At the core of every business lies its employees. But, have you ever wondered how much each employee costs? Rather, how each company manages payroll expenses? Well, that’s where payroll accounting announces its entry. Accounts and payroll are inextricably linked to one another. While you are probably aware of what is payroll in HR, accounting it is a little different. Payroll accounting is the process by which you can keep a proper record of employees’ salaries, wages, benefits, taxes, and the list goes on.

As much as the definition of payroll accounting presented an easy-peasy picture, carrying out the process is actually a mammoth task. But, not anymore! In this blog, we have curated a list of the top 20 payroll software for accountants, that are currently making news in 2023. With an accountant payroll software in place, generating payroll in less than 5 seconds, is going to be the reality. Further, you won’t have to lose your sleep over truckloads of figures, reports, and whatnot in the tax season.

Before we introduce you to some of the amazing payroll software, let’s get into the basics of payroll accounting (including payroll accounting meaning) first.

Table of Contents

- What is Payroll Accounting?

- What Kinds of Employee-Related Expenses are Included in Payroll Accounting?

- Why Precise Payroll Accounting is Crucial?

- Steps to Set Up Payroll Accounting

- Importance of Payroll Software for Accountants

- Key Features to Look For in a Payroll Accounting Software

- Top 10 Payroll Accounting Software for Accountants in 2023

- Evaluating Payroll Accounting Software: Cost Vs. Benefit

- The Future of Payroll Software for Accountants

- Making the Right Choice: Selecting Your Payroll Accounting Software

What is Payroll Accounting?

Payroll accounting holds the key to the growth of a company. It is a system by which a firm gains an in-depth understanding of each employee’s cost. Tracking and recording the business expenses related to payroll, therefore, becomes crucial. To state in simple terms, management of accounts payroll is all about maintaining a database containing an employee’s compensation, which includes:

- Salaries;

- Benefits or incentives;

- Deductions;

- Payroll taxes

All these important details are stored in financial journal entries to get an overall idea of employee-centric expenses, and every minute details about each financial transaction. In that way, you get to view the complete summary of a firm’s transactions, and net cash flow.

Each journal entry you come across is actually stored on a General Ledger or GL that documents a list of financial transactions. This record comes in handy at times of financial reporting.

After expense-related information of each employee gets recorded, the HR department can extract this data. They can then send this to their immediate seniors for initiating discussions about performance management, future growth plans, and so on.

Research studies reveal that the HR department spends about 30% of its time on traditional people management-related activities.

No wonder why it’s the right time now to automate complex processes like payroll accounting, and various other HR-related processes.

Now that you are aware what is payroll in accounting, let’s hop on to see what needs to be included in payroll accounting.

Recommended Read: Navigate the Latest Tax Slabs Changes in the 2023-24 Budget

What Kinds of Employee-Related Expenses are Included in Payroll Accounting?

While storing data on the ledger, a payroll accountant needs to be extremely careful and precise in what they do. Missing out on including any benefits, deductions, wages, etc., may result in great payroll mishap. Let’s have a look at the types of expenses that you ought to include while chronicling employee costs.

When things come to managing accounts and payroll in India, you need to take into consideration the following expenses while recording compensation of each employee.

- Employee Compensation: Everything starting from employee salary, commission, overtime pay, etc. form a part of this component.

- Tax Withholdings: This usually groups tax deductions- Professional Tax (PT), Tax Deduction at Source (TDS), and other pertinent tax from an employee’s salary.

- Benefits: This includes Employee Provident Fund (EPF), Employee Pension Scheme (EPS), Employee State Insurance (ESI), and other deductions, as required by law of the land.

- Miscellaneous: Under miscellaneous section, any amount that the company needs to reimburse to its employees is included in payroll accounting.

Why Precise Payroll Accounting is Crucial?

For any company aspiring to grow at a momentous pace, payroll accounting is a must. And, a payroll accountant has a huge role to advance the strides of a company. Further, as per the Companies Act of 2013, every company located in India ought to have an organized record of all the financial transactions that take place, and payroll in accounting undoubtedly forms a core part of that documentation.

Let’s have a quick look at the reasons that make precise payroll accounting extremely important.

Establishes the Cost of Each Employee

Payroll accounting entries against individual employees help understand the cost that the company carries for each of them. This will also help you gain greater insights into taking cognizance of labor expenses. In that way, you can plan and revise company budget. Further, you can gain clarity of the exact cost of hiring full-time employees, freelancers or independent contractors, and part-time staff. Accordingly, you can make alterations in financial planning.

Maintains Statutory Compliance and Adherence to Tax Regulations

Payroll accounting ensures statutory compliance and obligation to tax regulations. By clearly laying out costs of each employee, taxes payable, and details of every monetary transaction, the process helps you stay aware as to whether your firm is following all the tax laws. For instance, you can check if your company is adhering to the provisions of the Companies Act, Income Tax Act, Provident Fund, and ESI. This insulates your firm from any risks of legal conflicts or hefty penalties.

Interprets Business Costs and Other Expenses

Precise employee cost documentation will aid you in conducting an intense analysis of business expenses. This will further assist you to examine profitability and monitor cash flow with great efficacy. Payroll accounting is concerned with transparency, thereby ensuring that every transaction finds its place in the record.

Also read: How to Calculate Income Tax and TDS Like an Expert?

Steps to Set Up Payroll Accounting

While the entire process of recording payroll accounting entries may appear to be overwhelming, following these steps will help you do it effortlessly. Let’s see what are the steps to keeping a company’s financial transaction track record clean!

Getting a TAN or EIN Assigned

Firstly, your company needs to be registered and identified to follow payroll and tax regulations. The Income Tax Department of India will assign your firm with a Tax Deduction and Collection Account Number (TAN). You need to apply to obtain this number. Make sure that your company receives registration numbers from all the statutory bodies, including:

- Employees’ Provident Fund Organization (EPFO);

- Employees’ State Insurance Scheme (ESI);

- Labor Welfare Fund;

- Authorities concerning Professional Tax

Company Registration with the State Authorities

Setting up a business directly implies registering it with the state out of which it is based. This is crucial to oblige to all the state-specific compliances and income tax guidelines.

Deciding The Way of Maintaining Your Company’s Books of Accounts

So, your company registration is done! What next? Well, now you need to decide the way you are going to maintain the books of accounts for your business. You can adopt any of these three methods of accounts payroll:

1. Manual Recording of Transactions

Some businesses stick to spreadsheets to perform payroll accounting processes manually. This process is not much recommended because its is quite prone to errors and consumes a lot of time.

2. Deploying the Role to an Accountant

Hiring an accountant for payroll is a good way to record the nitty-gritty of business expenses and financial transactions. As they bring their expertise in financial management to the fore, businesses choose this to be a prudent idea because they know that payroll accounting entries will be reported accurately. While this option may be ideal for large corporations, small businesses may find it to be inconvenient owing to the enhanced expenditure of hiring a professional accountant.

3. Resorting to a Payroll Software Offering Easy Integration with an Accounting Software

If you are looking for a smart way to manage your business, this can be an ideal option for you. By using a highly efficient payroll software like Asanify that offers the potential of easy integration with accounting software, you can monitor every aspect of company cash flow. Say adieu to all sorts of payroll miscalculation with a payroll software made to suit the needs of an accountant.

Determining Type of Payment and its Frequency

Before working on payroll general journal entry, deciding payment type and its frequency is crucial. Determine how you want to release payments, that is, weekly, bi-weekly, or monthly. Further, it is important to come to a conclusion if you want to run the payroll once a month or every two weeks.

Prepare an Accounts Chart Detailing Payroll Expenses

Creating an accounts chart laying down the details of every payroll-related expenses is yet another vital aspect of payroll accounting. Important details that you need to include in this chart are:

- Payable net salary of employees;

- Deductions/Tax withholdings to meet statutory compliances;

- Expense reimbursements;

- Miscellaneous expenses related to payroll

Create a Business Bank Account

Running a business without having a separate bank account for it is a big no-no. Having a separate bank account for your business is highly recommended. Further, this is necessary to project clear recordings of financial dealings and cash flow map. You may want to spend some time researching on selecting the bank and then submit the following documents to your chosen bank:

- Copy of your business registration certificate;

- Documents supporting address proof;

- PAN card;

- Other relevant documents pertaining to identification

Work Out the Establishment of a Proper Salary Structure

While creating a salary structure, take into account some of the crucial factors, such as:

- Your company requirements;

- Job roles of employees;

- Years of relevant experience of employees;

- Market standards

Laying the foundation of a proper salary structure is essential to plan and manage company finances efficiently. Further, giving your employees a proper insight into the various components of the salary brings in an element of transparency and fairness.

Recommended Read- Salary Structure in India: The Ultimate Expert Guide

Gather Details of Employees

After the firm kick-starts the hiring process, they need to obtain some essential employee information. For freshers who are beginning their professional journey, you need to get their Universal Account Numbers (UAN) obtained. Make sure that every new hire is provided with Form 12B. Its core purpose is to share information about the new employee’s income figure from their past employer.

As per Rule 26A, a person joining a new establishment in the middle of the year needs to submit Form 12B, which is essentially an Income Tax form.

Further, it is essential to ask for the following details from each employee:

- Social Security Number;

- Date of birth;

- Contact details;

- Address details

Automate the Process of Running Payroll for Your Employees

Once you automate payroll processing, the heavy load wearing down your shoulders will be gone. By using a highly intuitive payroll software, you can automate the payment of employee salaries, expense reimbursements, tax deductions, benefits, etc. Moreover, you can stay assured of making not a single error because the payroll software will streamline the entire process for you. Calculating salaries and issuing payslips will become a breeze. As a result, payroll accounting can also be done accurately.

Maintain a Proper Record of Payroll Accounting Entries in Salary Journal

To ensure you are payroll accounting in the right way for a particular pay period, create a record of salary journal entries once payment for each employees gets released. Here’s how you can create a record of the same in the ideal way:

|

Salary Journal Entries [Format] |

|

|

Debit |

Credit |

|

Employee salary expense |

Total salary payable |

|

Deductions |

Expense reimbursements |

|

Employee benefits |

Deductions for statutory compliances |

Overwhelmed by the lengthy process of payroll accounting? Well, it’s time to use a payroll accounting software and automate the process of managing expenses related to employee salaries, benefits, etc.

To ensure payroll accounting is carried out in the most precise way possible, using a payroll software (tailor-made for accountants) for your business is crucial. Before we hop on to the top 10 payroll accounting software, let’s first understand its importance and features you need to look out for in the ideal platform. No matter whom you hire as an accountant, it is important to ensure they are using the right payroll accounting tool and help manage company/client finances.

You may like to check out: How to Get Tax Deduction for Employment Generation?

Importance of Payroll Software for Accountants

Payroll software automates the entire process of calculating, processing, and managing employee salaries, tax withholdings, deductions, and other payroll-related tasks. By eliminating manual calculations and paperwork, payroll software saves valuable time and reduces the risk of errors.

But what exactly does this mean for accountants? Well, imagine a world without payroll software. Accountants would have to spend countless hours manually calculating each employee’s salary, factoring in tax withholdings, deductions, and other variables. This tedious process not only consumes valuable time but also increases the chances of making mistakes. With payroll software, accountants can breathe a sigh of relief as the software takes care of all the complex calculations with precision and accuracy.

The Role of Payroll Software in Accounting

Payroll software not only simplifies and streamlines payroll processing but also integrates with other accounting systems, such as general ledger software. This integration ensures that payroll data seamlessly flows into the accounting system, maintaining accuracy and consistency across financial records.

Imagine a scenario where payroll data is manually entered into the accounting system. This manual process is not only time-consuming but also prone to errors. With payroll software, accountants can easily transfer payroll data to the accounting system with just a few clicks. This integration eliminates the need for manual data entry, reducing the risk of errors and ensuring that financial records are up-to-date and accurate.

Recommended Read: Payroll Outsourcing- The Ultimate Guide With Advantages and Disadvantages

Key Features to Look for in a Payroll Accounting Software

When choosing the best payroll software for your accounting needs, it’s important to consider several key features:

Automated Calculations

Look for software that can accurately calculate wages, deductions, and taxes based on the latest federal, state, and local regulations.

Automated calculations are a crucial feature of payroll software. With ever-changing tax laws and regulations, it can be challenging for accountants to keep up with the latest updates. Payroll software that automatically calculates wages, deductions, and taxes based on the most recent regulations ensures accuracy and compliance.

Tax Filing and Compliance

Ensure that the software handles complex tax calculations, generates tax forms, and keeps up with ever-changing payroll tax laws.

Tax filing and compliance are areas where accountants need to be meticulous. Payroll software that handles complex tax calculations and generates tax forms simplifies the process for accountants. Additionally, with the ever-changing landscape of payroll tax laws, having software that stays up-to-date with these changes is essential for compliance.

Employee Self-Service

An intuitive interface that allows employees to access their payroll information, view payslips, and make changes to personal details can significantly reduce HR’s administrative burden.

Employee self-service is a feature that benefits both accountants and employees. With an intuitive interface, employees can access their payroll information, view payslips, and make changes to personal details without having to rely on HR. This reduces the administrative burden on HR and allows accountants to focus on more critical accounting tasks.

Customization Options

Choose software that enables you to configure settings and generate reports tailored to your unique business requirements.

Every business has unique payroll requirements. Payroll software that offers customization options allows accountants to configure settings and generate reports that align with their specific business needs. This flexibility ensures that the software adapts to the business’s payroll processes and provides accurate and relevant information.

Integration Capabilities

Compatibility with other software systems, such as accounting, time and attendance, and human resources, promotes data accuracy and reduces duplicate data entry. So, integration capabilities are crucial for seamless data flow between different systems.

Payroll software that integrates with other software systems, such as accounting, time and attendance, and human resources, ensures data accuracy and reduces the need for duplicate data entry. This integration, therefore, streamlines the overall payroll process and minimizes the chances of errors.

Also read- Salary Structure in India: The Ultimate Expert Guide

Top 10 Payroll Accounting Software for Accountants in 2023

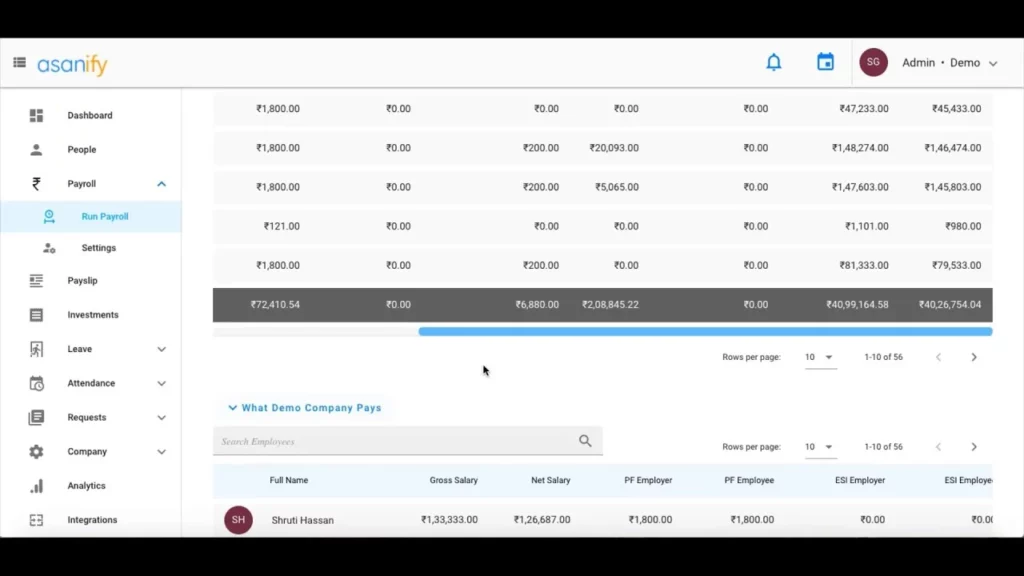

#1: Asanify

Asanify is the most highly-rated payroll accounting software, that is used by hundreds and thousands of accountants and small businesses globally. Well, that doesn’t mean the exclusion of large corporations from its vast clientele base. It is probably the easiest payroll system offering 100% adherence to statutory compliances.

Asanify’s uniqueness lies in the fact that it offers both domestic and global payroll processing features. As a result, payments to contractors located globally can also be done in seconds. Further, it offers easy integration with multiple accounting software tools, thereby making the lives of accountants easier. This payroll software may turn out to be an asset for accountants who wants things clean and enjoy the feature of 24-hour deposits. Starting from data syncing to provision of core HR management, Asanify has everything that payroll accountants may ever need to record payroll accounting entries. The best part? This ideal payroll software for accountants offers free 14-days trial, that comes with all of its three plans.

Pricing

- Essential: This plan costs $3.99 per person per month (minimum 20 persons).

- VIP: This pricing model charges $7.99 per person per month (minimum 10 persons).

- EOR- India: This costs $199 per employee per month.

Features

- Easy integration with diverse accounting software tools, thereby making data syncing a breeze;

- Completion of payroll process in <5 seconds;

- End-to-end HRMS;

- Customization of salary slip with paced up payroll execution;

- Offers room for large-scale customization to suit the individual needs of payroll accountants;

- Gamified investment declaration feature;

- Core HR modules, starting from leaves, employee attendance, LOP calculations, employee directory, Performance Management System to reports and analytics;

- 24/7 customer support;

- 100% compliance assistance

Pros

- Simplified payroll tool for a smooth user experience;

- Easier set-up;

- Provision of core HR Management;

- Payroll general journal entry simplified with full automation of payroll run

- Protection from tax penalties

Cons

- Not available for free usage;

- Separate modules can’t be purchased- with compulsory availing of either Essential or VIP plan to get access

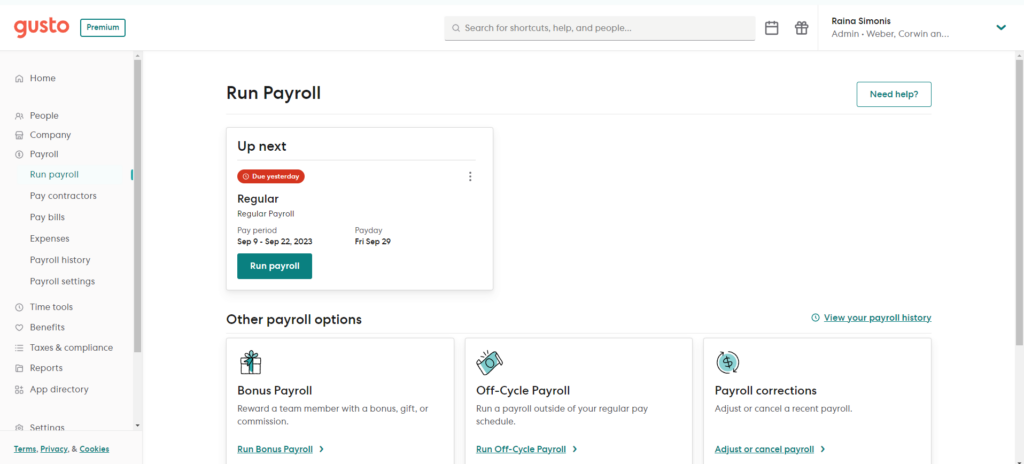

#2: Gusto

Gusto is a smart payroll software that accountants and small business owners can use extensively. It integrates well with multiple accounting software platforms such as Quickbooks, Xero, Aplos, Freshbooks, and many more- thereby making it a favourite payroll software tool of over 200,000 small businesses and multiple accounting firms. Apart from automation of payroll services, it offers compact HR support. Therefore, for accountants who wants to escape the nerve-wracking task of heavy calculations and enjoy the feature of next-day direct deposit, Gusto’s payroll software can act as a welcome relief.

Pricing

- Simple: This plan costs $40 per month + $6 per month per person.

- Plus: This plan charges $80 per month + $12 per month per person.

- Premium: This offers solely exclusive pricing.

The interesting part? Gusto Pro is absolutely free for accountants, but there is a condition. In case of continuation of onboarding a minimum of one client every 12 months, you will have it free. Further, this payroll software also offers flat 10 to 20% discounts to those accountants who are working with multiple clients.

Features

- Automated and fast-paced payroll processing;

- Complete HR Management;

- Zero-cost marketing collateral exclusively for Gusto-partnered accounting firms;

- 24/7 customer support;

- Next-day direct deposit with Gusto Simple Plan;

- Same-day direct deposit with remaining plans of Gusto;

- Efficient management of employee benefits and accurate tax filing;

- Chance to bag CPE credits by attending live webinars;

- Access to a wide array of hiring and employee onboarding tools

Pros

- Easy and simple UI to navigate through;

- Integration with multiple software tools;

- Full automation of payroll processing;

- Assistance to adhere to compliances

Cons

- Restricted customization opportunities;

- Limited global range or coverage;

- No provision of free trial

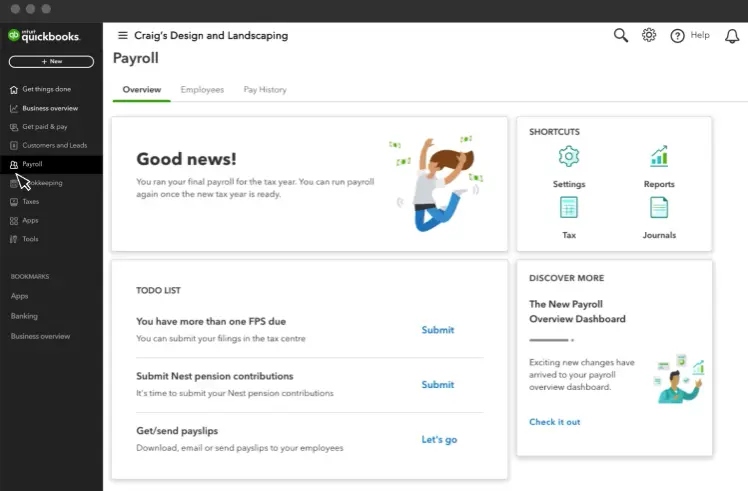

#3: QuickBooks Payroll

Renowned for its unrestrained payment disbursal schedules and quick deposits, Intuit QuickBooks’ payroll product, that is, QuickBooks Payroll can be a good choice for accountants. Its wide array of features makes it a go-to option for accountants to offer excellent service to their clients. Moreover, it offers a charming collection of perks, starting from software subscriptions at zero cost to exciting client discounts.

Interestingly, its easy-to-understand periodical reports along with an array of monitoring tools makes things easily manageable. As a result, it would be easier to view data related to profitability along with payroll expenses. No wonder this will further aid a payroll accountant in tracing and planning the growth of the company, for which they are working.

Pricing

- Simple Start: This plan is priced at $15 per month.

- Essentials: This plan costs $30 per month.

- Plus: This plan is priced at $45 per month.

- Advanced: Users can avail of this plan at $100 per month.

There is a special provision for QuickBooks ProAdvisors, who are accountants partnering with its online payroll tool. This unique program of QuickBooks ProAdvisors bills accounting firms at a lucrative discounted rate. Further, new customers get the opportunity to choose either a free trial for a period of 30 days or enjoy a discount of 50% for the first three months.

Features

- Easy-to-navigate user interface;

- Fund transfer within 24 hours;

- Inventory tracker to manage varied bookkeeping tools for various business establishments;

- Access to a vast collection of tax compliance tools;

- Obtain detailed report and analytics to better interpret payroll expenses and create room for future growth;

- Project profitability tracker to enhance chances of getting profits and closely monitor payroll expenses

Pros

- Quick and easy setup/installation;

- Hassle-free integration with QuickBooks Online, thereby enabling the already existing users of this tool to switch to its payroll counterpart instantaneously;

- No compulsion of entering into a long-contract;

- Time tracking;

- Streamlined payroll processing;

- Elimination of chances of violating tax-related regulations

Cons

- Lack of proper customer support;

- Limited HRMS tools and features;

- May turn out to be a costly tool as compared to other competitor tools;

- Several negative public reviews

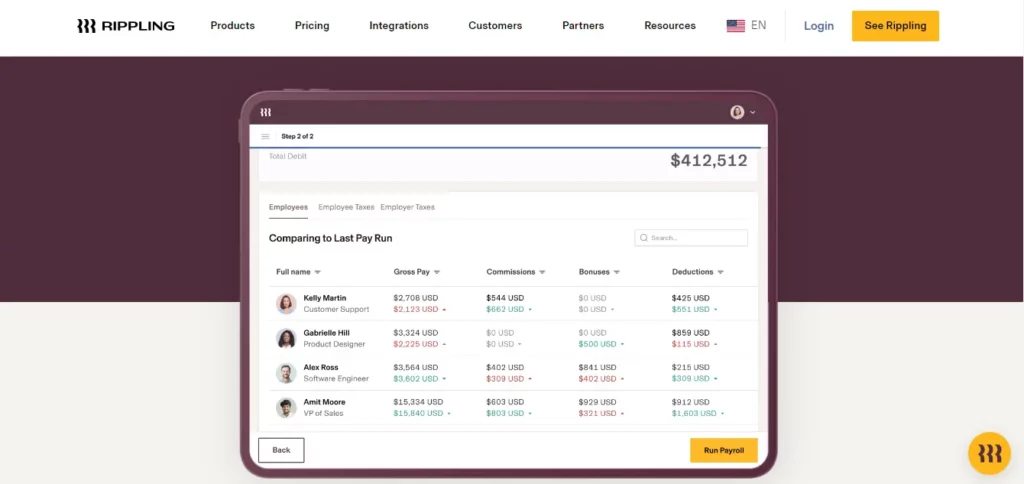

#4: Rippling

With its compact set of HR, IT, and Finance tools, Rippling stands out as a perfect payroll software for an accountant payroll. Like Asanify, it offers the provision to run payroll for both full-time employees and global contractors or freelancers working for a company. What is remarkable to note is that Rippling offers complete remote tech management. Apart from recording payroll accounting entries, maintaining payroll general journal entry, and tracking expenses closely, this payroll tool lets businesses customize and manage their software easily. Therefore, accountants who have large corporations as clients, can use Rippling to simplify payroll accounting while offering a host of other added services.

Rippling also offers innovative finance solutions that lets accountants monitor expense claims and varied other tasks. Moreover, its open-API capabilities, assorted collection of task management tools, HR Management suite, custom alerts, and integrated employee database- streamlines various processes. Accountants can record every financial transaction going on in a company and record payroll accounting entries easily by using Rippling and all other 300 third-party platforms with which it offers easy integration.

Pricing

While Rippling doesn’t reveal its pricing modules online, it just makes a declaration that the starting price of plans is $8 per month per user. If accountants wish to use a customized package of Rippling, they first need to use Rippling Unity, which is nothing but its software tool itself. The cost of using it is $35 per month. Right from this platform, the required modules can be added, be it HRMS, task management, etc. However, each module comes with a separate per-employee fee. The greater the number of modules selected, the higher will be the total charge.

Features

- Automation of payroll processing;

- Potential to integrate with accounting software tools like QuickBooks, Sage Intacct, Net Suite, and Xero;

- Assigning its partner accountants with a Rippling Advisor to assist them in navigating through the platform;

- Core HRMS tools;

- Tax violation safeguarding;

- Management of payroll expenses with provision of corporate cards;

- All-in-one platform for HR, finance, and IT tools

Pros

- Complete automation of payroll processing leading to the generation of error-free reports;

- Diverse HR tools;

- Remote tech management;

- Ensures statutory compliances;

- Makes payroll accounting easier by its multiple integrations with accounting software tools

Cons

- May turn out to be costly for small businesses;

- No clear projection of pricing plans on its website;

- Ambiguity in information concerning perks available to accountants

#5: Patriot Payroll

Patriot Payroll Software is yet another easy-to-use, budget-friendly tool that may come handy. For accountants offering payroll accounting services to small businesses, this software even has an exclusive partner program. With the expansion of accounting business, the rate of discounts offered by this tool keeps increasing. Absolutely free setup with an expert team’s assistance at the time of onboarding- forms a remarkable feature of the accountant partner program. It also offers protection from any sort of penalties related to the violation of tax norms. The most exciting part? For accountants having 6 or more clients, Patriot offers payroll and accounting services for free. It also comes with a 30-day free trial.

Pricing

Patriot payroll software has a special pricing program for professionals entrusted with the task of payroll accounting. The idea is to enjoy bigger discounts if the number of clients is higher.

- Silver: Payroll accountants having 1-5 clients can go for this while bagging 5% discount. The accounting premium costs $28.50 per month while full service payroll comes at $35.15 per month plus $3.80 per employee or contractor.

- Gold: This pricing package is for those payroll accountants having 6-15 clients with the discount rate being 10%. Cost of accounting premium is $27 per month. For full-service payroll, the rate is $33.30 per month with $3.60 per employee or contractor.

- Platinum: For an accountant payroll handling 21-50 clients, this can be a good fit. The discount rate here is 15%. Accounting premium cost is $27 per month, while full service payroll is $31.45 per month with $3.40 per employee or contractor.

- Diamond: This pricing model has been designed for payroll accountants having 51-100 client accounts. As is obvious, the discount rate is really great, that is, 20%. Accounting premium rate is at $24 per month and full service payroll is at $29.60 per month with an additional rate of $3.20 per employee or contractor.

Features

- Generation of 100% customized payroll reports to cater to the needs of each client;

- Quick data migration for clients;

- Setup and onboarding at zero cost for every client;

- Provision of 30-day free trial to all the new client accounts;

- Easy handling of multiple client accounts with just a single log-in

Pros

- Extremely easy to use, specially, for non-tech people;

- Tax compliance support;

- Access to onboarding file importer;

- Umbrella login;

- Tax compliance support;

- Free to use in case of having six or more active clients;

- Consolidated billing;

- Free expert support at times of need;

Cons

- Lack of diverse HRMS tools;

- Limited integrations with accounting software tools- with QuickBooks Online or Patriot’s own software being the options;

- No dedicated mobile app;

- Blocked access to free time-tracking feature as it is a paid add-on

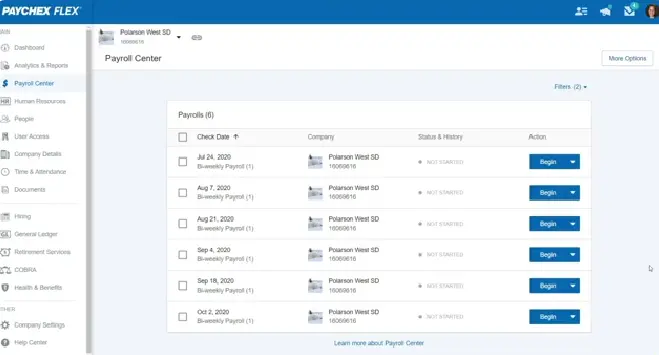

#6: Paychex

Paychex may prove to be payroll accountants’ go-to tool for tracking payroll expenses, and several other functions. It enables the calculation, filing, and payment of payroll taxes not only with great precision but also at a lightning pace.

With its 200+ compliance experts constantly tracking and monitoring the rapidly changing laws and regulations in the area, accountants get to stay worry-free. After all, the chances of not complying to the governing laws gets eliminated. Paychex also has an expert HR team that can help accountants understand various labour laws.

Further, this payroll software tool has an exclusive partnering program for accountants. Paychex’s high-grade technology-backed services can act miracles for them as they won’t have to worry about errors in the payroll. Interestingly, with Paychex, CPAs can easily work with the software’s Dedicated Accountant Service Team. It also has Employee Retention Tax Credit Service that aids business owners ascertain eligibility and then claiming the credit by making use of payroll data.

Pricing

Paychex enumerates the following pricing models online.

- Essentials: This package costs $39 per month with a charge of $5 per employee per month.

- Select: This plan is custom-priced. So, accountants need to contact Paychex to get the quote.

- Pro: Much like the Paychex Select plan, this too has custom pricing.

Features

- Seamless integration with the General Ledger of Paychex;

- Suite of accounting tools;

- Multiple options of payment, starting from direct deposit, pay cards to paper checks;

- Quick data import;

- Access to a collection of HR tools for both payroll accountants and their clients;

- Employee self-service portal;

- Team of compliance support experts;

- ERTC service;

- Dedicated tax service;

Pros

- Rich repertoire of HR and payroll-related educational materials for accountants who can then share these with their clients;

- Chance to obtain free CPE credits by attending its webinars and completing various Paychex online courses;

- Opportunity to purchase retirement plan options at heavily discounted rates;

- Employee self-service by letting them access their payroll information online;

- Excellent customer support round the clock

Cons

- Non-transparent pricing plans;

- Extra fees for payroll tax services and integration with accounting software

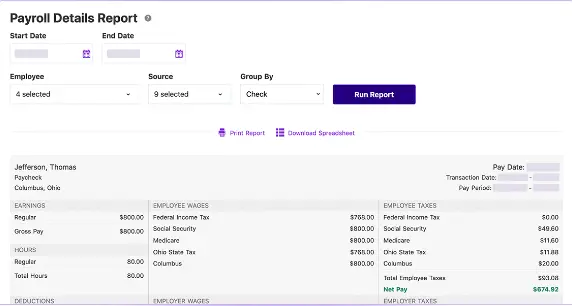

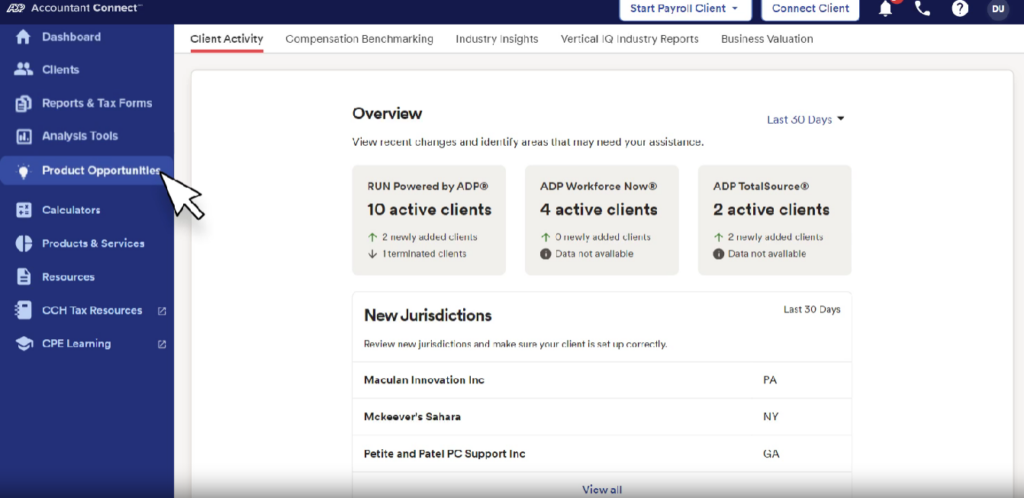

#7: ADP Payroll

ADP Payroll can fit the needs of small and medium-sized businesses in the most apt way possible. Both local and global payroll processing gets completed in seconds, thereby erasing the stress of accountants who would otherwise have to struggle their way through huge data and numbers. What is worth noting is that its Accountant Connect program lets payroll accountants easily access and track their clients’ general ledger. It also offers tonnes of educational materials for accountants to ace payroll accounting and enjoy success in their professional journey.

Accountants who go on to become ADP’s partners can make use of Counting Works Pro Marketing Suite to create excellent company newsletter and a website. Moreover, they can also utilize a host of critical analysis tools to facilitate their services to clients.

Pricing

ADP Payroll has not revealed its pricing information online. As a result, accountants would have to directly contact the company to get a quote and confirm with them if they give any discounts.

Features

- Publishes detailed payroll reports for multiple clients;

- Access to multiple clients’ accounts with just a single log-in;

- Ultra-easy onboarding process;

- Employee salary benchmarking;

- Expert industry resources from Vertical IQ;

- Business valuation tool by BizEquity;

- Tool to access client insights;

- Provision of HR tips and resource-rich newsletters;

- Automation of payroll processing;

- Simplified payroll accounting

Pros

- Integrations with multiple accounting tools such as QuickBooks, Xero, and Sage;

- Easy-to-use mobile app for enhanced user experience;

- Marketing support;

- Client letter toolkit offering over 600 ready-to-use templates to boost client communications;

- A wide array of calculators, starting from payroll, tax, to retirement;

- Latest news about tax norms and legislative reforms

Cons

- Lack of a transparent pricing information on web;

- Restrained liberty to sign up independently; a compulsory talk with a sales representative is a must;

- Access to HR tools comes with costly plans

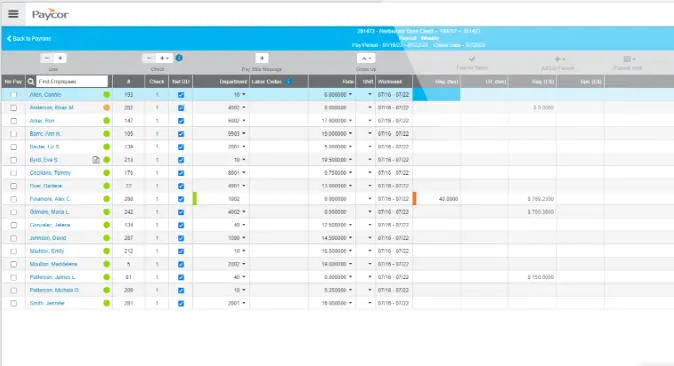

#8: Paycor

Paycor is a highly efficient Human Capital Management (HCM) platform offering the unique feature of on demand pay. This means that employees can get paid instantaneously for the number of hours they have worked. Further, it also comes with a compact package of HR, recruitment, and payroll processing tools. The most likeable fact about this payroll accounting tool is that it comes with a dedicated mobile app, named Paycor Mobile. In this app, every operation can be carried out without any hassle. Moreover, its easy onboarding process and use-of-ease draws several accountants to using it for recording payroll accounting entries. Starting from time tracking, administering benefits to tax filing, Paycor offers a vast range of solutions to make things easier for accountants relying on it.

Pricing

Paycor comes with four pricing models:

- Basic

- Essential

- Core

- Complete

However, there is no clear information about Paycore’s pricing online. Accountants would have to contact the company to get a quote.

Features

- Payroll processing automation;

- Multiple pay options starting from direct deposit, paycards to earned wage access;

- Easy access to payroll reports;

- Tax compliance support;

- Payroll run in seconds with error-free outcome;

- Employee self-service;

- Compact HCM suite

Pros

- Separate mobile app that makes work easier;

- Tax filing support;

- Compliance assistance;

- Time tracking;

- Benefits monitoring;

- Wide range of employee self-service tools

Cons

- No disclosure of pricing models;

- Several tools come as extra add-ons, thereby making it an expensive option

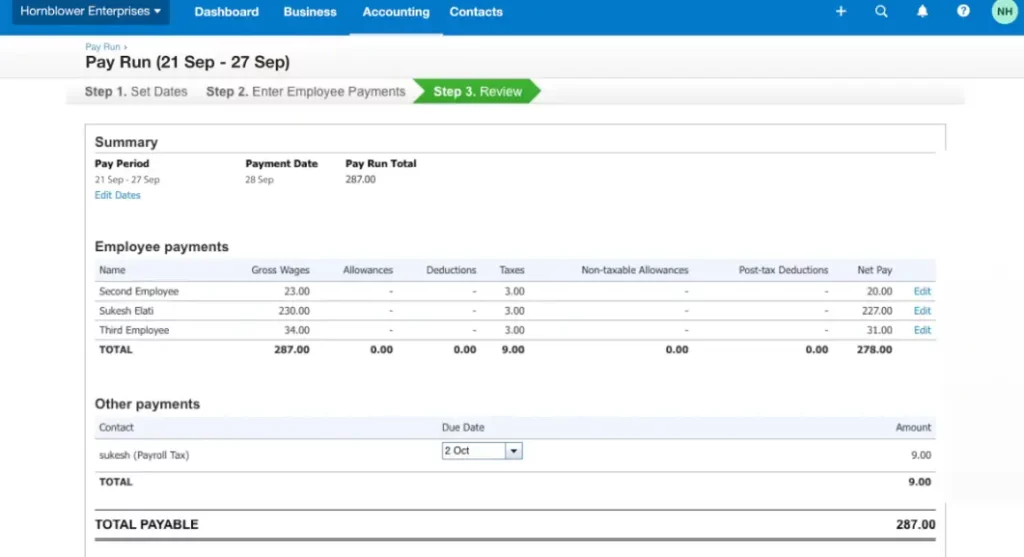

#9: Xero

Xero is one of the best payroll accounting software tools for accountants. When things come to handling financial tasks, Xero’s name stands out. Financial operations often appear to be complex. But with this tool, even non-accountants can carry out things with ease. Moreover, it streamlines payroll runs and offers the option to pay employees either manually or in batches. It also aids in the generation of payslips showcasing a complete breakup of employee earnings, along with deductions and net pay. Further, employee details, starting from payroll information, bank account details, email, tax number to postal address can also be added.

The most noteworthy aspect is that all these crucial bits of information are encrypted with multiple security layers. Not only this but Xero also offers inventory and bill management, invoicing, cash flow monitoring, to time tracking and various other services. Moreover, its accountant partner program brings in efficiency. Therefore, it enhances the chances of boosting revenue for accounting firms.

Pricing

- Starter: This is priced at $25 per month.

- Standard: This costs $40 per month.

- Premium: This has the pricing of $54 per month.

Features

- Two-factor authentication to minimize the risks of frauds;

- Reporting feature offering feedback on a particular company’s budgets and financial operations;

- Robust information recorder;

- Quick payroll runs

Pros

- User-friendly interface;

- Complex financial functions simplified;

- Single platform to manage employee details and track payroll expenses;

- Simplified generation of payslips;

- Access to payroll reports

Cons

- Limited options for customization;

- Lack of phone support;

- Restricted project management options;

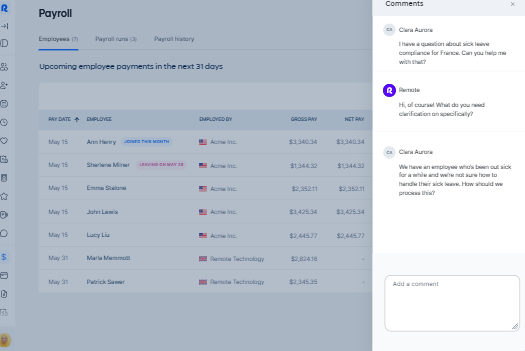

#10: Remote

Remote may turn out to be a remarkable choice for accountants who are in dire need of global payroll services. All the upcoming pay runs can be viewed in a single place, thereby bringing in an element of order and efficiency for accountants as they indulge in recording payroll accounting entries. Moreover, it comes with a employee self-service payroll platform and dedicated mobile app. Starting from payroll calculation, benefit and tax deductions, time off management, to local tax returns and much more, Remote payroll offers a huge set of features. As a result, it may establish itself to be quite promising and can aid accountants to a miraculous extent.

Pricing

The basic plan at Remote starts from $349 per employee, per month. For accountants directly paying for the entire year, 14% discount can be obtained. It also offers a free contractor management plan.

Features

- Quick, uninterrupted running of global payroll;

- Local payroll expert support;

- Local tax reporting and returns;

- Compliance support;

- Efficient time-off and expense management;

- Automation of payslip generation;

- On-time tax and benefits deductions;

Pros

- Complete suite of global payroll management;

- Built-in API offering easy integrations with third-party applications;

- Global compliance guidance;

- Excellent customer support;

- Multi-currency support system;

- Hassle-free onboarding;

- Benefits packages specific to countries

Cons

- Some pricing plans require personally contacting them and requesting for a quote;

- May not be the best option for accountants having domestic clients

Evaluating Payroll Accounting Software: Cost vs. Benefit

Understanding Pricing Structures of Payroll Accounting Software Tools

When evaluating payroll software, it’s essential to consider the pricing structures offered by different vendors. Some software solutions charge a per-employee fee, while others offer subscription-based models. Therefore, it is important to carefully assess the pricing options. Further, evaluating which one aligns with your organization’s budget and projected growth is crucial.

Let’s delve deeper into the various pricing structures available for payroll software.

The per-employee fee model charges a set amount for each employee on your payroll. This pricing structure can be advantageous for smaller businesses with a limited number of employees, as it allows for more flexibility in terms of cost control. On the other hand, subscription-based models offer a flat fee for unlimited users. This pricing structure is often preferred by larger organizations with a higher number of employees, as it provides a more predictable and scalable cost structure.

Moreover, it’s important to consider the long-term implications of the pricing structure you choose. While a per-employee fee may seem cost-effective initially, it can become burdensome as your organization grows and hires more employees. Conversely, a subscription-based model may offer better value in the long run, especially if your organization anticipates significant growth in the future.

Assessing the Value of Payroll Accounting Software

While cost is a crucial factor, it’s equally important to assess the value and benefits that payroll software brings to your accounting operations. Consider factors such as increased efficiency, improved accuracy, reduced compliance risk, and time saved on manual tasks. A comprehensive evaluation of the software’s features and the potential return on investment will help determine its true value.

One of the key benefits of payroll software is increased efficiency. By automating repetitive tasks such as calculating wages, generating pay stubs, and filing taxes, payroll software streamlines the entire payroll process. This not only saves time but also reduces the risk of errors that can occur with manual calculations. Additionally, payroll software often integrates with other accounting systems, such as time and attendance tracking, further enhancing efficiency and accuracy.

Another important aspect to consider is the software’s ability to ensure compliance with tax regulations and labor laws. Payroll software can automatically calculate and withhold the correct amount of taxes, ensuring that your organization remains compliant with tax regulations. Further, it can also help with generating accurate reports and maintaining records, simplifying the process of audits and ensuring compliance with labor laws.

Furthermore, payroll software can provide valuable insights and analytics that can aid in decision-making. By generating reports on labor costs, overtime expenses, and employee productivity, the software enables you to make informed decisions regarding resource allocation, budgeting, and performance management.

Lastly, the time saved on manual tasks by using payroll software can be redirected towards more strategic activities. HR and finance teams can focus on analyzing data, developing employee engagement strategies, and implementing cost-saving initiatives. Therefore, this shift in focus can lead to improved overall organizational performance and employee satisfaction.

The Future of Payroll Software for Accountants

Emerging Trends in Payroll Accounting Software

As technology continues to evolve, so does payroll software. Artificial intelligence and machine learning are revolutionizing payroll processing by automating complex calculations and providing real-time insights. Integration with biometric authentication systems and mobile apps enhances security and accessibility, making future payroll software even more sophisticated.

One emerging trend in payroll software is the use of natural language processing (NLP) algorithms. These algorithms enable the software to understand and interpret human language, allowing accountants to interact with the system using voice commands or written instructions. This not only streamlines the payroll process but also reduces the chances of errors caused by manual data entry.

Another exciting development in payroll software is the integration of blockchain technology. By leveraging the decentralized and transparent nature of blockchain, payroll software can ensure the integrity and security of payroll data. As a result, this eliminates the need for intermediaries and reduces the risk of data breaches or tampering.

Suggested Read: How to Handle Investment Declaration in Payroll?

How Technology is Shaping Payroll Processing

The rise of cloud-based solutions has transformed the way accountants approach payroll processing. With anytime, anywhere access, real-time data synchronization, and automatic updates, cloud-based payroll software ensures that accountants always have the latest information at their fingertips. Additionally, the integration of analytics and reporting tools enables accountants to gain valuable insights and make data-driven decisions.

Cloud-based payroll software also offers scalability and flexibility, allowing businesses to easily accommodate changes in their workforce size or structure. Whether a company is expanding, downsizing, or implementing remote work policies, cloud-based payroll software can adapt to these changes seamlessly.

Furthermore, the integration of artificial intelligence (AI) in payroll software has significantly improved accuracy and efficiency. AI algorithms can analyze historical payroll data, identify patterns, and predict future trends. As a result, this enables accountants to forecast labor costs, optimize resource allocation, and proactively address potential issues.

Additionally, AI-powered chatbots are becoming increasingly common in payroll software. These chatbots can answer employees’ questions regarding payroll, benefits, and tax-related matters, reducing the burden on HR departments and improving employee satisfaction.

Moreover, the future of payroll software lies in its ability to integrate with other business systems seamlessly. Integration with accounting software, human resources management systems, and time tracking tools eliminates the need for manual data entry. Further, it ensures data consistency across different platforms.

Making the Right Choice: Selecting Your Payroll Accounting Software

Choosing the right payroll software is a crucial decision for any company or accounting firm. With numerous options available in the market, it’s essential to consider your specific needs and requirements before making a final selection. Therefore, to ensure that you make an informed decision, there are several key factors to consider.

Considerations for Choosing Payroll Accounting Software

When selecting payroll software, it’s essential to consider the specific needs of your accounting firm. Identify the critical features required, define your budget, and assess the scalability of the software. Further, a payroll software should be able to handle the size of your organization and accommodate any future growth. It’s also important to consider the software’s compatibility with other systems you use, such as accounting software or time-tracking tools.

Take advantage of free trials, product demos, and customer reviews to gather all the necessary information before making a well-informed decision. Moreover, test the software’s user interface, ease of use, and reporting capabilities. Also, look for features like automated tax calculations, direct deposit options, and customizable pay structures. Additionally, consider the level of customer support provided by the software vendor, as it can greatly impact your experience with the software.

Implementing Your Chosen Payroll Accounting Software

Once you have selected the best payroll software for your accounting firm, it’s time to implement it seamlessly. Implementation is a critical phase that requires careful planning and execution to ensure a smooth transition. To successfully implement your chosen payroll software, consider the following steps:

1. Develop an implementation plan: Create a detailed plan that outlines the tasks, timelines, and responsibilities for each step of the implementation process. This plan should include data migration, employee onboarding, and system integration.

2. Allocate sufficient time and resources: Implementing payroll software requires time and resources. Make sure you allocate enough time for training your staff, transferring data, and setting up the software according to your organization’s needs.

3. Provide comprehensive training: Proper training is essential to ensure that your staff understands how to use the new payroll software effectively. Provide training sessions, workshops, or online tutorials to familiarize your team with the software’s features and functionalities.

4. Test and troubleshoot: Before going live with the new payroll software, thoroughly test it to identify any issues or bugs. Conduct test runs, simulate different scenarios, and address any problems that arise during the testing phase.

A well-executed implementation will maximize the benefits of your chosen payroll software. It will help streamline your payroll processes, reduce errors, and improve overall efficiency.

Also read: How to Calculate HRA to save tax?

FAQs- Payroll Accounting

1. How do you prepare payroll accounting?

To prepare payroll accounting, you need to take into consideration employee compensation, deduct benefits and taxes, compute payroll liabilities, and finally, maintain payroll general journal entry. All these may turn out to be a complicated procedure with higher chances of making errors. Therefore, the best way to prepare payroll accounting is to use a payroll accounting software and track payroll expenses without facing any hassle.

2. Is payroll a journal entry?

A payroll journal entry is basically a record of the amount a company pays to its employees and track payroll expenses. Therefore, this would result in the opening up of chances of company growth.

3. What accounts are used for payroll?

To track payroll, an accountant needs to set up an expense account and a liability account.

4. What is payroll formula?

Usually, the formula for calculating payroll is:

Gross Salary= Basic Salary + HRA + DA + Allowances +Incentives

5. Is payroll a debit or credit?

At the time of payroll accounting, expenses on gross wage is debited and all the liability accounts are credited.

6. What is payroll process?

Payroll process is all about compensating employees for their work by means of salary.

7. What is the salary ledger account?

The salary ledger account is where employee salary expenditure carried out by a company is recorded.

8. What is record of payroll?

Payroll records refer to amalgamated documents concerning payroll that companies need to record and maintain for every employee.

Not to be considered as tax, legal, financial or HR advice. Regulations change over time so please consult a lawyer, accountant or Labour Law expert for specific guidance.