Are you planning to hire contractors in Thailand? Well, you’re in the right place! In this comprehensive guide, we will walk you through the entire process of hiring and paying contractors in Thailand. From understanding who qualifies as an independent contractor to navigating the intricacies of payroll and taxation, we’ve got you covered. So, let’s dive in and learn everything you need to know to hire and pay contractors in Thailand successfully.

Contents

- Who is an Independent Contractor in Thailand?

- How is an independent contractor in Thailand different from an Employee?

- Penalties for Contractor and Employee misclassification in Thailand

- What are the Labor Laws in Thailand?

- Steps to Hire a Contractor in Thailand

- Important Considerations for Hiring and Managing Contractors in Thailand

- How to draw up an independent contractor agreement in Thailand

- Do’s and Don’ts of Designing an Independent Contractor Agreement to Hire and Pay Contractors in Thailand

- How Payroll Works When You Move Ahead to Pay Contractors in Thailand

- Tax Filing Requirements for Contractors in Thailand

- Tax Compliance Forms for US-based Companies

- Minimum Wages for Contractors in Thailand

- Best Ways to Pay Contractors in Thailand

- Currency and Other Considerations to Pay Contractors in Thailand

- Tax and Other Payroll Costs for Contractors in Thailand

- Termination or extension terms for independent contractors in Thailand

- How to Convert an Independent Contractor in Thailand to an Employee?

- Quick Wrap Up

- Frequently Asked Questions

Who is an Independent Contractor in Thailand?

Before we delve into the details of hiring and paying contractors in Thailand, let’s clarify who qualifies as an independent contractor. In Thailand, an independent contractor is an individual who provides services to a company or individual on a contractual basis. Unlike employees, independent contractors work independently and are not considered part of the company’s workforce.

Thailand, known for its vibrant culture and bustling economy, has a diverse range of industries that rely on the expertise of independent contractors. From the bustling streets of Bangkok to the serene beaches of Phuket, independent contractors can be found in various sectors such as technology, tourism, manufacturing, and more.

When it comes to the legal definition of an independent contractor in Thailand, there are certain criteria that need to be met.

1. Written Contract Agreement

Firstly, the contractor must have a written agreement with the company or individual they are providing services to. This agreement outlines the scope of work, payment terms, and duration of the contract.

2. Autonomy of Work

An independent contractor in Thailand must have control over how they perform their work. Unlike employees who are typically given specific instructions and guidelines, contractors have the freedom to determine the methods and processes they use to complete their tasks. This level of autonomy allows contractors to showcase their expertise and deliver results in a way that aligns with their unique skill set.

3. Nature of Financial Arrangement

Another important aspect to consider is the financial arrangement between the contractor and the company. Independent contractors in Thailand are responsible for their own taxes and social security contributions. Unlike employees who have their taxes deducted from their salary, contractors must handle their own tax obligations and ensure compliance with the local tax laws.

It is worth noting that the distinction between an independent contractor and an employee is crucial in Thailand. Companies must be mindful of the legal implications and potential consequences of misclassifying workers. The Thai government has specific regulations in place to protect the rights of both employees and independent contractors, ensuring fair treatment and appropriate compensation.

Overall, the role of an independent contractor in Thailand is an integral part of the country’s workforce. Their expertise, flexibility, and ability to work independently contribute to the growth and success of various industries. Whether it’s a software developer working on a cutting-edge project or a freelance tour guide showcasing the beauty of Thailand, independent contractors play a vital role in shaping the economy and providing valuable services to businesses and individuals alike.

Also Read: Pay Contractors in the United States- A Consolidated Hiring Guide

How is an Independent Contractor in Thailand Different from an Employee?

Understanding the difference between independent contractors and employees in Thailand is essential for both employers and workers. While employees work under an employment agreement, independent contractors operate under a service agreement. This distinction has significant implications for the rights, responsibilities, and legal protections afforded to each category.

Suggested Read: Pay Contractors in India- The Ultimate Hiring Guide

Penalties for Contractor and Employee Misclassification in Thailand

Classifying workers correctly is vital to avoid legal issues in Thailand. Misclassifying workers can lead to penalties and potential legal action. The Royal Thai Revenue Department and the Ministry of Labor are strict in enforcing regulations, as misclassification can result in tax evasion and the denial of employee rights. Therefore, it is essential to ensure proper classification of workers.

When it comes to contractor and employee misclassification, the Thai government takes the matter seriously. The consequences of misclassifying workers can be severe, impacting both the employer and the employees involved. Let’s take a closer look at the penalties that can be imposed in such cases.

1. Financial Penalties

Firstly, if a contractor or employer is found to have misclassified workers, they may face financial penalties. These penalties can vary depending on the severity of the misclassification and the number of workers affected. The Royal Thai Revenue Department has the authority to impose fines and penalties, which can range from monetary fines to suspension of business operations.

2. Back Taxes

In addition to financial penalties, the employer may also be required to pay back taxes and social security contributions for the misclassified workers. This can result in a significant financial burden for the employer, as they would need to cover the unpaid taxes and contributions for the entire period of misclassification.

3. Legal Action

Misclassification can lead to legal action initiated by the affected workers. Employees who have been misclassified may file complaints with the Ministry of Labor, seeking compensation for the denial of their rights and benefits. This can result in costly legal battles for the employer, including potential settlements and legal fees.

The Thai government is committed to protecting the rights of workers and ensuring fair employment practices. To achieve this, they have implemented strict measures to prevent contractor and employee misclassification. Employers are expected to comply with these regulations and properly classify their workers to avoid penalties and legal consequences.

It is worth noting that the consequences of misclassification extend beyond financial penalties and legal action. Employers who are found to have misclassified workers may also face reputational damage. Word spreads quickly in the business community, and a company known for misclassifying workers may find it challenging to attract and retain top talent.

In conclusion, contractor and employee misclassification in Thailand can have severe consequences for both employers and employees. The penalties imposed by the Royal Thai Revenue Department and the Ministry of Labor are meant to deter such practices and ensure fair treatment of workers. Employers must take the necessary steps to correctly classify their workers to avoid financial penalties, legal action, and reputational harm. Compliance with the regulations is not only a legal requirement but also a responsible business practice that promotes a fair and inclusive work environment.

Also Read: Employee Classification Guide- The Key to Avoiding Hefty Penalties!

What are the Labor Laws in Thailand?

Thailand’s labor laws cover various aspects for both employees and contractors. Let’s find out what these are!

For Employees

1. Working Hours

The standard working hours are 8 hours per day, 48 hours per week. For working any hour exceeding eight on a workday is compensated at 150% of the hourly salary of an employee. However, if worked for a shift of 8 hours on a holiday or day off, overtime compensation rate of 200% of the base rate is applicable. If employees work beyond 8 hours on a holiday, it has to be compensated at 300% of the base hourly rate.

2. Minimum Wage

Thailand sets a minimum wage, which varies by province. Employers must adhere to these rates. The exact figure of the minimum wage rate is mentioned below.

3. Leave Entitlements

Employees are entitled to annual leave, sick leave, and public holidays. Maternity and paternity leave are also granted.

4. Social Security

Employers and employees contribute to the social security fund, covering health, unemployment, and other benefits.

5. Termination and Severance

Termination requires notice or payment in lieu. Severance pay depends on the duration of employment.

6. Work Permits

Foreign employees must obtain work permits, and employers are responsible for securing these permits.

For contractors

1. Contractual Arrangements

Contractors typically operate under fixed-term contracts or project-based agreements, specifying terms, deliverables, and compensation.

2. Taxation

Contractors are responsible for their taxes, and withholding tax may apply. The tax obligations depend on the nature and duration of the contract.

3. Social Security

Contractors are not covered by the employee social security system. They are responsible for their insurance and benefits.

4. Intellectual Property

Ownership of intellectual property created during the contract may be defined in the agreement.

5. Liabilities

Contractors are often considered independent entities, limiting the client’s liability. However, the contract should clearly outline responsibilities and liabilities.

6. Termination

Termination terms for contractors are usually specified in the contract, including notice periods and conditions for termination.

Suggested Read: Pay Contractors in Sweden- A Comprehensive Guide to Hiring

Steps to Hire a Contractor in Thailand

Now, let’s explore the necessary steps to hire a contractor in Thailand. Follow these guidelines to ensure a smooth and legally compliant hiring process:

Step 1: Define your requirements- Clearly define the scope of work, desired qualifications, and term of the contract

When defining your requirements, it is important to be as specific as possible. Consider the tasks you need the contractor to perform, the skills and experience they should possess, and the duration of the contract. By clearly outlining your requirements, you can attract candidates who are the best fit for your project.

Step 2: Find suitable candidates- Utilize online platforms, recruitment agencies, or personal networks to find potential contractors

Thailand offers a variety of online platforms where you can find suitable candidates for your project. Websites such as JobsDB, LinkedIn, and ThaiJob.com are popular choices for both employers and job seekers. Additionally, you can reach out to recruitment agencies that specialize in contractor placements or leverage your personal networks to find recommendations.

Step 3: Vet candidates- Conduct thorough background checks and interviews to assess candidates’ skills and suitability for the role

When vetting candidates, it is crucial to conduct thorough background checks to verify their qualifications and experience. This can include checking their educational credentials, previous work experience, and contacting their references. Additionally, conducting interviews allows you to assess their communication skills, problem-solving abilities, and cultural fit within your organization.

Step 4: Draft a service agreement- Create a comprehensive service agreement that outlines the terms and conditions of the contractor’s engagement

When drafting a service agreement, it is important to include all relevant details to protect both parties involved. This can include the scope of work, payment terms, confidentiality clauses, intellectual property rights, termination conditions, and any other specific requirements. It is advisable to seek legal advice to ensure that the agreement complies with Thai labor laws and regulations.

Step 5: Register the contract- Register the service agreement with the Department of Labor Protection and Welfare to ensure legal compliance

In Thailand, it is mandatory to register employment contracts with the Department of Labor Protection and Welfare. By registering the service agreement, you ensure that both parties are protected and that the contract is legally binding. Failure to register the contract may result in legal complications and penalties.

Step 6: Retain necessary documentation- Keep a copy of the service agreement, contractor’s identification documents, and proof of payment for record-keeping purposes

It is essential to retain all necessary documentation related to the contractor’s engagement. This includes a copy of the signed service agreement, the contractor’s identification documents, such as their passport or work permit, and proof of payment for their services. These documents serve as evidence of the contractual relationship and can be useful for record-keeping, audits, or any future disputes that may arise.

Also Read: Pay Contractors in Australia- A Guide to the Hiring Process

Important Considerations for Hiring and Managing Contractors in Thailand

When hiring and managing contractors in Thailand, there are several essential considerations you should keep in mind:

- Clear communication: Maintain clear and consistent communication with contractors to ensure they understand their responsibilities and deliverables.

- Schedule and deadlines: Set realistic deadlines and expectations to ensure timely completion of projects.

- Payment terms: Clearly define payment terms, including rates, frequency, and methods of payment in the service agreement.

- Intellectual property rights: Establish ownership and usage rights of any intellectual property created by the contractor during the engagement.

- Confidentiality and non-compete clauses: Include clauses to protect sensitive information and prevent contractors from engaging in direct competition.

- Performance evaluation: Regularly assess contractors’ performance to ensure they meet expectations and provide constructive feedback when necessary.

How to Draw Up an Independent Contractor Agreement in Thailand

When hiring a contractor in Thailand, it is crucial to draft a comprehensive independent contractor agreement. This agreement will provide legal protection for both parties involved. Here are some essential elements to include:

- Identification details: Include the full names and addresses of both parties.

- Scope of work: Clearly outline the contractor’s responsibilities, deliverables, and project timeline.

- Compensation: Specify the contractor’s fee, payment terms, and any additional expenses the contractor may be entitled to.

- Confidentiality and non-disclosure: Protect any confidential information shared during the engagement.

- Termination clauses: Define the conditions under which either party can terminate the contract.

- Dispute resolution: Establish the process for resolving any potential disputes that may arise during the engagement.

Recommended Read: Independent Contractor Agreement for USA (Download Template)

Do’s and Don’ts of Designing an Independent Contractor Agreement to Hire and Pay Contractors in Thailand

How Payroll Works When You Move Ahead to Pay Contractors in Thailand

Now, let’s dive into the intricacies of payroll when paying contractors in Thailand. While contractors differ from employees in terms of legal classification, payroll still plays a crucial role. It is important to ensure timely and accurate payments to maintain a positive working relationship with contractors. Here’s how payroll works when paying contractors:

- Calculate gross payments: Determine the gross amount payable to the contractor based on the agreed-upon fee and any additional expenses.

- Deduct withholding tax: Deduct the applicable withholding tax from the gross payment amount according to Thai tax laws.

- Make net payments: Pay the contractor the net amount after deducting withholding tax.

- Keep records: Maintain proper records of payments made to contractors for tax and audit purposes.

Suggested Read: Non-Disclosure Agreement [+Template]

Tax Filing Requirements for Contractors in Thailand

Contractors in Thailand have specific tax filing requirements. Understanding and fulfilling these obligations is crucial to maintain compliance with the Thai Revenue Department. Here are the essential tax filing requirements for contractors:

- Independent contractors in Thailand need to file and pay their income taxes by themselves.

- Contractors, who are functioning as a company, ought to pay a Corporate Income Tax (CIT) rate of 20%.

- Companies having paid-in capital of THB 5 million (that is, USD 140,000) or less than this amount- need to pay a progressive tax rate of 15% for a net profit of THB 300,001 to 3 million (that is, USD 8,380 to USD 83,800). Or, they would have to pay 20% for a net profit of an amount exceeding THB 3 million.

Important Note About CIT Returns

It is crucial to know that half-year CIT returns need to be filed and paid within a tenure of 2 months after the first 6 months of the tax year. This can be done while the final CIT return and payment remain as dues within 150 days of the end of the tax year.

VAT Rate

The standard VAT rate of 10% is applicable for contractors in Thailand. However, the VAT rate has been reduced to 7% as of September 2023. Depending upon the kind of the commercial activities undertaken, contractors in Thailand might have to pay extra business tax.

Note: Contractors in Thailand may choose to secure social security coverage voluntarily through the Social Security Office (SSO). Doing so is not at all mandatory.

Tax Compliance Forms for US-based Companies

For US-based companies looking to hire and pay contractors in Thailand, tax compliance involves several forms and considerations. It’s essential to adhere to both US and Thai tax regulations. Let’s what these crucial tax forms are:

1. Form W-8BEN-E: Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities)

- This form is typically provided by the Thai contractor to establish their foreign status and claim any applicable tax treaty benefits.

- It helps determine the appropriate withholding tax rate on payments made to foreign entities.

2. Form 1099-NEC: Non-employee Compensation

- If the Thai contractor qualifies as a non-employee, the US company may need to issue a Form 1099-NEC to report payments made to the contractor.

- This form is crucial for both IRS reporting and providing the contractor with income information.

3. Form 1042: Annual Withholding Tax Return for U.S. Source Income of Foreign Persons

If there is withholding on payments made to the Thai contractor, the US company may need to file Form 1042 to report and remit the withholding tax to the IRS.

4. Form 8805: Foreign Partner’s Information Statement of Section 1446 Withholding Tax

If the Thai contractor is considered a foreign partner in a U.S. partnership, Form 8805 might be required to report income effectively connected with a U.S. trade or business.

5. Form 5472: Information Return of a 25% Foreign-Owned U.S. Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business

If the Thai contractor is paid by a foreign-owned U.S. corporation, Form 5472 may be necessary to report certain transactions between the foreign-owned corporation and the foreign contractor.

Also Read: Invoice for Contractors- The Guide to Making an Ideal One!

Minimum Wages for Contractors in Thailand

Thailand has a minimum wage policy, set up by the Ministry of Labour, to protect workers from exploitation. The minimum wage rate varies on the basis of regions. Usually, it ranges from 328 THB per day to 354 THB ($10.20 USD per day). Therefore, the monthly minimum wage rate varies from 9000 THB to 10000 THB. (equivalent to $261 USD per month). However, minimum wage regulations generally apply to employees and not independent contractors. As contractors negotiate their fees independently, the minimum wage law does not restrict their earnings. Nevertheless, it is essential to ensure that the agreed-upon compensation is fair and aligns with industry standards.

Best Ways to Pay Contractors in Thailand

In Thailand, various payment methods are used to pay contractors, depending on the agreement between the parties involved. Let’s have a look at some of the most common payment methods:

1. Bank Transfers- To Pay Contractors in Thailand

Direct bank transfers are widely used for contractor payments in Thailand. Employers can transfer funds directly into the contractor’s bank account. This method is secure and traceable, providing a transparent transaction process.

2. Cheques- To Pay Contractors in Thailand

While less common than bank transfers, cheques are still used for contractor payments. The contractor can deposit the cheque into their bank account. It’s important to note that processing times for cheques may vary, and electronic methods are often preferred.

3. Cash Payments- To Pay Contractors in Thailand

In some cases, cash payments might be made, especially for smaller transactions or when dealing with informal agreements. However, this method is less common due to security and record-keeping concerns.

4. Online Payment Platforms- To Pay Contractors in Thailand

With the rise of digital payments, online platforms such as PayPal or local equivalents may be used. Ensure that the contractor has access to and prefers such methods before proceeding.

5. Letter of Credit (L/C)- To Pay Contractors in Thailand

For larger projects or international transactions, a letter of credit may be used. This involves a bank guaranteeing payment to the contractor once specified conditions are met, providing security to both parties.

6. Mobile Banking Apps- To Pay Contractors in Thailand

Many contractors prefer receiving payments through mobile banking apps. Employers can transfer funds using the contractor’s registered mobile number, providing a convenient and efficient option.

7. Payment in Installments- To Pay Contractors in Thailand

Instead of a lump sum, some contracts involve payments in installments based on project milestones. This can be facilitated through any of the above methods, with agreed-upon schedules for each payment.

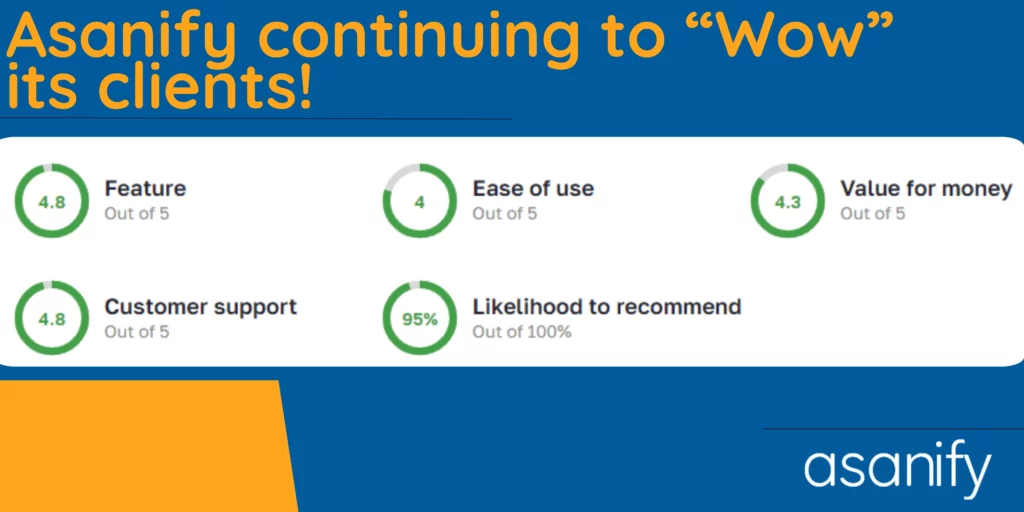

Wondering what can be the easiest way to manage contractor payroll? Well, using Asanify’s global contractor payroll tool, you can simplify work. With Asanify, you can run contractor payroll in a single click. Further, you can get rid of calculation errors in payroll, and keep things organized and precise. Staying compliant with laws of both the countries- one, where you reside and the other, where the contractor is from- becomes easier. Click here to get started now!

Suggested Read: How to Pay Contractors in Your Business? The Ultimate Guide

Currency and Other Considerations to Pay Contractors in Thailand

When paying contractors in Thailand, you’ll need to consider currency exchange rates and other related factors. Here are some key considerations:

- Exchange rates: Monitor exchange rates to ensure that contractors receive their payments in the agreed-upon currency without incurring unnecessary conversion fees.

- Bank fees: Be aware of any potential bank fees associated with international fund transfers to optimize cost-efficiency.

- Contractor preferences: Consult with contractors to determine their preferred payment method and currency to streamline the process.

Tax and Other Payroll Costs for Contractors in Thailand

In addition to taxes, there may be other payroll costs associated with hiring contractors in Thailand. These costs can vary depending on the nature of the engagement and the contractor’s contractual terms. Here are some potential additional payroll costs to be aware of:

- Social security contributions: Contractors may be liable for social security contributions, depending on the nature of their engagement.

- Insurance premiums: Depending on the industry and specific circumstances, contractors may require additional insurance coverage.

- Professional fees: If you engage the services of an external payroll or accounting firm, their fees may form part of the overall payroll costs.

Termination or Extension Terms for Independent Contractors in Thailand

Terminating or extending the engagement of an independent contractor in Thailand should be done in accordance with the terms outlined in the service agreement. It is crucial to follow the agreed-upon procedures to ensure a smooth transition. Here are some essential considerations when terminating or extending an independent contractor’s engagement:

- Notice period: Determine the notice period required by both parties to terminate or extend the contract.

- Payment obligations: Clarify any financial obligations that arise upon termination or extension.

- Deliverables and handover: Clearly outline the deliverables required at the end of the engagement and facilitate a smooth handover if necessary.

Suggested Read: Terminating a Contractor- Know How to End an Agreement Politely

How to Convert an Independent Contractor in Thailand to an Employee?

Converting an independent contractor to an employee in Thailand involves several steps:

1. Legal Assessment

- Ensure compliance with Thai labor laws and regulations.

- Review the existing independent contractor agreement and assess its alignment with employment laws.

2. Contract Termination

- Notify the contractor in writing about the intended change.

- Follow the termination clauses outlined in the existing agreement.

3. New Employment Agreement

- Draft a new employment contract outlining terms such as salary, working hours, benefits, and responsibilities.

- Ensure the agreement complies with Thai labor standards.

4. Work Permits and Visas

If the contractor is a foreign national, obtain the necessary work permits and visas for employment.

5. Employee Benefits

Determine and provide statutory benefits required for employees in Thailand, such as social security contributions, health insurance, and any other mandated benefits.

6. Tax Implications

Update tax arrangements to reflect the change in employment status, ensuring proper withholding and reporting.

7. Notice Periods

- Establish notice periods for both parties in case of termination.

- Comply with Thai labor laws regarding notice periods.

8. Registration with Authorities

Register the employee with relevant authorities, such as the Ministry of Labor, to ensure compliance with reporting requirements.

9. Orientation and Training

Provide necessary orientation and training to the new employee regarding company policies, procedures, and job expectations.

10. Communication

Clearly communicate the transition to the team and address any concerns or questions from the contractor.

11. Legal Consultation

Consider seeking legal advice or consulting with local labor authorities to ensure all steps comply with current regulations.

12. Record Keeping

Maintain proper documentation of the transition, including the termination of the contractor agreement and the commencement of the new employment agreement.

Also Read: Full and Final Settlement- See How to Run Termination Payroll

Quick Wrap Up: Pay Contractors in Thailand

In this comprehensive guide, we have explored everything you need to know about hiring and paying contractors in Thailand. From understanding the differences between independent contractors and employees to navigating the complexities of payroll and taxation, we have covered it all. By following the steps outlined and adhering to Thai labor laws, you can ensure a successful engagement with contractors in Thailand.

Frequently Asked Questions: Pay Contractors in Thailand

Q: Can a contractor work for multiple clients simultaneously in Thailand?

A: Yes, independent contractors in Thailand are typically free to work with multiple clients simultaneously, as long as it does not breach any non-compete agreements or conflict with the terms stated in their service agreements.

Q: Are there any restrictions on hiring foreign contractors in Thailand?

A: Hiring foreign contractors in Thailand may have additional requirements and restrictions, such as work permits and visa arrangements. It is important to research and comply with the relevant immigration laws and regulations.

Q: How can I ensure proper classification of workers to avoid misclassification penalties?

A: To ensure proper classification of workers, carefully review the scope of work and control exercised over the individual. Consult legal professionals experienced in Thai labor laws to ensure compliance.

Q: Do contractors need to provide their services exclusively to one client in Thailand?

A: No, independent contractors in Thailand are not typically required to provide their services exclusively to one client, unless otherwise stated in their service agreements.

Q: Are there any limitations on the duration of a contractor engagement in Thailand?

A: There are generally no specific limitations on the duration of a contractor engagement in Thailand. The length of the engagement is typically determined by the terms stated in the service agreement.

Q: Is it necessary to engage the services of a legal professional or accountant when hiring contractors in Thailand?

A: While not mandatory, engaging the services of a legal professional or accountant experienced in Thai labor laws can help ensure proper compliance and minimize potential risks.

Q: What happens if a contractor fails to fulfill their contractual obligations?

A: If a contractor fails to fulfill their contractual obligations, refer to the termination clauses outlined in the service agreement. Follow the agreed-upon procedures for termination and resolve any potential disputes according to the dispute resolution mechanism established in the agreement.

Not to be considered as tax, legal, financial or HR advice. Regulations change over time so please consult a lawyer, accountant or Labour Law expert for specific guidance.