Are you planning to hire and pay contractors in Japan? This comprehensive guide will walk you through the process from start to finish, ensuring that you have all the information you need to navigate the unique intricacies of hiring and paying contractors in Japan. From understanding the difference between independent contractors and employees to managing payroll and tax requirements, we’ve got you covered.

Let’s delve deep into the topic!

Contents

- Who is an Independent Contractor in Japan?

- How is an independent contractor in Japan different from an Employee?

- Penalties for Contractor and Employee misclassification in Japan

- What are the Labor Laws in Japan?

- Steps to Hire a Contractor in Japan

- Important Considerations for Hiring and Managing Contractors in Japan

- How to draw up an independent contractor agreement in Japan

- Do’s and Don’ts of Designing an Independent Contractor Agreement to Hire and Pay Contractors in Japan

- How Payroll Works When You Move Ahead to Pay Contractors in Japan

- Tax Filing Requirements for Contractors in Japan

- Tax Compliance for US-based Companies

- Minimum Wages for Contractors in Japan

- Best Ways to Pay Contractors in Japan

- Currency and Other Considerations to Pay Contractors in Japan

- Tax and Other Payroll Costs for Contractors in Japan

- Termination or extension terms for independent contractors in Japan

- How to Convert an Independent Contractor in Japan to an Employee?

- Quick Wrap Up

- Frequently Asked Questions

Who is an Independent Contractor in Japan?

In Japan, an independent contractor is an individual who works for a company or individual on a self-employed basis, providing specialized services or expertise. Unlike employees, independent contractors have more control over their work, schedule, and methods.

Being an independent contractor in Japan comes with its own set of advantages and responsibilities. One advantage is the flexibility it offers. Independent contractors have the freedom to choose their own projects and clients, allowing them to pursue work that aligns with their skills and interests. This flexibility also extends to their working hours, as they have the autonomy to set their own schedules.

Another advantage of being an independent contractor in Japan is the potential for higher earnings. Since contractors are not bound by a fixed salary, they have the opportunity to negotiate their rates based on the value they bring to the table. This can result in higher income compared to traditional employment.

However, along with the benefits, independent contractors also have additional responsibilities. They are responsible for managing their own taxes and social insurance contributions. Unlike employees, who have their taxes automatically deducted from their salary, independent contractors must handle their tax obligations independently. This includes filing tax returns and making regular contributions to the national pension and health insurance systems.

It is important for independent contractors in Japan to establish clear contracts and agreements with their clients to protect their rights and ensure fair compensation. These contracts should outline the scope of work, payment terms, and any additional provisions to avoid any potential disputes.

Also Read: Pay Contractors in India- The Ultimate Hiring Guide

How is an Independent Contractor in Japan Different from an Employee?

Understanding the differences between independent contractors and employees is crucial when it comes to proper classification and compliance with Japanese labor laws. While both play important roles in the workforce, there are distinct characteristics that set them apart.

Employees in Japan enjoy a higher level of legal protection compared to independent contractors. They are entitled to benefits such as social insurance, paid leave, and protection against unfair dismissal. Employers are also responsible for withholding income tax and social insurance contributions on behalf of their employees.

On the other hand, independent contractors have more flexibility in how they carry out their work. They have the freedom to negotiate their terms and conditions, including the scope of work, working hours, and payment structure. Independent contractors are responsible for managing their own taxes and social insurance contributions.

It is important to note that misclassifying employees as independent contractors can have serious consequences. The Japanese government takes a strict stance on this issue, and employers found to be in violation may face penalties and legal action. To avoid any problems, it is crucial for employers to comply with the guidelines set by the Ministry of Health, Labor, and Welfare (MHLW).

The MHLW provides guidelines to help determine whether a worker should be classified as an employee or an independent contractor. Factors such as the degree of control exerted by the employer, the nature of the work, and the level of financial risk should be considered. It is recommended that employers consult these guidelines and seek legal advice if they are unsure about the classification of their workers.

Suggested Read: Pay Contractors in Indonesia- The Ultimate Guide to Hiring

Penalties for Contractor and Employee Misclassification in Japan

Misclassifying contractors or employees can have severe financial and legal repercussions. The Ministry of Health, Labour and Welfare (MHLW) in Japan has implemented strict penalties to discourage misclassification practices and ensure fair treatment of workers. It is crucial for employers to understand and adhere to these regulations to avoid facing hefty fines or potential legal actions.

When a contractor or employee is misclassified, it means that their employment status is inaccurately determined, leading to potential exploitation and denial of certain benefits and protections. To prevent such unfair practices, the MHLW has established clear guidelines and penalties.

1. Hefty Fines

One of the primary penalties for misclassification is the imposition of substantial fines. Employers found guilty of misclassifying workers can face fines ranging from tens of thousands to millions of yen, depending on the severity of the violation and the number of affected workers. These fines are intended to serve as a deterrent and to compensate workers for any financial losses or damages incurred due to misclassification.

2. Lawsuits

In addition to financial penalties, employers may also be subject to legal actions, including lawsuits filed by workers seeking compensation for unpaid wages, benefits, and other entitlements. These legal actions can result in further financial burdens, as employers may be required to pay not only the owed amounts but also legal fees and court costs.

Furthermore, the MHLW has the authority to conduct inspections and investigations to ensure compliance with classification regulations. In cases where misclassification is suspected, the MHLW may initiate audits and interviews with both employers and workers to gather evidence and determine the appropriate penalties. This proactive approach by the MHLW aims to protect workers’ rights and maintain a fair and transparent labor market.

3. Reputational Damage

It is worth noting that misclassification can also have indirect consequences for employers. In addition to the financial and legal penalties, misclassification can damage a company’s reputation and credibility. Negative publicity and public backlash can result in loss of business opportunities, difficulty in attracting and retaining talented employees, and strained relationships with stakeholders.

To avoid misclassification, employers should familiarize themselves with the criteria used to differentiate between contractors and employees. They should carefully evaluate the nature of the work relationship, considering factors such as control over work hours, level of supervision, provision of tools and equipment, and the degree of financial risk assumed by the worker. Seeking legal advice and consulting with labor experts can also help employers ensure compliance and avoid potential misclassification pitfalls.

In conclusion, the penalties for contractor and employee misclassification in Japan are severe and encompass both financial and legal consequences. Employers must prioritize accurate classification to protect the rights of workers and avoid the detrimental effects of misclassification on their businesses. Adhering to the regulations set by the MHLW is essential for maintaining a fair and equitable labor market in Japan.

Recommended Read: Employee Misclassification Guide- The Key to Avoiding Hefty Penalties

What are the Labor Laws in Japan?

In Japan, labor laws distinguish between employees and contractors, with specific regulations for each category.

For Employees

1. Working Hours: The standard workweek is 40 hours, with overtime regulations for additional hours.

2. Overtime Pay: Overtime work is compensated at a higher rate, typically 1.25 times the normal rate.

3. Leave: Employees are entitled to paid leave, including annual paid leave, national holidays, and special leave for events like weddings or funerals.

4. Termination: Employers must provide a valid reason for termination, and unfair dismissal is prohibited. Severance pay may be required based on the circumstances.

For Contractors

1. Contractual Agreements: Contractors operate under a separate contract, outlining the terms and conditions of their work.

2. Taxation: Contractors are responsible for their own taxes and social insurance contributions.

3. Working Hours and Overtime: Contractors often have more flexibility in setting their working hours, and they negotiate their own compensation.

4. Benefits: Contractors generally do not receive employee benefits, such as health insurance or retirement plans.

Common Regulations for Both

1. Equal Treatment: Regardless of employment status, discrimination based on gender, age, nationality, etc., is prohibited.

2. Health and Safety: Employers are obligated to provide a safe working environment for both employees and contractors.

Suggested Read: Pay Contractors in Sweden- A Comprehensive Guide to Hiring

Steps to Hire and Pay Contractors in Japan

When you decide to hire a contractor in Japan, there are several steps you need to take to ensure a smooth and legally compliant process. Let’s break it down:

Step 1: Define your needs

Clearly identify the specific skills and services you require from the contractor. Before embarking on the journey of hiring a contractor in Japan, it is crucial to have a clear understanding of your needs. Take the time to carefully assess the scope of your project and determine the specific skills and services you require from the contractor. Whether it is construction, renovation, or any other specialized work, having a well-defined set of requirements will help you find the most suitable candidate.

Step 2: Find potential candidates

Utilize professional networking platforms, job boards, or consider seeking recommendations. Once you have a clear idea of your needs, it’s time to start searching for potential candidates. In Japan, there are various ways to find contractors. You can utilize professional networking platforms such as LinkedIn or industry-specific forums to connect with professionals in your desired field. Additionally, exploring job boards and online marketplaces can provide you with a wide range of options. Don’t forget to reach out to your network and seek recommendations from colleagues, friends, or business partners who have previously hired contractors in Japan.

Step 3: Screen candidates

Review resumes, conduct interviews, and check references to select the most suitable contractor for your project. Screening candidates is a crucial step in the hiring process. Once you have a pool of potential candidates, carefully review their resumes to assess their qualifications and experience. Look for relevant certifications, past projects, and any specialized skills that align with your requirements. Consider conducting interviews to get a better understanding of their expertise, work ethic, and communication skills. Don’t hesitate to ask for references and follow up with them to gain insights into the contractor’s past performance and reliability.

Step 4: Create a written agreement

Establish a comprehensive independent contractor agreement that outlines the terms and conditions of the engagement. After selecting the most suitable contractor for your project, it is essential to create a written agreement to formalize the engagement. The agreement should clearly outline the terms and conditions, including the scope of work, project timeline, payment terms, and any other relevant details. It is advisable to consult with a legal professional or seek guidance from local authorities to ensure the agreement complies with Japanese labor laws and regulations.

Step 5: Provide necessary tools and resources

Ensure the contractor has access to the required equipment, software, and information needed to perform their tasks effectively. For a contractor to successfully carry out their work, it is essential to provide them with the necessary tools and resources. Depending on the nature of the project, this may include access to specific equipment, software, or information. Collaborate with the contractor to identify their requirements and ensure they have everything they need to perform their tasks effectively. Clear communication and timely provision of resources will contribute to a smooth and productive working relationship.

Step 6: Monitor performance

Regularly communicate with the contractor, track their progress, and address any issues promptly. Once the contractor begins working on your project, it is crucial to maintain regular communication and monitor their performance. Schedule periodic check-ins to discuss progress, address any concerns, and provide feedback. This will help ensure that the project stays on track and meets your expectations. If any issues or challenges arise during the course of the engagement, address them promptly and work collaboratively with the contractor to find solutions.

Suggested Read: Invoice for Contractors- The Key to Making an Ideal One!

Important Considerations to Hire, Manage, and Pay Contractors in Japan

When hiring and managing contractors in Japan, there are additional considerations to keep in mind:

- Cultural and language barriers: Ensure clear communication to avoid misunderstandings.

- Respect for hierarchy and protocol: Understand the importance of proper etiquette and formalities within the Japanese business culture.

- Compliance with labor laws: Familiarize yourself with the relevant labor laws to prevent any legal complications.

- Protection of intellectual property: Establish confidentiality agreements to protect your company’s valuable information.

Expanding on these considerations:

Cultural and Language Barriers

Japan has a unique culture with its own customs and traditions. When working with contractors in Japan, it is crucial to be aware of these cultural differences and adapt your communication style accordingly. Japanese is the primary language spoken in the country, so it is essential to have a clear understanding of the language or work with a translator to ensure effective communication. Misunderstandings can arise due to language barriers, so taking the time to clarify expectations and instructions can help avoid any potential issues.

Respect for Hierarchy and Protocol

Japanese society places a strong emphasis on hierarchy and respect for authority. This hierarchical structure extends to the business environment, where individuals are expected to show deference to those in higher positions. When managing contractors in Japan, it is important to understand and respect this hierarchy. Addressing individuals by their appropriate titles and using formal language demonstrates respect and helps maintain a positive working relationship. Additionally, being aware of proper business etiquette, such as exchanging business cards with both hands and bowing as a sign of respect, can go a long way in building rapport.

Compliance with Labor Laws

Japan has strict labor laws that govern employment relationships, including those with contractors. As a company hiring contractors in Japan, it is crucial to familiarize yourself with these laws to ensure compliance. Understanding regulations related to working hours, overtime, holidays, and benefits is essential to avoid any legal complications. It is advisable to consult with legal experts or seek guidance from local authorities to ensure that your contracts and work arrangements align with Japanese labor laws.

Protection of Intellectual Property

Intellectual property rights are highly valued in Japan, and protecting your company’s intellectual property is of utmost importance. When engaging contractors, it is essential to establish clear confidentiality agreements to safeguard your valuable information. These agreements should outline the scope of the contractor’s access to sensitive data, the obligations to maintain confidentiality, and the consequences of any breaches. Taking proactive measures to protect your intellectual property can help prevent unauthorized use or disclosure, ensuring the long-term success and competitiveness of your business.

By considering these additional factors when hiring and managing contractors in Japan, you can navigate the unique business landscape and foster successful collaborations. Embracing cultural differences, respecting hierarchy, complying with labor laws, and protecting intellectual property are key elements in establishing strong and mutually beneficial relationships with contractors in Japan.

Also Read: How to Pay Contractors in Your Business? The Ultimate Guide

How to Draw up an Independent Contractor Agreement in Japan

An independent contractor agreement is a crucial document that establishes the rights and obligations of both parties involved. When creating an agreement, consider the following:

- Clearly define the scope of work: Specify the tasks and deliverables expected from the contractor.

- Include compensation details: Outline the payment terms, rates, and invoicing procedures.

- Set confidentiality and non-compete clauses: Protect your company’s sensitive information and ensure the contractor does not engage in activities that compete with your business.

- Include termination provisions: Specify the circumstances under which the contract can be terminated by either party.

- Review with legal counsel: Seek advice from an experienced lawyer to ensure compliance with Japanese laws and regulations.

Do’s and Don’ts of Designing an Independent Contractor Agreement to Hire and Pay Contractors in Japan

Do’s

1. Specify Scope of Work

Clearly define the tasks and responsibilities of the independent contractor to avoid misunderstandings.

2. Payment Terms

Outline the payment structure, including rates, frequency, and any additional expenses or reimbursements. Ensure compliance with Japanese tax regulations.

3. Term and Termination

Clearly state the contract duration and conditions under which either party can terminate the agreement.

4. Confidentiality

Include clauses to protect sensitive information and clearly define what constitutes confidential data.

5. Intellectual Property

Address ownership of intellectual property created during the contract and clarify if it belongs to the contractor or the hiring company.

6. Compliance with Laws

Ensure the contract complies with Japanese labor laws, tax regulations, and any other relevant legal requirements.

7. Insurance and Liability

Clarify who is responsible for insurance coverage and outline liability limitations for both parties.

8. Dispute Resolution

Include a provision for resolving disputes, whether through negotiation, mediation, or arbitration, specifying the jurisdiction.

Don’ts

1. Ambiguous Language

Avoid vague or unclear language that may lead to misinterpretation. Be precise and detailed.

2. Ignoring Japanese Labor Laws

Familiarize yourself with Japanese labor laws and ensure the agreement complies with them. Failure to do so may result in legal issues.

3. Neglecting Tax Considerations

Take into account Japanese tax regulations and clearly define tax responsibilities to avoid complications.

4. Overlooking Cultural Nuances

Be mindful of cultural differences in business practices and communication to foster a positive working relationship.

5. Incomplete Scope of Work

Ensure all tasks and deliverables are explicitly outlined to prevent misunderstandings or disputes over expectations.

6. Ignoring Termination Clauses

Clearly define the conditions for terminating the contract to avoid potential legal issues.

7. Neglecting Confidentiality

Failing to include robust confidentiality clauses may jeopardize sensitive information and harm the hiring company.

8. Ignoring Language Requirements

If the contract is in Japanese, ensure accuracy and clarity in translation to prevent misunderstandings.

Also, check out: Independent Contractor Agreement for USA

How Payroll Works When You Move Ahead to Pay Contractors in Japan

When it comes to paying contractors in Japan, understanding the intricacies of payroll is essential for compliance and ensuring timely payments. Here’s how it typically works:

- Register with tax authorities: Before making any payments to contractors, you must register with the tax authorities and obtain a withholding tax identification number.

- Calculate and withhold taxes: As an employer, you are responsible for withholding income tax and social insurance premiums from the contractor’s payments.

- Report and remit tax deductions: Process and submit the required tax reports and payments to the appropriate authorities.

Tax Filing Requirements for Contractors in Japan

Contractors in Japan have specific tax filing requirements. They need to keep thorough records of their income and expenses and file their tax returns by the designated deadlines. The deadline for filing taxes is 15th March for the preceding tax year. Contractors in Japan can easily file taxes online at the e-tax portal of National Tax Agency- kokuzei chou.

In case of hiring a Japanese contractor as an individual, the recruiting company will have to deduct income tax from the payments made to the contractor. However, no such automatic tax deductions are made if the independent contractor functions as a legal business entity.

Japan has a Consumption Tax (CT) system instead of VAT. Contractors, whose earnings exceeds ¥10 million (that is, $75,000) over two calendar years- need to register for, as well as, charge their clients- CT. The standard CT rate in Japan is 10%.

Suggested Read: EOR India- A Detailed Guide on Employer of Record

Tax Compliance for US-based Companies

US companies planning to hire and pay contractors in Japan may need to adhere to various tax compliance requirements.

1. W-8BEN Form

Contractors in Japan may need to complete a W-8BEN form to certify their foreign status for tax withholding purposes.

2. Form 1042-S

If the US company makes payments subject to withholding to foreign contractors, it must file Form 1042-S to report these payments and the withholding tax.

3. Form 1099-NEC

US companies may also need to issue Form 1099-NEC to contractors in Japan who receive payments of $600 or more during the tax year.

4. Documentation of Payments

Maintain detailed records of payments made to contractors, including invoices, receipts, and any relevant correspondence, for documentation and potential audit purposes.

5. Legal and Regulatory Compliance

Ensure compliance with both US and Japanese labor and tax laws, considering factors such as social security contributions and other local requirements.

Remember that tax laws and regulations can change, so staying updated and seeking professional advice is crucial to ensuring compliance. This overview provides a starting point, but the specifics of your situation may require a more tailored approach.

Also Read: How to Pay Contractors in Canada? A Step-by-Step Guide

Minimum Wages for Contractors in Japan

Japan has established minimum wage laws to protect workers’ rights and ensure fair compensation. In 2023, minimum wages in Japan spiked to 1002 JPY per hour from 961 JPY per hour in 2022. However, the minimum wage rules in Japan don’t apply to independent contractors. Anyway, as an employer, it’s crucial to offer fair pay rates to contractors.

Best Ways to Pay Contractors in Japan

In Japan, various payment methods are used to compensate contractors. These commonly include:

1. Bank Transfers (Ginkō Furikomi)- To Pay Contractors in Japan

A widely used method, where the employer transfers funds directly to the contractor’s bank account. This is a secure and convenient option.

2. Cash Payments (Genkin Shiharai)- To Pay Contractors in Japan

While less common for larger transactions, some smaller jobs or informal arrangements may involve cash payments. However, this is not the preferred method due to lack of traceability.

3. Checks (Kogitte)- To Pay Contractors in Japan

Employers may issue checks to contractors. This method provides a record of the transaction and is suitable for those who prefer non-electronic options.

4. PayPal and Other Digital Payment Platforms- To Pay Contractors in Japan

With the increasing use of technology, some contractors may prefer payments through platforms like PayPal. However, this method might not be as prevalent as bank transfers.

5. Invoice Systems (Seikyuusho)- To Pay Contractors in Japan

Contractors often submit invoices detailing the services provided and the corresponding costs. Employers then process these invoices for payment through established channels.

6. Credit Transfers (Furikae)- To Pay Contractors in Japan

This method involves setting up a regular transfer schedule for recurring payments. It’s commonly used for ongoing services or contracts.

7. Corporate Credit Cards- To Pay Contractors in Japan

In certain cases, companies may issue corporate credit cards to employees or contractors for business-related expenses. This method streamlines payments and expense tracking.

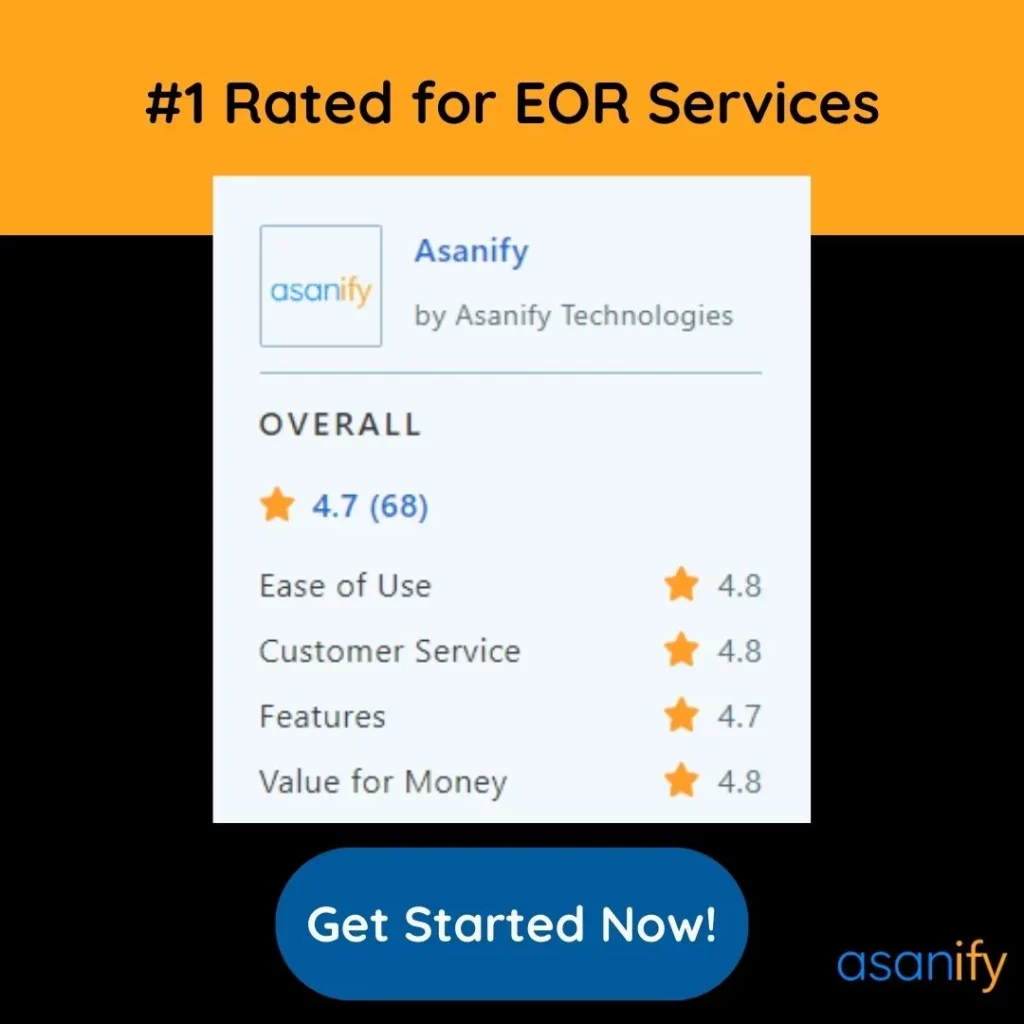

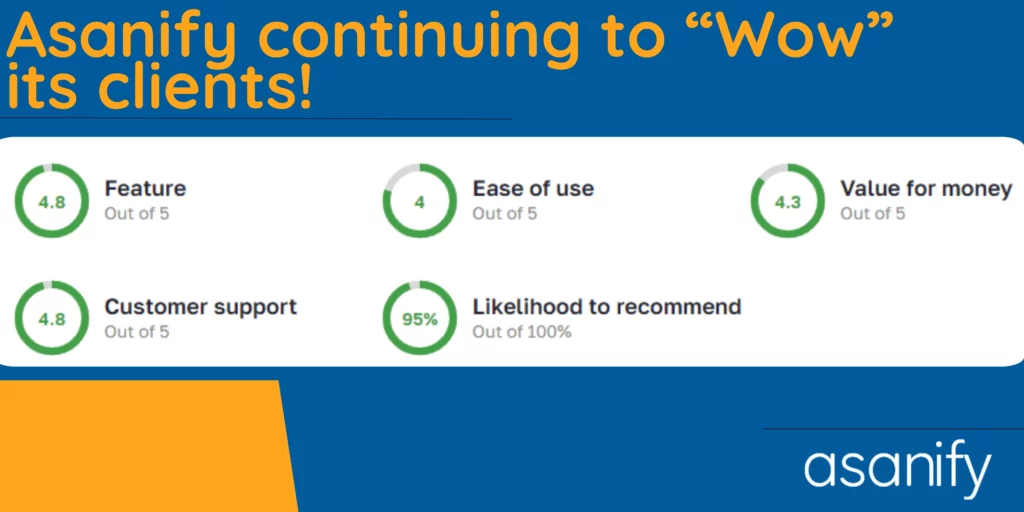

Not able to figure out as to what can be the easiest way to pay contractors in Japan? Well, using global contractor payroll services is going to simplify this otherwise arduous task. Using Asanify, you can run contractor payroll in a single click. All your stress related to errors in payroll calculation is sure to get eliminated. Further, you get access to complimentary HRMS with contractor payroll. If that sounded exciting, click here.

It’s crucial to note that payment practices can vary based on the nature of the work, the terms of the contract, and the preferences of both parties involved. Additionally, Japan’s business culture places importance on punctuality and proper documentation in financial transactions. Always ensure clarity in payment terms to avoid misunderstandings.

Suggested Read: Hire Employees in India Through EOR- Your Go-to Guide

Currency and Other Considerations to Pay Contractors in Japan

When paying contractors in Japan, it’s vital to consider currency exchange rates and any associated fees. Depending on your location and currency, you may need to factor in conversion costs and choose a payment method that offers competitive rates.

Tax and Other Payroll Costs for Contractors in Japan

In addition to income tax, employers in Japan are responsible for social insurance premiums and other payroll costs for contractors. It’s crucial to budget for these expenses and ensure compliance with the relevant regulations.

Termination or Extension Terms for Independent Contractors in Japan

When working with independent contractors in Japan, it’s necessary to have clear provisions in the contract regarding termination or extension. Make sure to outline the conditions under which the contract may be terminated or renewed to avoid any ambiguity or legal disputes.

Suggested Read: Terminating a Contractor- Know How to End an Agreement Politely

How to Convert an Independent Contractor in Japan to an Employee?

Converting an independent contractor to an employee in Japan involves several steps:

1. Legal Compliance

Ensure compliance with Japanese labor laws. Different rules apply to contractors and employees, so understanding the legal requirements is crucial.

2. Contract Review

Review the existing independent contractor agreement. Identify any terms that need adjustment for an employment relationship, such as working hours, benefits, and termination procedures.

3. Mutual Agreement

Discuss the proposed changes with the contractor. Obtain mutual agreement on the transition to an employee status, including changes in responsibilities, working conditions, and compensation.

4. New Employment Contract

Draft a new employment contract reflecting the agreed-upon terms. Specify the employment conditions, benefits, probationary period (if any), and any other relevant details.

5. Registration with Authorities

Notify the appropriate labor authorities of the change in employment status. This may involve submitting necessary documents and updating employee records.

6. Social Insurance Enrollment

Enroll the employee in social insurance programs, including health insurance and pension schemes. Ensure compliance with mandatory insurance requirements in Japan.

7. Tax Implications

Consider tax implications for both the employer and the employee. Ensure proper withholding of income tax and social insurance contributions.

8. Employee Handbook

Provide the new employee with an employee handbook outlining company policies, procedures, and expectations.

9. Orientation and Training

Conduct an orientation session for the newly hired employee. Provide any necessary training to help them integrate into the company culture and understand their new role.

10. Communication

Clearly communicate the transition to the rest of the team to ensure a smooth integration process.

11. Termination of Contractor Agreement

Officially terminate the independent contractor agreement, outlining the reasons for termination and any relevant final payments.

12. Follow-up

Regularly follow up with the new employee during the initial months to address any concerns, provide feedback, and ensure a successful transition.

Always consult with legal and HR professionals familiar with Japanese labor laws to ensure full compliance and a smooth transition. Further, Asanify is here to help you convert your favorite contractors to full-time employees smoothly and compliantly. You won’t have to worry about misclassification risks because everything will be carried out in accordance with the rules and regulations of the land.

Also Read: Pay Contractors in Poland- A Complete Hiring Manual

Quick Wrap Up: Pay Contractors in Japan

Hiring and paying contractors in Japan can be a complex process, but with the right knowledge and preparation, you can navigate it successfully. Remember to understand the legal distinctions between contractors and employees, ensure compliance with labor laws, and establish clear agreements and payment processes. By following these guidelines, you can build positive and productive relationships with contractors in Japan.

Frequently Asked Questions: Pay Contractors in Japan

To further assist you in your journey of hiring and paying contractors in Japan, here are answers to some common questions:

Q: How do I pay contractors in Japan?

A: Payments to contractors in Japan are commonly made through bank transfers. Ensure you have the contractor’s bank details, including account name, number, and branch information.

Q: Are there specific invoicing requirements for contractor payments in Japan?

A: Yes, invoices should include details like the contractor’s name, address, the nature of services, and the agreed-upon payment terms. It’s advisable to consult with a local accountant for precise requirements.

Q: What are the common payment terms when working with contractors in Japan?

A: Net 30 days is a standard payment term in Japan. However, terms can vary, so it’s essential to discuss and agree upon payment timelines with the contractor beforehand.

Q: Are there any tax implications for paying contractors in Japan?

A: Yes, withholding tax may apply to payments made to foreign contractors. It’s crucial to understand the tax regulations and potentially seek advice from a local tax professional.

Q: Can I pay contractors in foreign currency?

A: While it’s possible, it’s recommended to pay contractors in Japanese Yen to avoid potential currency exchange issues. Confirm with the contractor and your bank for the most suitable arrangement.

Q: Are there specific regulations for paying freelance contractors compared to regular employees in Japan?

A: Yes, freelancers often fall under different tax and social insurance regulations. Be sure to understand the distinction and comply with relevant laws.

Q: What records should I maintain for contractor payments in Japan?

A: Keep detailed records of all transactions, including contracts, invoices, and proof of payments. This documentation is vital for compliance and auditing purposes.

Q: How do I handle consumption tax when paying contractors in Japan?

A: Consumption tax rules may apply depending on the nature of services. Check whether your contractor is liable for consumption tax and adjust payments accordingly.

Q: Can I use online payment platforms to pay contractors in Japan?

A: While some contractors may accept online payments, traditional bank transfers are more widely used. Confirm the preferred payment method with your contractor.

Q: Are there penalties for late payments to contractors in Japan?

A: Late payment penalties may apply, and it’s essential to adhere to the agreed-upon payment terms. Communicate proactively if any delays are anticipated. Always consult with a local professional or legal advisor for the most accurate and up-to-date information on paying contractors in Japan.

Now that you have a comprehensive guide at your disposal, you can confidently navigate the process of hiring and paying contractors in Japan. By understanding the legal requirements, following best practices, and fostering strong relationships with contractors, you can create successful partnerships and achieve your business goals.

Not to be considered as tax, legal, financial or HR advice. Regulations change over time so please consult a lawyer, accountant or Labour Law expert for specific guidance.