Parameters | PEO | EOR |

| Structure | Takes up the role of a co-employer | Acts as a full legal employer |

| Risk | Shares liability with your business | Minimises liability with your business |

| Scale | Suitable for relatively smaller companies having full-time employees | Suitable for businesses planning to expand globally and venture into new markets while hiring both employees and contracts from any part of the world |

| Scope | Serves the function of HR and payroll outsourcing | Portrays the complete role of an employer |

| Cost | Turns out to be an expensive choice in the longer run | Results in minimised spending as it helps in saving costs in a long-term tenure |

| Services | Broader range of services, but not in-depth | Fewer range of services, but in-depth |

Structure: PEO vs EOR

The distinction between a Professional Employer Organization (PEO) and an Employer of Record (EOR) lies fundamentally in their structural roles within employment relationships. A PEO functions as a co-employer, engaging in a partnership with client businesses to share employer responsibilities. This arrangement entails a collaborative effort in HR management, where both entities hold joint employer status and contribute to various aspects of workforce administration.

Conversely, an EOR operates as the legal employer, assuming sole responsibility for all employment-related obligations on behalf of its client businesses. This includes payroll processing, tax withholding, benefits administration, and compliance with local labor laws. As the legal employer, an EOR provides a simplified employment structure for businesses seeking to expand globally, alleviating the complexities associated with establishing legal entities in foreign jurisdictions. You won’t even have to undergo the complex process of business registration and attempt to understand the labor laws of a new country where you are planning to expand your business.

Risk: PEO vs EOR

The disparities between a Professional Employer Organization (PEO) and an Employer of Record (EOR) concerning risks and liabilities for businesses are substantial and pivotal in decision-making. With a PEO, as a co-employer, the risks and liabilities are shared between the PEO and the client business. While the PEO assumes responsibilities for HR functions such as payroll, benefits, and compliance, the client business retains certain risks associated with day-to-day operations, including business strategy, employee supervision, and operational decisions. So, in case of PEO, there is liability sharing with businesses.

On the other hand, partnering with an EOR alleviates a significant portion of employer risks and liabilities for the client business. By becoming the legal employer, the EOR assumes full responsibility for employment-related obligations, shielding the client business from potential liabilities such as compliance violations, legal disputes, and financial penalties, particularly in international expansions where navigating foreign labor laws can be complex and daunting. This crucial distinction underscores the appeal of EOR services for businesses seeking to minimize risks and ensure compliance in global workforce management.

Scale: PEO vs EOR

PEOs are well-suited for businesses looking to scale domestically, offering comprehensive HR solutions that accommodate growth in employee numbers and operational complexity. They provide a broad range of services, including payroll processing, benefits administration, compliance assistance, and employee relations support. Therefore, PEO is an ideal choice for small to mid-sized businesses seeking to streamline HR functions without the burden of managing them internally.

Contrarily, EORs are particularly advantageous for businesses expanding internationally, offering turnkey solutions for global workforce management. By assuming legal employer status, EORs facilitate seamless international expansions, eliminating the need for establishing legal entities in foreign countries and navigating complex compliance requirements. This makes EORs an invaluable partner for businesses aiming to enter new markets efficiently and compliantly, regardless of their size or industry.

Scope: PEO vs EOR

The thing with PEO is that it offers services in a location where you already have your own entity. It helps you tackle payroll processing, ensure compliances, handle tax filings, and manage employees. However, EOR services are largely used when you are planning to expand your business internationally, in new countries where you don’t own a legal entity. The best part? You won’t have to even care about setting up one because the EOR will function as your legal employer, thereby eliminating the need to mete out the complex processes of business registration and comprehend local labor laws of the country. For multinational expansion, an EOR is simply the best choice.

Cost: PEO vs EOR

PEOs typically operate on a fee structure based on a percentage of total payroll costs or a flat fee per employee. While PEOs may entail higher upfront costs, they provide comprehensive HR solutions that encompass payroll processing, benefits administration, compliance assistance, and employee relations support, making them a cost-effective option for businesses seeking bundled HR services.

On the other hand, EORs typically charge a fee per employee or a flat rate based on services provided. While EORs may have lower upfront costs compared to PEOs, they specialize in assuming legal employer status for businesses’ employees, focusing primarily on payroll processing, tax withholding, benefits administration, and compliance with local labor laws. Ultimately, the cost-effectiveness of each model depends on factors such as the size of the workforce, the scope of services needed, and the complexity of compliance requirements, with businesses weighing the benefits and costs of each option based on their specific needs and budgetary constraints.

Services: PEO vs EOR

A PEO can be an ideal choice for your business if you want to outsource the complex tasks of payroll processing, employee benefits administration, ensuring compliances, and tax handling to a partner who will act as your co-employer. With the aid of PEO experts, you won’t have to worry about compliances and violations of labor laws. In that way, you will be able to focus on building your business and strengthening core operations and not get weary of the insecurity if you are really complying with the laws of the land.

However, if you have plans of expanding your business to other countries, an EOR ought to be your ideal choice. You can hire global employees and independent contractors at the sae time, and that too, seamlessly. No need of setting up legal entity or gain understanding of local labor laws while using EOR services. Your employees will be covered under the EOR’s insurance. After all, it is your legal employer.

PEO vs EOR: How to Decide The Right One for Your Business?

Deciding between a Professional Employer Organization (PEO) and an Employer of Record (EOR) requires careful consideration of several factors to determine which option aligns best with the unique needs and objectives of a business. It is important to take the decision while keeping in mind the following considerations:

1. Business Goals and Growth Strategy

Start by assessing your business’s short-term and long-term goals, as well as its growth strategy. If you plan to expand internationally, an EOR may be the more suitable choice, providing a streamlined solution for global workforce management. Conversely, if the focus is on domestic growth and scaling operations, a PEO might offer the comprehensive HR support needed to manage increasing employee numbers and operational complexities.

2. Scope of Services Needed

Evaluating the specific HR functions and services required by your business is crucial. PEOs offer a broad range of HR solutions, including payroll processing, benefits administration, compliance assistance, risk management, and employee relations support. If you want a bundled package of HR services for its domestic operations, a PEO may be the preferred option. However, if the primary need is for compliance and administrative support in international expansions, an EOR specializing in global employment may be more appropriate.

3. Budgetary Considerations

Considering the cost implications of each option and how they fit within your business’s budgetary constraints is super critical. PEOs typically operate on a fee structure based on a percentage of total payroll costs or a flat fee per employee. While PEOs may entail higher upfront costs, they provide comprehensive HR solutions. In contrast, EORs usually charge a fee per employee or a flat rate based on services provided, focusing primarily on assuming legal employer status for businesses’ employees. The cost-effectiveness of each model depends on factors such as the workforce size of your company, the scope of services needed, and the complexity of compliance requirements.

4. Geographic Expansion Plans

Assess whether you are contemplating on your business’ geographic expansion, either domestically or internationally. If international expansion is on the horizon, an EOR specializing in global employment can provide valuable support in navigating foreign labor laws and ensuring compliance in new markets. On the other hand, if the business is primarily focused on domestic operations, a PEO may offer the comprehensive HR solutions needed to manage growth within the country.

5. Risk Tolerance and Control

Make sure to consider your business’s risk tolerance and preference for control over HR functions. PEOs operate under a co-employment model, where they share employer responsibilities with client businesses. While this arrangement provides access to comprehensive HR support, businesses may relinquish some control over certain HR functions. In contrast, EORs assume full legal employer status for businesses’ employees, providing greater control over employment-related matters and minimizing risks associated with compliance.

PEO vs EOR: Features at a Glance

|

Pointers |

PEO |

EOR |

| Is a legal entity needed? | Yes | No |

| Serves as a legal employer? | Client organisations | EOR |

| Shared legal liability? | Shares liability with the company | Entire liability falls on EOR solely |

| Offers compliance support? | Yes | Yes |

| End-to-end HR services and payroll processing? | Yes | Yes |

| Talent staffing services? | No | No |

| Provision of employee payments? | Restricted | Yes |

Frequently Asked Questions- PEO Vs EOR

1. What is a PEO?

A Professional Employer Organization (PEO) is a company that enters into a co-employment relationship with your business. They handle various HR functions such as payroll, benefits administration, compliance, and employee relations.

2. What is an EOR?

An Employer of Record (EOR) is a service provider that assumes the employer responsibilities for your workforce, including payroll, tax withholding, benefits administration, and compliance with employment laws and regulations.

3. What are the main differences between a PEO and an EOR?

The primary difference lies in the employment relationship. With a PEO, your employees become co-employed by the PEO, while with an EOR, the EOR becomes the legal employer of your employees. Additionally, EORs typically offer a broader range of HR services beyond basic employment administration while eliminating the need of establishing a legal entity in a new market. This helps you get rid of the stress associated with understanding the complex labor codes applicable in a new country.

With a PEO, employer responsibilities are shared between your business and the PEO. The PEO assumes certain HR functions, but your business retains control over day-to-day operations. With an EOR, the EOR takes on all employer responsibilities, including legal liability and compliance.

5. Which model offers more flexibility for business operations?

Both PEOs and EORs offer flexibility, but in different ways. PEOs provide flexibility in HR management and scalability, while EORs offer flexibility in global expansion without the need for establishing legal entities in foreign countries.

6. How does each model impact compliance?

PEOs and EORs both help ensure compliance with employment laws and regulations. However, EORs assume full legal responsibility for compliance in the countries where they operate, providing additional peace of mind for businesses expanding internationally.

7. What are the cost considerations for each model- PEO vs EOR?

PEOs typically charge a percentage of total payroll costs, while EORs may charge a fee per employee or a flat rate based on services provided. The cost of each model depends on factors such as the size of your workforce, the scope of services needed, and the complexity of compliance requirements.

8. PEO vs EOR- which model is better suited for global expansion?

EORs are generally better suited for global expansion, as they provide a turnkey solution for hiring and managing employees in foreign countries. They handle all aspects of employment administration and ensure compliance with local laws and regulations.

9. How do I decide whether PEO vs EOR is right for my business?

It is recommended to consider factors such as your business size, growth plans, geographic footprint, HR needs, and budgetary constraints while making the choice. Consulting with HR professionals or legal advisors can also help you make an informed decision based on your specific circumstances.

10. What is the difference between a PEO and an AEO?

A PEO (Professional Employer Organization) shares employer responsibilities with a business, co-employing its workforce. An AEO (also known as an EOR, Employer of Record) assumes all employer responsibilities, becoming the legal employer of a business’s workforce. AEOs handle payroll, benefits, and compliance, simplifying global expansion.

Not to be considered as tax, legal, financial or HR advice. Regulations change over time so please consult a lawyer, accountant or Labour Law expert for specific guidance.