If you are looking to hire and pay contractors in Mexico, you have come to the right place. Bustling with a population of almost 130 million and boasting of 1.273 trillion USD, Mexico is considered to be the 15th largest economy in the world. The best part? The nation shelters exceptional talent and educated, tech-savvy workforce. No matter what project you have at hand, you can always get access to top-notch skills of independent contractors in Mexico by hiring them. However, hiring contractors from Mexico may turn out to be a bit riddling if you are not aware of the worker classification rules and compliances.

Navigating the intricacies of international business practices can be challenging, but understanding the unique landscape of contractor engagement in Mexico is crucial for a successful partnership. In this blog, we’ll delve into the essential aspects of hiring contractors, from legal considerations to payment structures, providing you with valuable insights to streamline your operations and foster positive working relationships south of the border. Whether you’re a seasoned business owner or venturing into cross-border collaborations for the first time, join us as we unravel the complexities and guide you through the process of working with contractors in Mexico.

Let’s start decoding as to how you can hire and pay contractors in Mexico seamlessly!

Contents

- Who is an Independent Contractor in Mexico?

- How is an independent contractor in Mexico different from an Employee?

- Penalties for Contractor and Employee misclassification in Mexico

- What are the Labor Laws in Mexico?

- Steps to Hire a Contractor in Mexico

- How to draw up an independent contractor agreement in Mexico

- Do’s and Don’ts of Designing an Independent Contractor Agreement to Hire and Pay Contractors in Mexico

- How Payroll Works When You Move Ahead to Pay Contractors in Mexico

- Tax Filing Requirements for Contractors in Mexico

- Tax Compliance for US-based Companies

- Minimum Wages for Contractors in Mexico

- Best Ways to Pay Contractors in Mexico

- Currency and Other Considerations to Pay Contractors in Mexico

- Tax and Other Payroll Costs for Contractors in Mexico

- Termination or extension terms for independent contractors in Mexico

- How to Convert an Independent Contractor in Mexico to an Employee?

- Quick Wrap Up

- Frequently Asked Questions

Who is an Independent Contractor in Mexico?

In Mexico, an independent contractor is often referred to as a “contratista independiente” or “trabajador independiente.” An independent contractor is an individual or business entity that provides services to another party under a contract. Unlike an employee, an independent contractor is not considered a permanent staff member of the hiring party and operates as a separate business entity or self-employed individual.

Key characteristics of an independent contractor in Mexico include:

1. Independence

Independent contractors operate independently and are not considered employees of the company for which they provide services. They are in business for themselves and may work for multiple clients simultaneously.

2. Contractual Relationship

The engagement between the hiring party and the independent contractor is based on a contractual agreement. This agreement outlines the scope of work, deliverables, payment terms, and other relevant details.

3. Financial Independence

Independent contractors are responsible for their own business expenses, taxes, and contributions. They are not entitled to employee benefits such as health insurance, vacation pay, or retirement plans from the hiring company.

4. Flexibility

Independent contractors have more flexibility in terms of working hours and work location. They are not subject to the same level of control and supervision as employees.

5. Taxation

Independent contractors are typically responsible for handling their own taxes, including income tax and social security contributions. They issue invoices for their services and may be subject to value-added tax (VAT).

6. Project-Based Work

Independent contractors are often hired for specific projects or tasks. Once the project is completed, the contractual relationship may end or be renewed based on mutual agreement.

Suggested Read: Pay Contractors in the United States- A Consolidated Hiring Guide

How is an Independent Contractor in Mexico Different from an Employee?

In Mexico, distinguishing between an independent contractor and an employee is crucial, as it determines various legal and tax implications for both parties. Here are key differences between an independent contractor and an employee in Mexico:

|

Parameters |

Independent Contractor |

Employee |

|

Nature of the Relationship |

Operates as a separate business entity or self-employed individual. | Has an ongoing, often long-term relationship with the employer. |

| Control and Supervision | Retains a higher degree of independence and control over how work is performed. | Subject to more direct control and supervision by the employer, including specific work hours, reporting structures, and performance expectations. |

| Tax and Social Security Contributions | Responsible for handling their own taxes, including income tax and social security contributions. | Taxes and social security contributions are typically withheld by the employer, who is responsible for submitting these to the appropriate authorities. |

| Benefits and Protections | Does not receive employee benefits such as health insurance, vacation pay, or retirement plans. | Eligible for benefits provided by the employer, including health insurance, paid time off, and other employment-related protections under labor laws. |

| Duration of Relationship | Engagements are often project-based, with a specific scope and duration. | Typically has an ongoing and long-term relationship with the employer, and the employment contract may not have a defined end date. |

| Labor Laws and Regulations | Governed by civil law contracts. | Protected by labor laws, including minimum wage regulations, working hours, and termination rights. |

| Termination | The contract specifies the conditions for termination. | Termination is subject to labor laws, and specific procedures, including notice periods and severance pay, may apply. |

Penalties for Contractor and Employee Misclassification in Mexico

In Mexico, misclassifying workers as independent contractors or employees can have legal and financial consequences for employers. Penalties for misclassification may vary, and it’s crucial for businesses to comply with labor laws to avoid legal challenges and financial liabilities. Here are potential penalties for contractor and employee misclassification in Mexico:

1. Tax Penalties

Misclassification may lead to tax-related penalties. If a worker is misclassified as an independent contractor, the employer might face issues related to tax withholdings, such as income tax and social security contributions.

2. Social Security Penalties

Employers are required to contribute to social security on behalf of employees. Misclassifying employees as contractors may result in penalties for failing to make the necessary social security contributions.

3. Back Payments and Benefits

Misclassified workers may claim entitlement to employee benefits and back payments, including unpaid wages, vacation pay, and other benefits they would have received if properly classified.

4. Labor Law Violations

Misclassification can lead to violations of labor laws, resulting in penalties imposed by labor authorities. These penalties may include fines for non-compliance with regulations related to working hours, rest days, and termination procedures.

5. Severance Pay

If an individual classified as an independent contractor is later determined to be an employee, they may be entitled to severance pay upon termination, as per labor laws.

6. Legal Proceedings and Lawsuits

Misclassified workers may file legal claims or lawsuits to seek compensation for alleged labor law violations. Employers may face legal proceedings and incur legal costs in defending against such claims.

7. Damages and Interest

Employers found to have misclassified workers may be liable for damages and interest payments. These can include compensation for the financial losses suffered by misclassified workers due to the lack of proper benefits and protections.

8. Reclassification Orders

Labor authorities may issue reclassification orders, requiring the correct classification of workers. Employers may need to adjust the status of workers, adhere to labor laws, and make any necessary retroactive payments.

Recommended Read: Pay Contractors in India- The Ultimate Hiring Guide

What are the Labor Laws in Mexico?

Labor laws in Mexico distinguish between employees and independent contractors, each having specific rights and obligations. Below is an overview of labor laws for both employees and contractors in Mexico:

Labor Laws for Employees

1. Employment Contracts

Employment contracts in Mexico must be in writing and include essential terms such as the nature of the work, salary, benefits, working hours, and duration of the contract.

2. Working Hours

The standard workweek in Mexico is 48 hours, divided into 6 working days. Overtime pay is required for work exceeding the standard hours. In Mexico, overtime wages ought to be 100 percent higher than the wages applicable during the usual working hours.

3. Benefits

Employees are entitled to various benefits, including social security, which covers healthcare, maternity leave, and other social benefits. Employers are responsible for making contributions to social security.

4. Vacation and Holidays

Employees are entitled to paid vacation days and holidays. The number of vacation days depends on the length of service.

5. Termination and Severance

Termination of employment must be justified, and employees are entitled to severance pay if terminated without cause. The amount of severance pay depends on the length of service.

6. Collective Bargaining

Mexican labor law recognizes the right of employees to engage in collective bargaining. Labor unions play a significant role in negotiating collective agreements.

7. Workplace Safety and Health

Employers are obligated to provide a safe and healthy working environment. Compliance with safety regulations is crucial to avoid legal consequences.

8. Labor Tribunals

Disputes between employers and employees may be resolved through labor tribunals. These tribunals handle cases related to wrongful termination, labor law violations, and other employment-related issues.

Labor Laws for Independent Contractors

1. Independent Contractor Agreements

Independent contractors operate under a service contract or agreement that defines the scope of work, compensation, and other terms. The agreement should clearly establish the independent nature of the contractor.

2. Tax Obligations

Independent contractors are responsible for handling their own tax obligations, including Value Added Tax (VAT) and Income Tax (ISR). Contractors typically issue invoices for their services.

3. Social Security

Independent contractors in Mexico are not entitled to social security benefits. They are responsible for their own contributions to health insurance, pension, and other social security programs.

4. Freedom to Work for Multiple Clients

Independent contractors have the freedom to work for multiple clients simultaneously, demonstrating a lack of exclusivity that distinguishes them from employees.

5. No Employment Benefits

Unlike employees, independent contractors are not entitled to employment benefits such as paid vacation, holidays, or severance pay. They negotiate their compensation independently.

6. Autonomy in Work

Independent contractors have greater autonomy in how they perform their work. They are not subject to the same level of control and supervision as employees.

7. Contract Duration

Independent contractor agreements may have a specific duration or be project-based. The agreement should clearly define the terms under which the contract may be terminated or extended.

Suggested Read: Hire Employees in India Through EOR- Your Go-to Guide

Steps to Hire a Contractor in Mexico

Hiring a contractor in Mexico involves several steps, and it’s important to navigate the legal and regulatory requirements to ensure compliance with labor laws. Here are the general steps to hire a contractor in Mexico:

Step 1: Determine Employment Relationship

Clearly define the nature of the working relationship as either an employment contract or a civil law contract for services. Understand the distinctions between employees and independent contractors.

Step 2: Draft a Contract

Prepare a written contract that clearly outlines the terms and conditions of the engagement. Include details such as the scope of work, duration, compensation, and any other relevant provisions.

Step 3: Compliance with Labor Laws

Ensure that the contract and working conditions comply with Mexican labor laws. Be aware of minimum wage requirements, working hours, and other regulations that apply to the specific type of engagement.

Step 4: Tax Considerations

Understand the tax implications of hiring a contractor. Ensure that the contractor issues proper invoices, and be aware of any withholding tax obligations.

Step 5: Social Security Contributions

Determine the social security contributions that may apply to the contractor. Independent contractors are typically responsible for their own social security contributions.

Step 6: Verify Documentation

Collect and verify the necessary documentation from the contractor. This may include tax identification information, proof of registration, and any other documentation required by local authorities.

Step 7: Register with Local Authorities

Depending on the nature of the engagement, there may be a need to register the contract with local labor authorities. Check local regulations to determine if registration is required.

Step 8: Issuance of Invoices

Independent contractors are typically responsible for issuing invoices for their services. Ensure that the contractor follows proper invoicing procedures and complies with tax regulations.

Step 9: Payment Procedures

Establish clear payment procedures, including the frequency and method of payment. Ensure that the contractor provides the necessary documentation to support payments.

Step 10: Maintain Records

Keep accurate records of the contract, payments made, and any relevant documentation. Proper record-keeping is essential for compliance and potential audits.

Step 11: Review and Update Contracts

Regularly review and update contracts based on changing circumstances or project requirements. Ensure that contracts reflect any modifications to the scope of work or duration.

Step 12: Seek Legal Advice

Consider seeking legal advice to ensure compliance with local laws and regulations. Legal professionals can provide guidance on specific requirements based on the type of engagement.

Also Read: EOR India- A Detailed Guide on Employer of Record

How to Draw Up an Independent Contractor Agreement in Mexico?

Drawing up an independent contractor agreement in Mexico requires careful consideration of local laws and regulations. Let’s see how you can do it easily and accurately:

1. Title and Identification

Clearly title the document as an “Independent Contractor Agreement.” Include the legal names and addresses of both the hiring party (employer) and the independent contractor.

2. Scope of Work

Define the scope of work or services to be provided by the independent contractor. Specify the deliverables, tasks, and responsibilities in detail. Be clear about project timelines and milestones.

3. Duration of Engagement

Clearly state the start and end dates of the engagement. If the engagement is for a specific project, include the anticipated duration. Specify any conditions under which the agreement can be terminated.

4. Compensation

Outline the compensation structure, including the total compensation amount, payment frequency, and any additional expenses or reimbursements. Specify the currency in which payments will be made.

5. Payment Terms

Clearly state the payment terms, including the method of payment and the due date for each payment. If applicable, address any late payment penalties or interest charges.

6. Tax and Withholding

Include language specifying that the independent contractor is responsible for their own taxes. Clearly state that the hiring party will not withhold income tax or social security contributions on behalf of the contractor.

7. Confidentiality and Non-Disclosure

If the nature of the work involves confidential information, include clauses related to confidentiality and non-disclosure. Specify the obligations of the contractor to protect sensitive information.

8. Intellectual Property

Address ownership and rights related to intellectual property created during the engagement. Specify whether the hiring party or the contractor retains ownership of any intellectual property.

9. Termination Clause

Clearly outline the conditions under which the agreement can be terminated by either party. Include any notice periods and procedures for termination.

10. Independent Contractor Status

Explicitly state that the independent contractor is not an employee and that the relationship is that of an independent contractor. Include language emphasizing the contractor’s independence and control over their work.

11. Compliance with Laws

Include a clause stating that both parties will comply with all applicable laws and regulations, including labor and tax laws in Mexico.

12. Governing Law and Dispute Resolution

Specify the governing law that will apply to the agreement (Mexican law, for example) and outline the procedures for resolving disputes, such as arbitration or mediation.

13. Signatures and Date

Include spaces for the signatures of both parties and the date of execution. Ensure that the document is signed by individuals with the legal authority to bind the contracting parties.

Suggested Read: Download Independent Contractor Agreement for USA

Do’s and Don’ts of Designing an Independent Contractor Agreement to Hire and Pay Contractors in Mexico

When designing an independent contractor agreement to hire and pay contractors in Mexico, it’s essential to consider the legal and cultural context to ensure compliance and a successful working relationship.

Do’s

1. Define Clear Scope of Work

Do clearly outline the specific tasks, deliverables, and responsibilities of the independent contractor. A detailed description helps avoid misunderstandings and sets expectations.

2. Specify Compensation Terms

Do specify the compensation structure, including the total amount, payment frequency, and any additional expenses or reimbursements. Clearly state the currency for payments.

3. Include Payment Terms

Do include payment terms, such as due dates, methods of payment, and any applicable taxes. Be transparent about the invoicing process and the contractor’s responsibility for their own tax obligations.

4. Address Confidentiality

Do include a confidentiality clause if the contractor will have access to sensitive information. Clearly define the obligations of the contractor regarding the protection of confidential information.

5. Clarify Intellectual Property Rights

Do clarify ownership and rights related to intellectual property created during the engagement. Specify whether the hiring party or the contractor retains ownership of any intellectual property.

6. Establish a Termination Clause

Do include a termination clause that outlines the conditions under which the agreement can be terminated by either party. Include any notice periods and procedures for termination.

7. Emphasize Independent Contractor Status

Do emphasize in multiple clauses that the relationship is that of an independent contractor and not an employment relationship. Clearly state that the contractor is responsible for their own taxes.

8. Comply with Mexican Labor Laws

Do ensure that the agreement complies with Mexican labor laws, including minimum wage requirements and other regulations specific to independent contractors.

9. Include Governing Law and Dispute Resolution

Do specify the governing law (Mexican law, for example) and outline the procedures for resolving disputes, such as arbitration or mediation.

10. Seek Legal Advice

Do seek legal advice when drafting the agreement. Legal professionals can provide guidance on specific clauses and ensure compliance with Mexican laws.

Don’ts

1. Don’t Misclassify Workers

Don’t misclassify workers as independent contractors if they meet the criteria for employee status. Misclassification can lead to legal and financial consequences.

2. Avoid Ambiguous Language

Don’t use ambiguous language in the agreement. Clearly define terms and obligations to prevent misunderstandings.

3. Don’t Overlook Cultural Nuances

Don’t overlook cultural nuances in communication and business practices. Consider having the agreement translated if necessary and ensure that both parties fully understand the terms.

4. Don’t Ignore Tax Implications

Don’t ignore tax implications. Clearly state the contractor’s responsibility for their own taxes, and ensure that the payment terms align with tax regulations.

5. Avoid Omitting Confidentiality Protections

Don’t omit confidentiality protections, especially if the contractor will have access to proprietary information. Protecting sensitive information is crucial.

6. Avoid Excessive Control

Don’t exert excessive control over the contractor’s work. Independent contractors should have the autonomy to perform tasks according to their methods.

7. Don’t Use Generic Templates

Don’t solely rely on generic templates. Tailor the agreement to the specific nature of the engagement and seek legal advice to address any unique considerations.

8. Don’t Neglect Record-Keeping

Don’t neglect proper record-keeping. Maintain detailed records of the agreement, payments, and any relevant documentation for compliance and auditing purposes.

Also Read: Non-Disclosure Agreement [+Template]- 9 Points You Absolutely Cannot Skip

How Payroll Works When You Move Ahead to Pay Contractors in Mexico?

When it comes to paying contractors in Mexico, payroll processes differ from those for regular employees due to the distinct nature of the working relationship. Here’s an overview of how payroll works when paying contractors in Mexico:

1. Determine Compensation Terms

Agree on the compensation terms, including the total amount, payment frequency, and any additional expenses or reimbursements. The compensation structure should align with the terms outlined in the independent contractor agreement.

2. Invoicing

Independent contractors in Mexico typically invoice for their services. Contractors issue official invoices to the hiring party, specifying details such as the provided services, payment amount, and applicable taxes.

3. Specify Currency

Clearly specify the currency in which payments will be made. Ensure that the contractor’s invoice reflects the agreed-upon currency to avoid confusion.

4. Tax Implications

Independent contractors in Mexico are responsible for handling their own taxes. The hiring party is not required to withhold income tax or social security contributions on behalf of the contractor. The contractor should factor in their tax obligations when determining their invoiced amount.

5. Payment Process

Process payments based on the agreed-upon payment terms. Make payments to the contractor’s designated bank account, and retain records of all transactions.

6. Record-Keeping

Maintain detailed records of all payments made to the contractor, including copies of invoices. Proper record-keeping is essential for compliance, auditing, and potential tax inquiries.

7. Compliance with Labor Laws

Ensure that the independent contractor agreement and payment processes comply with Mexican labor laws and regulations. Misclassification or non-compliance can lead to legal consequences.

8. Social Security Contributions

Independent contractors are responsible for their own social security contributions. The hiring party is not obligated to contribute to social security on behalf of the contractor.

9. Currency Exchange Considerations

If the contractor is invoicing in a currency different from the hiring party’s local currency, consider any currency exchange considerations, such as exchange rates and potential conversion fees.

10. Periodic Audits

Periodically review and audit payment processes to ensure continued compliance with applicable laws and the terms outlined in the independent contractor agreement.

Also Read: Top 10 Payroll Software for Accountants

Tax-Filing Requirements for Contractors in Mexico

Independent contractors in Mexico need to mandatorily pay income tax (Impuesto Sobre la Renta or ISR) on the profits that they make. Further, charging Impuesto al Valor Agregado or IVA on the services rendered is a must. Do note that IVA is the Mexican term for VAT. In Mexico, there is no minimum limit for IVA registration. As a result, all contractors need to register themselves.

As the hiring party, you can make provisional income tax withholdings from the contractor’s payments but doing so is not mandatorily needed.

Tax Compliance for US-based Companies

When a U.S.-based company hires and pays contractors in Mexico, there are several tax compliance forms and obligations that need to be considered. It’s important to ensure compliance with both U.S. and Mexican tax regulations. Let’s see what crucial forms that an US-based company looking to hire contractors in Mexico, needs to pay heed to:

1. Form W-8BEN-E: Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities)

U.S. companies may request their Mexican contractors to complete Form W-8BEN-E. This form is used by foreign entities to certify their status and claim any applicable tax treaty benefits that may reduce or eliminate withholding taxes on payments made by U.S. companies.

2. Form 1042-S: Foreign Person’s U.S. Source Income Subject to Withholding

U.S. companies may need to report payments made to Mexican contractors on Form 1042-S. This form is used to report income subject to withholding under U.S. tax regulations. It includes details of income, withholding, and any applicable tax treaty benefits.

3. IRS Form 1099-NEC: Nonemployee Compensation

U.S. companies may use Form 1099-NEC to report payments made to nonemployee service providers, including independent contractors. This form is used to report income to both the IRS and the recipient.

Minimum Wages for Contractors in Mexico

A minimum wage legislation is applicable for workers in Mexico. As of 2023, the minimum wage rate in Mexico is MXN $207.44 per day. However, only employees enjoy this benefit. Contractors are not covered under this legislation. However, as a facet of best practice, the hiring party is expected to offer fair compensation rates to contractors.

Also, check out: Pay Contractors in Australia- A Detailed Guide to the Hiring Process

Best Ways to Pay Contractors in Mexico

When paying contractors in Mexico, there are several payment methods to consider. The choice of payment method may depend on factors such as the amount of the payment, the frequency of payments, and the preferences of both the payer and the contractor. Here are various payment methods you can use, as per your convenience, to pay contractors in Mexico:

1. Bank Transfer- To Pay Contractors in Mexico

Description: Direct bank transfers are a common and straightforward method. Funds are transferred electronically from the payer’s bank account to the contractor’s bank account.

Advantages: Fast, secure, and transparent. Commonly used for both domestic and international payments.

Considerations: Be aware of potential bank fees and exchange rates. Ensure that you have the contractor’s accurate banking details.

2. Wire Transfer- To Pay Contractors in Mexico

Description: Similar to bank transfers, wire transfers involve electronically transferring funds between bank accounts. Wire transfers are often used for larger transactions.

Advantages: Suitable for larger payments. Provides a secure and direct transfer of funds.

Considerations: May involve higher fees compared to other methods. Ensure accurate recipient details.

3. Electronic Payment Platforms- To Pay Contractors in Mexico

Description: Platforms like PayPal, TransferWise (now Wise), and others facilitate international money transfers. Users can link their bank accounts or credit cards to these platforms.

Advantages: Convenient, often with competitive exchange rates. Suitable for smaller to medium-sized transactions.

Considerations: Watch out for transaction fees, and be aware of the time it takes for the recipient to access the funds.

4. Check Payments- To Pay Contractors in Mexico

Description: Traditional paper checks can be issued and mailed to the contractor. The contractor then deposits the check into their bank account.

Advantages: Familiar method. May be suitable for domestic payments.

Considerations: Slower processing times. International checks may involve additional fees and complications.

5. Local Payment Platforms- To Pay Contractors in Mexico

Description: Mexico has local payment platforms and services that may be preferred by contractors. Examples include SPEI (Sistema de Pagos Electrónicos Interbancarios) for domestic transfers.

Advantages: Familiarity for local contractors. May have lower fees for domestic transactions.

Considerations: Ensure compliance with local regulations and verify the contractor’s preferred payment method.

6. Cash Payments- To Pay Contractors in Mexico

Description: In some cases, particularly for small transactions or local engagements, cash payments may be used. This is less common for international contractors.

Advantages: Immediate and convenient for local transactions.

Considerations: Limited use for larger transactions. May not be suitable for international payments.

7. Payment in Kind- To Pay Contractors in Mexico

Description: Instead of monetary payments, contractors may receive goods or services in-kind as part of their compensation.

Advantages: Provides an alternative compensation method.

Considerations: Requires clear agreement on the value of non-monetary compensation. Tax implications should be considered.

8. Bitcoin and Cryptocurrency- To Pay Contractors in Mexico

Description: Some contractors may be open to receiving payments in cryptocurrencies like Bitcoin. This method is less conventional but gaining acceptance in some industries.

Advantages: Offers a decentralized and potentially more private payment method.

Considerations: Both parties need to agree on using cryptocurrency. Be aware of the volatility of cryptocurrency values.

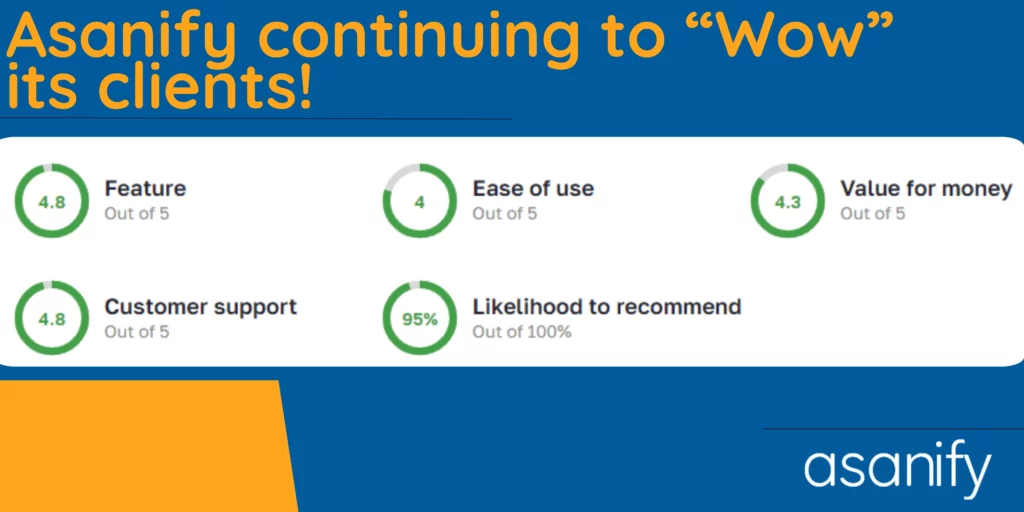

The best way to pay contractors is by using global contractor payroll services like Asanify. By using Asanify, you can seamlessly run payroll in a single click. Apart from smooth contractor payroll run, you get access to complimentary end-to-end HRMS, thereby offering the functions of contractor attendance, leaves, performance cycle, and so on. It’s time to avoid payroll calculations and bring in accuracy to your payroll runs.

Suggested Read: How to Pay Contractors in Your Business? The Ultimate Guide

Currency and Other Considerations to Pay Contractors in Mexico

The official currency of Mexico is the Mexican Peso (MXN). When paying contractors, it’s common to use the local currency. Make sure to clearly specify the currency in which payments will be made in the independent contractor agreement to avoid confusion. Further, it is very important to be aware of exchange rates when dealing with currencies other than the Mexican Peso. Exchange rates can fluctuate, impacting the amount received by the contractor. Make it a point to communicate how exchange rate fluctuations will be handled, especially if payments are in a different currency.

Let’s have a look at certain crucial considerations you need to keep in mind before you take the step to pay contractors to Mexico.

- Mexican contractors should have a tax identification number known as Registro Federal de Contribuyentes (RFC). Ensure that the contractor provides their RFC, and include it in any documentation related to payments. This is crucial for tax compliance.

- Obtain accurate and complete banking details from the contractor for direct transfers. This includes the account number, CLABE (Clave Bancaria Estandarizada), and the bank’s name. Verify the information to ensure accurate and timely payments.

- Mexican contractors typically issue invoices for their services. Ensure that the invoices comply with local regulations and include all necessary details, such as the contractor’s information, service description, payment terms, and any applicable taxes.

Also Read: Invoice for Contractors- The Guide to Making an Ideal One!

Tax and Other Payroll Costs for Contractors in Mexico

When hiring and paying contractors in Mexico, there are several tax and payroll considerations for both the contracting party and the contractor. Let’s have a glance at the core pointers when things come to contemplating upon tax and payroll costs:

1. Value Added Tax (VAT)

Contractors in Mexico may be required to charge and collect Value Added Tax (VAT) on their services. The standard VAT rate in Mexico is 16%. However, not all services are subject to VAT, and certain exemptions may apply.

2. Income Tax (ISR)

Independent contractors in Mexico are responsible for their own income tax obligations. They must report their earnings and pay income taxes directly to the tax authorities. The tax rate can vary based on the contractor’s total income.

3. Social Security Contributions

Unlike employees, independent contractors in Mexico are not entitled to social security benefits, and they are responsible for their own social security contributions. They must make contributions to health insurance, pension, and other social security programs independently.

4. Professional Fees

Contractors may incur professional fees related to tax compliance and accounting requirements. Engaging with tax professionals or accountants can help contractors fulfill their tax obligations and navigate regulatory requirements.

5. Labor Laws Compliance

While independent contractors are not subject to traditional labor laws in the same way as employees, they should ensure compliance with the terms outlined in their service agreements to avoid any misclassification issues.

Suggested Read: Pay Contractors in Dubai- The Ultimate Hiring Guide

Termination or Extension Terms for Contractors in Mexico

The termination or extension terms for independent contractors in Mexico are typically outlined in the independent contractor agreement between the hiring party (the contractor) and the independent contractor. While the specific terms may vary based on the agreement, there are certain common considerations that you ought to harbor in mind:

Termination Terms

1. Termination for Convenience

The agreement may include a provision allowing either party to terminate the contract for convenience. This means that the hiring party or the contractor can end the engagement without cause, usually with advance notice.

2. Termination for Cause

Grounds for termination with cause may be specified in the agreement. This could include a material breach of contract, failure to deliver agreed-upon services, or any other specified reasons.

3. Notice Period

The agreement might specify a notice period that either party must provide before terminating the contract. This notice period allows for a smooth transition and may vary depending on the nature of the engagement.

4. Payment for Services Rendered

Terms related to compensation upon termination may be outlined. This could include any outstanding payments for services rendered up to the termination date.

5. Return of Property

The agreement may specify that upon termination, the independent contractor must return any property, materials, or equipment provided by the hiring party.

Extension Terms

1. Renewal or Extension Clause

The agreement may include a clause allowing for the extension or renewal of the contract. This could be automatic or subject to mutual agreement between the parties.

2. Notice of Extension

If extensions require notice from one party to the other, the agreement may specify the timeframe within which such notice must be provided.

3. Adjustment of Compensation

Terms related to compensation for contract extensions may be outlined. This could include a renegotiation of rates or a pre-determined adjustment based on the extension period.

4. Scope of Work for Extended Period

If the scope of work is expected to change during the extended period, the agreement may outline any modifications or additions to the services to be provided.

5. Documentation of Extension

It’s common to specify that any extension or renewal must be documented in writing through an amendment to the original contract.

Termination and extension terms are crucial components of an independent contractor agreement, providing a framework for the engagement and helping to manage expectations on both sides. It’s recommended to customize these terms based on the specific needs of the parties involved and seek legal advice to ensure compliance with local regulations.

Also Read: Terminating a Contractor- Know How to End an Agreement Politely

How to Convert an Independent Contractor in Mexico to an Employee?

Converting an independent contractor to an employee in Mexico involves several legal and procedural steps to ensure compliance with labor laws and regulations. Wondering what these are? Well, these are mentioned below:

1. Review Independent Contractor Agreement

Carefully review the existing independent contractor agreement to understand the terms and conditions of the engagement. This includes termination and conversion clauses, if any.

2. Legal Consultation

Seek legal advice from professionals well-versed in Mexican labor laws. They can provide guidance on the legal requirements, potential liabilities, and steps to convert the contractor to an employee.

3. Assess Employment Eligibility

Ensure that the independent contractor is eligible for employment based on Mexican labor laws. Consider factors such as the nature of the work, control over working conditions, and the duration of the engagement.

4. Negotiate Terms

Discuss the transition with the contractor. This includes negotiating new employment terms, such as salary, benefits, working hours, and other employment-related conditions.

5. Draft Employment Agreement

Prepare a new employment agreement that outlines the terms and conditions of the employment relationship. This agreement should comply with Mexican labor laws and cover essential aspects of the employment, including compensation, benefits, and job responsibilities.

6. Register with Social Security

Enroll the employee in the Mexican social security system. This includes registering the employee with the Mexican Social Security Institute (Instituto Mexicano del Seguro Social or IMSS).

7. Tax Withholding and Reporting

Implement proper tax withholding procedures. Deduct and remit income tax and social security contributions according to Mexican tax regulations. Ensure that the employee provides the necessary tax identification information.

8. Provide Benefits

Offer the employee benefits mandated by Mexican labor laws, such as vacation days, holidays, and other statutory benefits. Adjust the employment agreement to reflect these benefits.

9. Notify Authorities

Notify relevant authorities, including the Mexican tax authorities, about the change in the employment status of the individual. Ensure that the necessary documentation is submitted as required by local regulations.

10. Termination of Contractor Agreement

Conclude the independent contractor agreement appropriately. This may involve providing notice as per the terms of the agreement or negotiating an amicable termination.

11. Employee Orientation

Provide the newly converted employee with an orientation that includes information about company policies, procedures, and expectations. Ensure they are aware of their rights and responsibilities as employees.

12. Compliance Check

Regularly review and update employment practices to ensure ongoing compliance with Mexican labor laws. Stay informed about any changes in regulations that may impact the employment relationship.

Do Check Out: Full and Final Settlement- See How to Run Termination Payroll

Quick Wrap Up- Pay Contractors in Mexico

To sum things up, exploring the landscape of hiring and paying contractors in Mexico requires a nuanced understanding of the local labor laws, cultural dynamics, and economic factors. By embracing transparency, communication, and compliance, businesses can forge successful partnerships with Mexican contractors. From leveraging digital tools for seamless payments to fostering strong relationships built on trust, the key lies in adapting to the unique aspects of the Mexican business environment. As the global workforce continues to evolve, embracing the diversity and expertise that contractors in Mexico offer can be a strategic advantage for companies seeking growth and success in an interconnected world.

Asanify is here to help you simplify contractor payroll management and take care of various other aspects, including making instant payouts, managing contractor attendance and so on. Click here to run contractor payroll in a single step. Save your precious time that you can otherwise invest in building your business. Here’s to simplifying work!

Frequently Asked Questions- Pay Contractors in Mexico

Q1: How do I legally hire a contractor in Mexico?

A: To legally hire a contractor in Mexico, you need a written contract outlining the terms, clear classification as an independent contractor, adherence to local labor laws, and compliance with tax obligations. Consult legal professionals for guidance.

Q2: What should be included in the contractor agreement in Mexico?

A: A contractor agreement in Mexico should include details on services, compensation, duration, termination clauses, intellectual property rights, and compliance with local laws. Ensure clarity on the independent contractor relationship.

Q3: Are there tax implications when paying contractors in Mexico?

A: Yes, contractors in Mexico may have tax obligations, including Value Added Tax (VAT) and Income Tax (ISR). Contractors are responsible for their taxes, but it’s essential to understand withholding and reporting requirements.

Q4: How do I process payments to contractors in Mexico?

A: Payments to contractors in Mexico can be processed through methods like bank transfers, wire transfers, or electronic payment platforms. Ensure compliance with local banking regulations and discuss currency considerations with the contractor.

Q5: Is there a need to register contractors with social security in Mexico?

A: No, independent contractors in Mexico are not entitled to social security benefits, and they are responsible for their own contributions. Social security registration is typically not required for contractors.

Q6: Can I convert an independent contractor to an employee in Mexico?

A: Yes, it’s possible to convert an independent contractor to an employee in Mexico. It involves legal considerations, negotiation of new terms, compliance with labor laws, and notifying relevant authorities.

Q7: What termination terms should be included in a contractor agreement?

A: Termination terms may include provisions for termination for convenience, termination for cause, notice periods, and details on payment for services rendered up to the termination date.

Q8: Do contractors in Mexico issue invoices, and what should be included?

A: Yes, contractors in Mexico typically issue invoices. Invoices should include the contractor’s tax identification number (RFC), a description of services, payment terms, and any applicable taxes.

Q9: What are the tax and payroll costs associated with hiring contractors in Mexico?

A: Tax and payroll costs may include Value Added Tax (VAT), Income Tax (ISR), and compliance with social security contributions. Contractors are responsible for their taxes, and the hiring party should understand withholding obligations.

Q10: How can I ensure compliance with Mexican labor laws when hiring contractors?

A: To ensure compliance, carefully classify the contractor, follow labor laws, have a clear agreement, adhere to termination and extension terms, and consult legal professionals to navigate any legal complexities.

Q11: Are there specific considerations for cross-border payments to contractors in Mexico?

A: Yes, consider exchange rates, potential fees for international transactions, and compliance with both U.S. and Mexican tax regulations. Professional advice can help manage cross-border payment complexities.

Q12: What records should I keep when hiring and paying contractors in Mexico?

A: Maintain detailed records of the contractor agreement, invoices, receipts, communication, and any documentation related to payments. Proper record-keeping is crucial for compliance and auditing purposes.

Not to be considered as tax, legal, financial or HR advice. Regulations change over time so please consult a lawyer, accountant or Labour Law expert for specific guidance.

![Read more about the article Holiday List 2024 Download PDF [India]: All Kinds of Holidays](https://asanify.com/wp-content/uploads/2024/02/Holiday-List-2024-300x169.webp)