Welcome to our comprehensive guide on how to hire and pay contractors in China. Whether you are expanding your business or need specialized services for a specific project, it’s essential to understand the process of hiring and paying contractors in China. In this guide, we will take you through the steps, considerations, and legal aspects involved in working with independent contractors in China.

Contents

- Who is an Independent Contractor in China?

- How is an independent contractor in China different from an Employee?

- Penalties for Contractor and Employee misclassification in China

- What are the Labor Laws in China?

- Steps to Hire a Contractor in China

- Important Considerations for Hiring and Managing Contractors in China

- How to draw up an independent contractor agreement in China

- Do’s and Don’ts of Designing an Independent Contractor Agreement to Hire and Pay Contractors in China

- How Payroll Works When You Move Ahead to Pay Contractors in China

- Tax Filing Requirements for Contractors in China

- Tax Compliance for US-based Companies

- Minimum Wages for Contractors in China

- Best Ways to Pay Contractors in China

- Currency and Other Considerations to Pay Contractors in China

- Tax and Other Payroll Costs for Contractors in China

- Termination or extension terms for independent contractors in China

- How do I Convert an Independent Contractor in China to an Employee?

- Quick Wrap Up

- Frequently Asked Questions

Who is an Independent Contractor in China?

Before we dive into the nuances of hiring and paying contractors in China, let’s clarify who qualifies as an independent contractor. In China, an independent contractor is an individual or entity that provides services to another company but is not considered an employee. Independent contractors are self-employed individuals who operate under their own business structure.

When it comes to determining whether someone is an independent contractor or an employee in China, several factors are taken into consideration. These factors include the level of control the hiring company has over the contractor, the nature of the work performed, the degree of independence the contractor has in carrying out their tasks, and the contractual relationship between the parties involved.

It is important to note that the distinction between independent contractors and employees is crucial in terms of legal rights and obligations. While employees are entitled to benefits such as social insurance, paid leave, and other employment-related protections, independent contractors are responsible for their own taxes, insurance, and other business-related expenses.

Salient Features of Being an Independent Contractor

- Independent contractors in China often work on a project basis or provide specialized services that require specific expertise. They may be hired for short-term assignments or on a contractual basis for a longer duration. Common examples of independent contractors in China include freelance writers, graphic designers, consultants, and IT professionals.

- One of the advantages of hiring independent contractors in China is the flexibility it offers to businesses. Companies can engage contractors for specific projects without the long-term commitment associated with hiring permanent employees. Additionally, independent contractors can bring a fresh perspective and specialized skills to the table, contributing to the growth and success of the hiring company.

To sum up, independent contractors in China are self-employed individuals or entities that provide services to other companies without being considered employees. The distinction between independent contractors and employees is important in terms of legal rights and obligations. Hiring independent contractors can offer flexibility and specialized expertise to businesses, but it is crucial to classify workers correctly to comply with local labor laws.

Also Read: Pay Contractors in India- The Ultimate Hiring Guide

How is an Independent Contractor in China Different from an Employee?

|

Parameters |

Independent Contractors |

Employees |

| Nature of Relationship | Contractors maintain a more autonomous relationship with the employer, often working on a project basis. | Employees have a more structured and ongoing relationship with the employer. |

| Working Hours and Control | They have more flexibility in setting their working hours and methods. Employers have limited control over how the work is performed. | Their working hours and conditions are generally set by the employer. Employers have a higher degree of control over the work process. |

| Tax and Social Insurance | They are responsible for handling their own taxes and social insurance contributions. Employers are not obligated to provide these benefits. | Employers are responsible for withholding taxes and contributing to social insurance on behalf of employees. |

| Labor Protections | They have fewer legal protections compared to employees. They are not covered by labor laws regarding working hours, overtime, and other employee rights. | Chinese labor laws provide extensive protection to employees, including regulations on working hours, overtime pay, holidays, and termination procedures. |

| Termination and Notice Period | The termination of a contract is typically based on the terms outlined in the contract itself. Notice periods are negotiated between the parties. | Termination of employment is subject to specific legal procedures, including notice periods and severance pay based on the length of service. |

| Benefits and Perks | They are not entitled to employee benefits such as health insurance, paid leave, or other company perks. | Companies are generally required to provide various benefits and perks to employees, including social insurance, housing fund contributions, and paid leave. |

| Contractual Agreements | They typically have a service or project-based contract with specific deliverables and timelines. | Employment contracts are more comprehensive, covering various aspects of the employment relationship, including roles, responsibilities, compensation, and benefits. |

Penalties for Contractor and Employee Misclassification in China

Misclassifying contractors as employees or vice versa can result in severe penalties and legal consequences in China. Government authorities closely monitor and enforce labor laws to protect the rights of individual workers. To avoid potential problems or disputes, it’s important to correctly classify workers based on their contractual arrangements and the nature of their work.

China’s labor laws are designed to ensure fair treatment and protection for all workers, whether they are contractors or employees. The government takes the issue of misclassification seriously, as it can lead to exploitation and unfair labor practices. Therefore, it is crucial for employers to understand the distinctions between contractors and employees and comply with the relevant regulations.

When it comes to misclassifying contractors as employees, the penalties can be significant.

1. Fines and Back Wages

Employers who fail to accurately classify their workers may be subject to fines, back payment of wages, and even criminal charges. These penalties are intended to deter employers from taking advantage of workers and to promote a fair and equitable labor market.

2. Deprivation of Rights and Benefits

Misclassifying employees as contractors pose serious consequences. In China, employees are entitled to various benefits and protections, such as social insurance, paid leave, and overtime pay. By misclassifying employees as contractors, employers may be depriving them of these rights and benefits, which is a violation of labor laws. In such cases, employers may face legal action from employees seeking compensation and the government may impose fines and penalties.

To avoid misclassification issues, employers should carefully review the nature of the work and the terms of the contractual arrangement. Factors such as the level of control exerted by the employer, the provision of tools and equipment, and the degree of independence of the worker can help determine whether someone should be classified as an employee or a contractor.

It’s worth noting that misclassification is not limited to intentional actions. Even unintentional misclassification can still result in penalties and legal consequences. Therefore, it is essential for employers to seek legal advice or consult with labor experts to ensure compliance with the law and avoid any potential pitfalls.

In conclusion, the penalties for contractor and employee misclassification in China are severe and can have far-reaching consequences for employers. It is crucial for employers to understand the distinctions between contractors and employees and to accurately classify their workers. By doing so, they can avoid legal disputes, protect the rights of their workers, and contribute to a fair and equitable labor market.

Also Read: Employee Misclassification- The Key to Avoiding Hefty Penalties

What are the Labor Laws in China?

China has specific labor laws and regulations that govern the employment relationships for both employees and contractors. Distinct provisions apply to each category. Let’s see what these are!

Labor Laws for Employees

1. Employment Contracts

Types of Contracts: China recognizes various employment contracts, including fixed-term contracts, open-term contracts, and project-based contracts.

Contract Contents: Contracts should specify terms such as job responsibilities, working hours, compensation, benefits, and the duration of the contract.

2. Working Hours and Overtime

Standard Working Hours: The standard work duration is 44 hours per week. Some industries or regions may have variations.

Overtime: Overtime work is regulated, and employees are entitled to additional pay for overtime hours. Any work performed beyond 8 hours in a day needs to be compensated at 1.5 times the usual salary of an employee.

3. Minimum Wage

Each province and municipality in China may set its own minimum wage levels. Employers must comply with local minimum wage regulations. Exact information about minimum wage rates has been discussed below.

4. Social Insurance

Employers are required to contribute to social insurance schemes, including pension, medical, unemployment, work-related injury, and maternity insurance for their employees.

5. Termination Procedures

Termination procedures are regulated, including notice periods and severance pay. Employees may be entitled to severance pay in certain situations.

6. Probation Periods

Probation periods are permissible but must be specified in the employment contract. The duration is generally limited.

7. Vacation and Leave

Employees are entitled to paid annual leave, sick leave, and other statutory leave as provided by law.

8. Collective Bargaining

Collective bargaining is encouraged in China, allowing employees to negotiate terms and conditions of employment collectively.

9. Occupational Health and Safety

Employers are responsible for providing a safe working environment for employees, adhering to occupational health and safety regulations.

10. Non-Competition Agreements

Non-competition agreements are allowed but must comply with specific legal requirements, such as reasonable geographic scope and duration.

11. Intellectual Property Rights

Default rules in China state that the employer owns the intellectual property created by an employee during the course of employment.

Labor Laws for Contractors

1. Independent Contractor vs. Employee Distinction

China distinguishes between independent contractors and employees. Contractors are engaged for specific projects or tasks, have more control over their work, and may work for multiple clients.

2. Contractual Agreements

Contractors are engaged through contractual agreements that specify the scope of work, deliverables, compensation, and other terms.

3. Taxation

Contractors are responsible for their own tax payments, and employers are not required to withhold taxes for them.

4. Social Insurance

Contractors are generally responsible for their own social insurance contributions.

5. Intellectual Property Rights

Intellectual property ownership should be explicitly defined in the contract. Contractors may retain intellectual property rights unless otherwise agreed.

6. Termination Procedures

Termination procedures for contractors are typically outlined in the contract. Notice periods and termination terms should be specified.

7. Non-Competition Agreements

Non-competition clauses may be included in contracts with contractors but must comply with legal requirements.

8. Working Hours and Overtime

Working hours for contractors are usually project-based, and overtime considerations depend on the terms negotiated in the contract.

Important Considerations for Both Employees and Contractors

Legal Compliance: Employers must ensure compliance with all relevant labor laws, including local and provincial variations.

Contractual Clarity: Written contracts are essential for both employees and contractors to clearly define rights, obligations, and other terms.

Collective Bargaining (for Employees): Employers should be aware of the potential for collective bargaining and engage in good faith negotiations when applicable.

Non-Discrimination: Both employees and contractors should be treated fairly and without discrimination based on gender, age, nationality, or other protected characteristics.

Steps to Hire a Contractor in China

When hiring a contractor in China, it’s essential to follow a systematic process to ensure compliance and a smooth working relationship. Here are the key steps involved:

1. Clearly define the project scope and requirements

Before starting the process of hiring a contractor in China, it is crucial to have a clear understanding of the project scope and requirements. This includes identifying the specific tasks that need to be completed, the desired outcomes, and any specific qualifications or expertise required.

2. Identify suitable contractors through referrals, online platforms, or professional networks

There are various ways to find suitable contractors in China. Referrals from trusted sources, such as business associates or industry contacts, can be a valuable resource. Additionally, online platforms and professional networks specific to the construction industry can provide a wide range of options to choose from.

3. Evaluate the qualifications and expertise of potential contractors

Once you have identified potential contractors, it is important to evaluate their qualifications and expertise. This can be done by reviewing their past projects, checking their certifications and licenses, and assessing their overall reputation in the industry. It is also advisable to conduct interviews or request references to gain further insights into their capabilities.

4. Negotiate and agree on the terms of engagement, including rates and deliverables

After identifying a suitable contractor, the next step is to negotiate and agree on the terms of engagement. This includes discussing and finalizing the project timeline, rates, payment terms, and deliverables. It is essential to ensure that both parties have a clear understanding of the expectations and responsibilities.

5. Prepare a written independent contractor agreement to outline the rights and obligations of both parties

To formalize the agreement, it is recommended to prepare a written independent contractor agreement. This document should clearly outline the rights and obligations of both parties, including project milestones, intellectual property rights, confidentiality clauses, and dispute resolution mechanisms. Having a legally binding contract provides a solid foundation for the working relationship.

6. Verify the contractor’s business registration and credentials

Before finalizing the hiring process, it is crucial to verify the contractor’s business registration and credentials. This includes checking their business license, tax registration, and any other relevant certifications. Verifying these details helps ensure that the contractor is operating legally and has the necessary qualifications to carry out the project.

7. Implement a robust communication and reporting system

Effective communication is key to a successful contractor-client relationship. Establishing a robust communication and reporting system from the beginning helps ensure that both parties are on the same page throughout the project. This can include regular progress meetings, status updates, and a designated point of contact for any queries or concerns.

8. Monitor the contractor’s performance and provide feedback as necessary

Throughout the project, it is important to monitor the contractor’s performance and provide feedback as necessary. Regularly assessing their progress against the agreed-upon deliverables helps identify any potential issues or deviations from the initial plan. Timely feedback allows for adjustments to be made, ensuring that the project stays on track.

9. Regularly review the contractor’s work to ensure compliance with the agreed-upon terms

As the project progresses, it is essential to regularly review the contractor’s work to ensure compliance with the agreed-upon terms. This includes assessing the quality of the deliverables, adherence to timelines, and overall compliance with the project scope. Regular reviews help maintain accountability and ensure that the project is progressing as planned.

By following these steps, you can navigate the process of hiring a contractor in China with confidence and increase the likelihood of a successful partnership.

Recommended Read- Invoice for Contractors: The Guide to Making an Ideal One!

Important Considerations for Hiring and Managing Contractors in China

While hiring contractors can offer flexibility and specialized expertise, there are important considerations to keep in mind:

- Language and cultural barriers can impact communication and project coordination

- Intellectual property rights and confidentiality should be adequately protected

- Ensure compliance with local tax and labor regulations

- Establish clear guidelines for quality control and performance standards

- Consider the contractor’s availability and workload to avoid potential delays

How to Draw Up an Independent Contractor Agreement in China

Having a well-drafted independent contractor agreement is essential for both parties involved. This agreement should clearly outline the scope of work, payment terms, confidentiality provisions, intellectual property rights, termination clauses, and other important details. Engaging a legal professional with expertise in Chinese labor laws can ensure the agreement is valid and enforceable.

Do’s and Don’ts of Designing an Independent Contractor Agreement to Hire and Pay Contractors in China

Do’s

1. Clearly outline the scope of work

Specify the tasks and responsibilities of the independent contractor to avoid misunderstandings.

2. Include payment terms

Define the compensation structure, payment schedule, and any additional expenses that will be covered.

3. Specify project timelines

Clearly state the project’s expected duration and any relevant milestones or deadlines.

4. Address confidentiality

Include clauses to protect sensitive information and trade secrets, emphasizing the contractor’s obligation to maintain confidentiality.

5. Compliance with local laws

Ensure the agreement adheres to Chinese labor laws and regulations to avoid legal complications.

6. Define intellectual property rights

Clearly outline ownership of any intellectual property created during the contract period.

7. Incorporate termination clauses

Specify conditions under which either party can terminate the agreement and the associated notice periods.

Don’ts

1. Avoid vague language

Clearly articulate all terms and conditions to minimize potential disputes.

2. Don’t overlook tax implications

Consider tax obligations and clarify whether the contractor is responsible for their own taxes.

3. Don’t ignore local customs

Be mindful of cultural differences in business practices and incorporate them appropriately into the agreement.

4. Steer clear of ambiguity

Ensure that all terms, including deliverables and payment details, are unambiguous to prevent misunderstandings.

5. Don’t neglect insurance requirements

Determine whether the contractor needs specific insurance coverage and outline those requirements in the agreement.

6. Avoid generic templates

Tailor the agreement to the specific needs of the project and the contractor to ensure relevance and legality.

7. Don’t disregard dispute resolution

Include a clear mechanism for resolving disputes, whether through arbitration or another agreed-upon method.

Suggested Read: Download Independent Contractor Agreement for USA

How Payroll Works When You Move Ahead to Pay Contractors in China

Understanding how payroll works when paying contractors in China is crucial to ensure compliance with tax and labor regulations. Unlike employees, contractors are responsible for managing their own taxes and social insurance contributions. However, companies should still keep proper documentation and records of payments made to contractors for auditing purposes.

Tax Filing Requirements for Contractors in China

Contractors in China are subject to tax filing requirements. They are typically responsible for reporting their income and paying taxes on a monthly or quarterly basis. While operating as a sole proprietor, the business income of the contractors gets included in their personal income tax returns. As a result, there is no need to pay extra corporate taxes.

Depending upon the earnings of a contractor, the business income will be subjected to tax rates varying from 5% to 35%. Though not mandatory, contractors in China may choose to make social security contributions voluntarily.

The State Taxation Administration (STA) may ask self-employed professionals to file their tax returns on any of the following basis, depending upon the nature of their business:

- Monthly;

- Annual;

- Transactional

Based on the earnings of the previous month, contractors need to make tax payments monthly.

Information on VAT for Contractors in China

Depending on their income level and business structure, contractors may need to register for value-added tax (VAT) and obtain relevant tax certificates. If a contractor’s monthly earnings exceeds ¥150,000 (that is, $20,000), they need to register for, as well as, charge their clients- VAT.

Usually, in China, a majority of the contractors are identified as small-scale VAT taxpayers. They are charged a slightly reduced VAT rate of 3%. Small-scale taxpayers ought to ensure that they are filing and paying VAT on a quarterly basis. Contractors, who make huge earnings, might be categorized as general VAT taxpayers. In that case, the VAT rate charged might reach 13%.

Tax Compliance for US-based Companies

When a U.S.-based company hires and pays contractors in China, it’s crucial to comply with U.S. tax regulations. The forms required may vary depending on the nature of the relationship between the U.S. company and the Chinese contractor. Let’s figure out some key forms and considerations!

1. Form W-8BEN: Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting

This form is typically provided by the Chinese contractor to the U.S. company. It certifies the contractor’s foreign status and may exempt them from certain U.S. tax withholding requirements. Further, Form W-8BEN includes information about the contractor’s identity, country of residence, and any applicable tax treaty benefits.

2. Form W-8BEN-E: Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities)

If the contractor is a business entity rather than an individual, they may use Form W-8BEN-E to certify their status and claim any applicable tax treaty benefits. This form requires information about the entity’s structure, ownership, and its eligibility for treaty benefits.

3. Form 1099-NEC: Nonemployee Compensation

U.S. companies are required to report payments of $600 or more made to contractors for services using Form 1099-NEC. This form is used to report nonemployee compensation, such as fees, commissions, prizes, or awards.

4. Form 1042: Annual Withholding Tax Return for U.S. Source Income of Foreign Persons

If the U.S. company is required to withhold taxes on payments made to foreign contractors, it may need to file Form 1042. This form reports the amount of withholding tax and other related information.

5. Form 1042-S: Foreign Person’s U.S. Source Income Subject to Withholding

Form 1042-S is provided to the foreign contractor to report the income subject to withholding. It includes details such as the type of income, the amount withheld, and any applicable tax treaty benefits.

6. Form 8804 and Form 8805: Annual Return for Partnership Withholding Tax (Section 1446)

If the contractor is a foreign partnership, the U.S. company may be required to file Form 8804 and provide a Schedule K-1 (Form 8805) to report the contractor’s share of partnership income.

Important Considerations

Tax Treaties: Consider any applicable tax treaties between the U.S. and China that may impact the withholding tax rate on payments to contractors.

Tax Identification Numbers (TINs): Ensure that contractors provide their correct TINs or foreign tax identification numbers on the relevant forms.

Timely Filing: Adhere to the deadlines for filing the required forms to avoid penalties and ensure compliance.

Legal and Accounting Advice: Given the complexity of international tax regulations, it’s advisable to seek guidance from tax professionals or legal advisors familiar with both U.S. and Chinese tax laws.

Compliance with tax regulations is essential when hiring and paying contractors internationally. Consulting with tax professionals and legal advisors can help ensure that your U.S.-based company fulfills its obligations and avoids potential issues with tax authorities.

Also Read: What is W8-BEN Form?

Minimum Wages for Contractors in China

As per China’s Provisions on Minimum Wage, the official minimum wage refers to the salary that an employer needs to pay to their employees for the labor rendered, on the condition that the employees supply the labor within the specified hours as mentioned in the labor contract.

In China, the provincial governments determine the minimum wage rates. Therefore, it keeps varying depending upon the following factors:

- Basic lifestyle expenditure of local employees and their dependents;

- Consumption price index of city dwellers;

- Employees’ average salary;

- Level of regional economic development;

- Social insurance premiums;

- Housing funds paid by employees;

- Local employment status

Types of Minimum Wage Standards in China

Minimum wage standards in China are of two kinds:

- Monthly Minimum Wage Standard- This form of minimum wage rate applies solely to full-time employees of any establishment.

- Hourly Minimum Wage Standard- This type of minimum wage rate is valid for temporary and part-time employees.

The exact figure of the minimum wage rate in China varies from one province to another. While Shanghai has the highest monthly minimum wage rate of RMB 2,690 (that is, USD $370 per month), Beijing has the highest hourly minimum wage rate of RMB 26.4 (that is, USD $3.7 per hour).

Do note that minimum wage rates in China are not applicable to independent contractors. They are free to negotiate their own rates. However, if you decide to convert any of the contractors into a full-time employees, you would have to adhere to the minimum wage rates in that case.

Best Ways to Pay Contractors in China

When it comes to paying contractors in China, there are various methods to consider. These may include bank transfers, international payment platforms, or online payment systems. It’s advisable to discuss the preferred payment method with the contractor and consider any foreign exchange and transaction fees that may be involved.

When paying contractors in China, it’s important to consider the most efficient and reliable payment methods that comply with local regulations. Here are several payment methods commonly used for paying contractors in China:

1. Bank Transfers- To Pay Contractors in China

Local Bank Transfers: Use local bank transfers within China for domestic payments. This method is straightforward and commonly used. Ensure you have the contractor’s accurate bank account information.

International Wire Transfers: For contractors outside China, international wire transfers may be necessary. Be aware of potential currency exchange fees and consider using a reliable foreign exchange service.

2. Alipay- To Pay Contractors in China

Digital Wallets: Alipay is a widely used digital payment platform in China. Many contractors prefer receiving payments through Alipay due to its convenience. Ensure that both parties have Alipay accounts and understand the process.

3. WeChat Pay- To Pay Contractors in China

Similar to Alipay, WeChat Pay is a popular digital payment method in China. Contractors may have preferences between Alipay and WeChat Pay, so it’s beneficial to discuss and agree on the preferred method.

4. Third-Party Payment Platforms- To Pay Contractors in China

PayPal: While not as commonly used as Alipay or WeChat Pay in China, some contractors may have PayPal accounts. This method is more suitable for international payments, but be aware of potential fees.

TransferWise (Wise): This platform allows for international transfers with competitive exchange rates and lower fees compared to traditional banks.

5. Cryptocurrencies- To Pay Contractors in China

Some contractors may be open to receiving payments in cryptocurrencies like Bitcoin or Ethereum. However, this option may not be suitable for everyone, and both parties should be comfortable with the use of cryptocurrencies.

6. Escrow Services- To Pay Contractors in China

Use escrow services for larger transactions to provide security for both parties. This involves a third party holding the funds until the agreed-upon conditions are met.

7. Corporate Credit Cards- To Pay Contractors in China

If the contractor provides services on an ongoing basis, a corporate credit card may be used for regular payments. This can simplify the payment process and provide a clear record of transactions.

8. Cross-Border Payment Services- To Pay Contractors in China

Consider using cross-border payment services that specialize in international transactions. These services may offer better exchange rates and lower fees compared to traditional banks.

9. Local Currency Payment- To Pay Contractors in China

Whenever possible, pay contractors in the local currency (Chinese Yuan, CNY) to avoid additional currency conversion fees.

10. Direct Cash Payments- To Pay Contractors in China

While less common and not always recommended due to the lack of a clear audit trail, direct cash payments might be an option for small transactions or situations where other methods are not feasible.

Important Considerations

- Legal Compliance: Ensure that your chosen payment method complies with Chinese regulations and tax laws.

- Communication: Discuss payment preferences with contractors and agree on a method that suits both parties.

- Transaction Costs: Be aware of any transaction fees associated with the chosen payment method, and consider negotiating how these costs will be covered.

- Documentation: Keep clear records of all transactions, including invoices, receipts, and any communication related to payments.

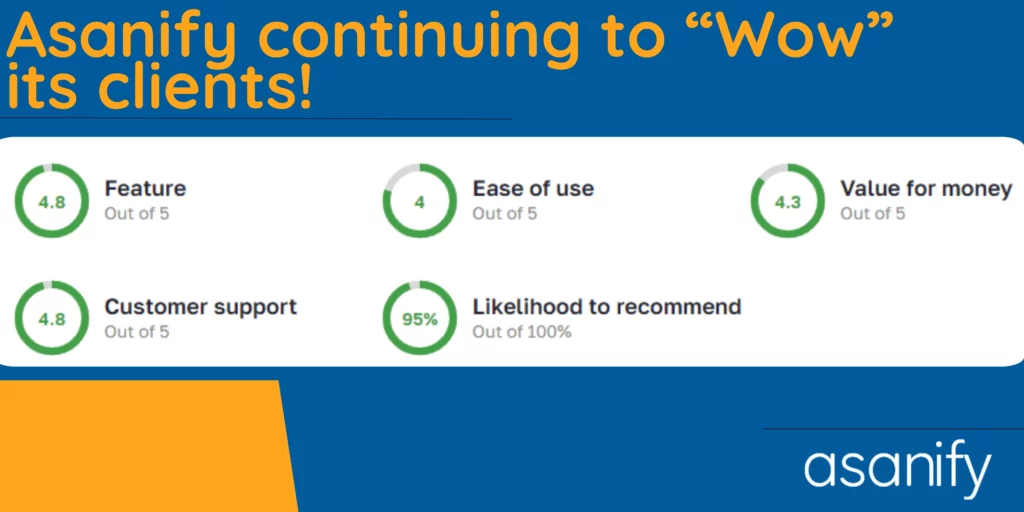

Your search for the easiest way to pay contractors in China doesn’t end with the above list. This is because you are yet to come across the simplest and most user-friendly way to run contractor payroll. Using global contractor payroll services like Asanify will help you run payroll in just a single click. Interestingly, you will also get access to the best-in-class FX rates for contractor payroll. Imagine how awesome it is to get to use complimentary HRMS package along with contractor payroll. Now, you can easily run payroll without making any errors in calculation and release payments to contractors’ accounts instantaneously.

Also Read- How to Pay Contractors in Your Business? The Ultimate Guide

Currency and Other Considerations to Pay Contractors in China

Renminbi is the official currency in China. Since China has strict currency controls, companies need to be aware of the regulations and limitations when making international payments to contractors. It’s essential to comply with the foreign exchange rules, provide required documentation, and ensure timely payment to avoid any disruptions in the working relationship.

Tax and Other Payroll Costs for Contractors in China

In addition to income taxes, there may be other payroll costs associated with hiring contractors in China. These costs can include social insurance contributions if the contractor is considered a “de facto” employee, as determined by Chinese labor authorities. It’s important to factor in these additional expenses when budgeting for contractor engagements.

Termination or Extension Terms for Independent Contractors in China

Terminating or extending a contract with an independent contractor in China should be clearly addressed in the initial agreement. Both parties should agree upon the conditions, notice periods, and potential consequences of terminating or extending the contractual relationship. It’s crucial to follow the agreed-upon terms while maintaining open communication to avoid disputes.

How do I Convert an Independent Contractor in China to an Employee?

Converting an independent contractor to an employee in China involves navigating through legal and regulatory requirements. It’s crucial to comply with local labor laws and regulations. The process can vary depending on the specific circumstances and the local jurisdiction, so it’s advisable to consult with legal professionals or human resources experts familiar with Chinese employment laws. Let’s have a look at the general guidelines:

1. Understand Local Employment Laws

- Familiarize yourself with the labor laws and regulations in the specific province or city where the individual is located, as there can be variations.

- China has different employment contract types, such as fixed-term, open-term, and part-time contracts.

2. Review the Current Contract

- Carefully review the existing independent contractor agreement to understand the terms and conditions.

- Identify any clauses that may impact the conversion, such as non-compete or confidentiality agreements.

3. Negotiate Terms

- Communicate with the independent contractor to discuss the conversion and negotiate terms such as salary, benefits, and working hours.

- Ensure that both parties are on the same page regarding the transition.

4. Prepare a New Employment Contract

Draft a new employment contract that adheres to Chinese labor laws and includes all necessary details, such as job responsibilities, salary, benefits, working hours, and any probationary period.

5. Ensure Compliance with Social Insurance and Benefits

China has mandatory social insurance contributions for employees. Ensure that the employee is enrolled in the appropriate social insurance schemes, including pension, medical, unemployment, work-related injury, and maternity insurance.

6. Obtain Necessary Permits

If the individual is a foreign national, ensure that they have the appropriate work permit and residence permit to work as an employee in China.

7. Notify Relevant Authorities

- Inform the local labor bureau or relevant government authorities about the change in employment status.

- Comply with any notification or registration requirements.

8. Tax Considerations

- Review the tax implications of the conversion for both the employer and the employee.

- Ensure that the necessary tax withholdings are made in compliance with Chinese tax regulations.

9. Employee Handbook and Policies

Provide the employee with an employee handbook that outlines company policies, procedures, and expectations.

10. Communication and Onboarding

- Communicate the changes to other employees and stakeholders.

- Facilitate a smooth onboarding process for the new employee.

11. Seek Legal Advice

Given the complexity of employment laws, it’s advisable to seek legal advice to ensure compliance with all relevant regulations.

12. Documentation

Keep thorough documentation of the entire process, including the new employment contract, communication with the employee, and any notifications sent to authorities.

13. Review Ongoing Compliance

Regularly review and update employment contracts, ensuring ongoing compliance with any changes in labor laws.

It’s essential to work closely with legal professionals or human resources experts to ensure that all legal requirements are met during the conversion process.

Suggested Read: Terminating a Contractor- Know How to End an Agreement Politely

Quick Wrap Up- Pay Contractors in China

When hiring and paying contractors in China, it’s important to understand the legal and practical considerations involved. By following the steps outlined in this comprehensive guide, you can navigate the process with confidence and ensure a successful working relationship with contractors in China.

Frequently Asked Questions- Pay Contractors in China

Q: Can a contractor in China work for multiple clients simultaneously?

A: Yes, independent contractors in China can work with multiple clients at the same time. This provides them with flexibility and the ability to choose projects that suit their expertise and availability.

Q: Do contractors in China have to pay income tax?

A: Yes, contractors in China are responsible for paying income taxes on their earnings. They need to report their income and pay taxes according to the tax filing requirements applicable to their business structure.

Q: Can a contractor be reclassified as an employee in China?

A: In certain circumstances, Chinese labor authorities may reclassify a contractor as an employee if they determine that the contractor’s engagement resembles an employment relationship. This can have significant implications for both parties involved.

Q: Are there any restrictions on hiring foreign contractors in China?

A: Hiring foreign contractors in China may involve additional considerations such as work permits and visa requirements. The Chinese government has specific regulations regarding employment of foreigners, so it’s important to ensure compliance with these rules.

Q: How can I ensure compliance with Chinese labor laws when hiring contractors?

A: To ensure compliance with Chinese labor laws, it’s advisable to work with legal professionals or consult with experts who specialize in Chinese employment regulations. They can provide guidance on drafting contracts, classification of workers, and compliance with tax and social insurance obligations.

Q: Can contractors in China be held liable for work-related accidents or damages?

A: Contractors in China are generally responsible for their work and any liabilities arising from it. However, it’s crucial to have clear contractual provisions regarding liability and indemnification to protect the interests of both parties.

Q: Should I provide equipment or materials to contractors in China?

A: The provision of equipment or materials to contractors in China can vary depending on the nature of the project and contractual arrangements. It’s advisable to clearly outline equipment or material requirements in the independent contractor agreement to avoid any confusion or disputes.

Q: Is it necessary to have a written agreement with a contractor in China?

A: While oral agreements can be legally binding in China, it’s highly recommended to have a well-drafted written agreement in place when engaging contractors. A written agreement helps clarify expectations, rights, and obligations for both parties, reducing the risk of misunderstandings or disputes.

Q: What are the benefits of hiring contractors in China?

A: Hiring contractors in China can provide access to specialized skills and expertise, flexibility in project-based work, and cost savings compared to hiring full-time employees. It allows businesses to tap into local talent without establishing a permanent presence in China.

Q: Are non-compete clauses enforceable with contractors in China?

A: Non-compete clauses included in independent contractor agreements can be enforceable in China, provided they meet certain legal requirements. It’s advisable to seek legal advice to ensure that non-compete clauses comply with Chinese labor laws and are enforceable when necessary.

Q: Can I convert a contractor to a permanent employee in China?

A: Yes, it’s possible to convert a contractor into a permanent employee in China, subject to proper procedures and compliance with labor regulations. However, it’s important to consult with legal professionals to understand the implications and legal requirements involved in such conversion.

Not to be considered as tax, legal, financial or HR advice. Regulations change over time so please consult a lawyer, accountant or Labour Law expert for specific guidance.