Personnel in an organization are paid a salary in return for the services they provide to the enterprise, it consists of different components such as CTC, Net Pay, Gross Salary, Allowances, Prerequisites, Deductions, and Payslip, all these are different parts of the salary structure in India.

While processing payroll, it is important to understand the salary breakup and the various elements associated with it. Salary structure is defined as the specified framework to work out the compensation of an employee.

Structuring salaries is one of the inescapable tasks for every HR and payroll professional, however most of the professionals do not know the technical processes and best practices for generating a perfect salary structure, which is why we are bringing you a detailed guide on pay structure in India.

Today we will cover:

- What is the Salary structure?

- Salary Breakup

- Salary Breakup Calculator

- What is CTC in salary with an example

- Common salary components

- What are the types of salary structures in India?

- Importance of salary structure

- How do you create a salary structure in India?

- Salary Structure format

- Salary Structure in India Excel

- New salary structure 2022

- Salary Structure calculator in India

- How do you structure your salary to save tax?

- Salary structure as per the Income Tax Act

- Frequently Asked Questions

Salary Structure in India

The salary structure is determined by the components, as decided by the companies or their management, that are paid out every month. Here are some factors that must be considered while deciding the salary structure of an employee.

What are the factors that determine the salary structure of an employee?

Deciding on the right pay can be a tedious task for HR professionals. There are so many factors that determine the right salary structure for an employee. Some of the most influential ones are:

-

Education and Years of Experience

The more experienced and educated the employee is, the higher will be his/her pay. Also, the employee’s expectation in terms of the earning components changes.

So when you plan to hire a post-graduate with 5 or more years of experience, or a seasoned industry veteran, you will need to compensate them accordingly.

-

Industry

Sometimes, two people with the same job title can also have different pay, depending upon the industry they are in.

There are certain reasons for this variance – sometimes one industry is considerably larger than another and in other cases, their job function may be far more critical to a particular industry.

-

Location

Cost of living (mainly housing expenses) is also a major determinant of the difference in salary, and this is based on the location where the employee works. Most of the time there is higher compensation for the same job in urban areas compared to rural areas.

But in recent times, when remote work has surged tremendously, employers have shifted from location-based compensation to role-based compensation.

-

In-demand skill sets

In deciding an employee’s compensation, his/her skill-set becomes another one of the key determinants.

Some skill sets can be applied to a much wider variety of roles within the organization, and hence command not just the higher value but also say higher variable components.

-

Demand and Supply

As per the laws of Economics, we know it is the demand and supply of an entity that determines the price for it.

In a geographical area where there is some gap between the supply of talent and the demand for those skill sets and experience, you may have to pay a higher price to recruit better talent.

Employers use a salary structure with pay grades to determine the expected salary for an employee so that employees can know about their expected salary. These grades are divided into three categories – high grade, mid-point, and low grade.

When an employee with lesser experience and seniority joins a company for the same job title, he may start at a low grade as compared to the more experienced one.

Simplify hiring with this highly efficient ATS! Click here to learn more about it.

Salary Structure Breakup

Now we will dissect each component of the salary and see how it is calculated. But before that, it is important to understand the meaning of the term CTC.

Salary Breakup Calculator

What is CTC in salary with an example?

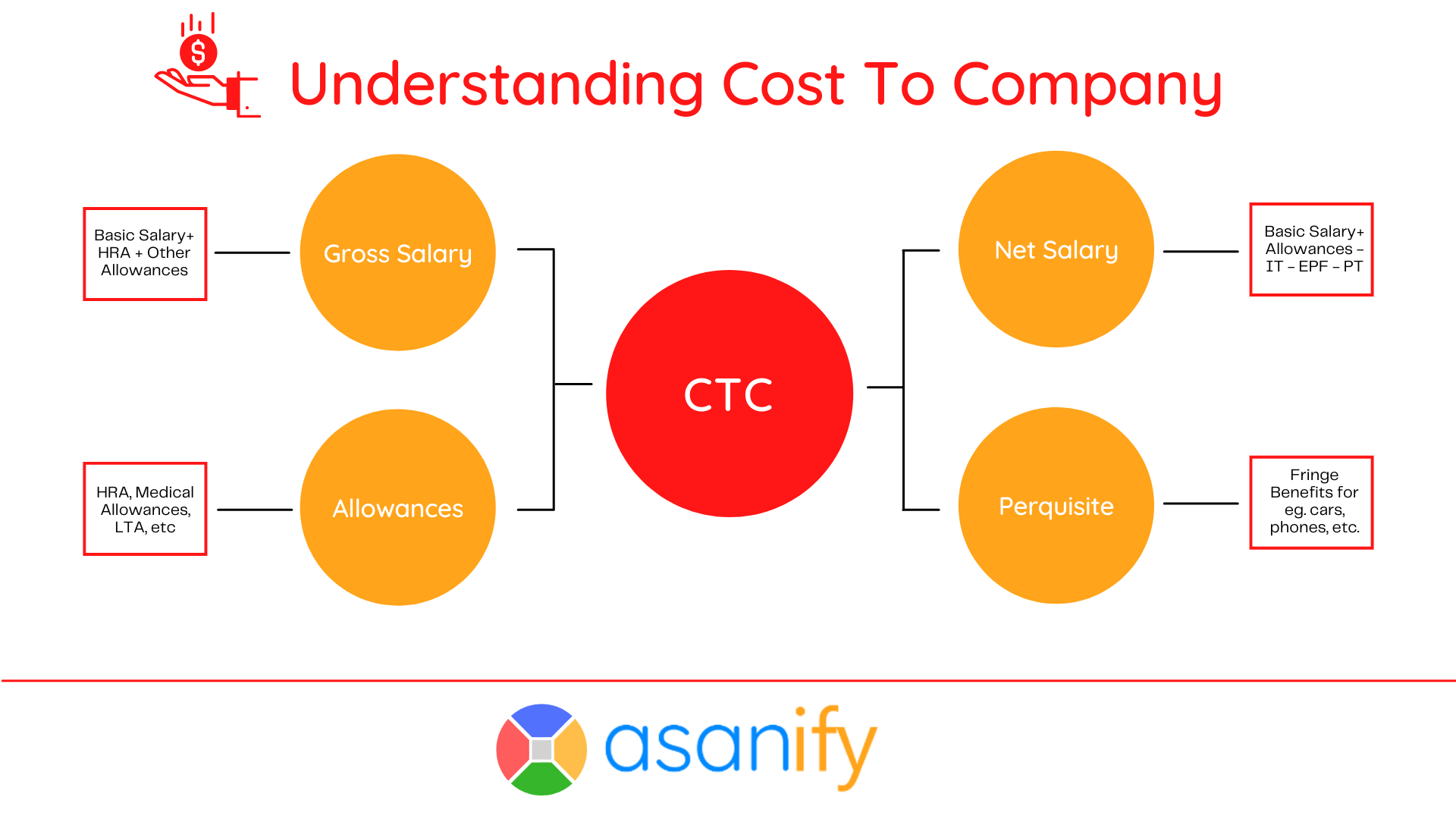

Cost to Company (CTC) or CTC in salary is the yearly expenditure that a company incurs on an employee. This depends on the salary and other variable components that we will discuss further.

CTC in salary is calculated by adding Basic Salary and other additional benefits that employees receive such as Gratuity, EPF, HRA, Travel Allowance, Food coupons, and so on.

As an informal definition, CTC is the cost of hiring and sustaining an employee in the organization. However, keep in mind that it is not the amount that an employee takes home each month.

CTC in salary is calculated as:

CTC = Gross Salary + Benefits

Common salary components in salary breakup

What is Basic in salary structure

It is the primary or the core element of a salary that makes about 40-45% of the total CTC.

It plays an important role in defining some of the other components, such as Provident Fund, Gratuity, and ESI.

Things to remember while setting up your employee’s basic salary

- Keeping it too high – As the basic component is fully taxable, keeping it too high will increase the tax liability of your employees. This will also increase the employee’s liability as he will need to contribute more towards PF and ESI.

- Keeping it too low – will increase the risk of salaries not falling under minimum wage norms set by the respective state government.

Gross salary

Gross salary is calculated by adding an employee’s basic salary and allowances before deductions of any taxes. This includes bonuses, overtime, holiday pay, and other components.

Gross salary is calculated as follows.

Gross salary = Basic salary + HRA + Other Allowances

Net salary or take-home salary

Take-home salary is calculated as the salary after tax deduction at source (TDS) and other tax deductions as per the company’s policy.

Calculation of Net salary:

Net salary = Gross Salary – Professional Tax – Employee Provident Fund – Income Tax

Now here are some of the most important components of a salary break-up:

Allowances

1. Dearness Allowance

Dearness Allowance was started as a part of salary to reduce the burden of inflation on salaried employees.

The government uses this component to compensate public sector employees and pensioners for the overall price rise. It is normally set at 5% of the CTC and it also affects components such as ESI and PF.

For salaried employees living in rented accommodation, HRA is one of the most effective tax saving tools.

The amount you can claim as a tax deduction for HRA cannot be over 50% of your basic salary in metro cities and 40% of your basic salary in non-metro cities. Hence it makes up 40-50% of the basic salary.

3. Leave Travel Allowance

LTA reimburses employees for travel within the country. This is another component widely used because of the tax benefits it provides. An employee can claim tax benefits on the Fare Expenses paid to his/her family during the holiday.

However, there are certain restrictions on what you can claim as a tax exemption under LTA:

- Only Fare Expenses are covered (i.e., stay and food expenses are not covered)

- Travel must be within India

- This is applicable only to immediate family members who depend on the employee

4. Conveyance Allowance

Introducing the standard deduction has removed the conveyance allowance as an exemption from tax starting April 2018. Employees now do not need to collect or submit any conveyance expense proof.

5. Medical Allowance

Similarly, the medical allowance is removed as an exemption from April 2018 onwards.

6. Child Education Allowance

This component is paid out towards the tuition fees of an employee’s children, which can be tax deductible up to Rs. 100 per month for a maximum of two children. So this amount is usually set at Rs 2400 per annum.

7. Special Allowance

It makes up for the rest of the salary. It is mostly smaller than the Basic salary and is fully taxable. Note that this was not taken into consideration while calculating the Provident Fund amount for the employee.

Gratuity

Lump-sum of the amount paid by employers to employees who leave the organization. This is only paid to employees who have completed 5 years of service with the company.

According to the Payment of Gratuity Act, 1972 gratuity is calculated as 4.81% of the basic pay. Organizations with over 10 employees come under this act.

Deductions

Employee Provident Fund

EPF is an employee welfare scheme in which both the employee and the employer make investments every month. It is a platform that provides an opportunity for employees to save a part of their salary as a long-term investment. Approximately 12% of the basic salary is automatically deducted from employees’ salaries each month.

This amount can be withdrawn following a month of cessation of service or upon retirement.

Professional Tax

Taxes levied by the state on income earned by salaried employees include doctors, lawyers, chartered accountants, etc. by the state government. Each state government has a unique method to calculate professional tax.

The maximum amount of tax payable is equal to Rs. 2,500. Employers calculate and deduct professional tax according to the prescribed rates from employees’ salaries and pay the collected amount on behalf of them to the government.

Perquisites

These are the non-cash benefits provided to employees, depending upon the position that they hold in the organization. This includes providing a company car, phone, internet services, etc.

Bonus

Bonuses are a taxable part of an employee’s salary, usually provided as a lump sum once a year based on the individual performance of an employee or the overall performance of the organization.

Reimbursements

Sometimes, employees are also provided reimbursements, such as phone bills, medical treatments, office stationery, and newspaper bills. This amount is compensated after the employee provides bills against these up to a specific acceptable limit.

ESIC

If an organization has 10 or more employees whose gross salary is less than Rs. 21,000, then for such employees the company should avail of the ESIC scheme. The employer’s contribution towards ESI should be 3.25% of the gross salary while the employee contribution must be 0.75%.

-

Employee stock options

ESOPs and employee stock options are free/discounted shares given to the employee primarily to increase employee retention.

As the name suggests, these are contributions made towards funds for the labour class. Just like professional taxes, this also varies from state to state. Both employers and employees make contributions towards these funds, and employers contribute twice as much as employees.

Contributions towards labour welfare funds are made semi-annually.

These are the most common components that make up a salary structure.

What are the Cost-to-Company (CTC) Benefits in India?

In the context of a Cost to Company (CTC) structure in India, there are two kinds of benefits- direct and indirect.

1. Direct Benefits

Direct benefits are those components directly received by an employee in monetary terms. These typically include the basic salary, house rent allowance (HRA), special allowances, and any other fixed monetary components. Direct benefits contribute to the taxable income of the employee.

2. Indirect Benefits

Indirect benefits are non-monetary components that add value to the overall compensation package. These may include contributions towards provident fund (PF), gratuity, medical insurance, life insurance, and other employee welfare benefits. Indirect benefits are not directly received as cash but enhance the overall well-being and financial security of the employee.

Both direct and indirect benefits are crucial in understanding the complete compensation offered by an employer. While direct benefits impact the take-home salary and are subject to taxation, indirect benefits contribute to long-term financial security and employee well-being. It’s essential for employees to consider both aspects when evaluating a job offer or understanding their overall compensation package.

Difference between Take-Home Salary and Cost to Company

Take-home salary, as the name suggests, is the final amount given to the employee by the employer every month after tax deductions and investments.

While CTC is a variable payment that includes direct benefits, indirect benefits, and savings contributions.

What are the types of salary structure in India?

There are 2 types of salary structures that decide how to break up the salary and also define CTC:

Two types of Salary Structure:

- Top-down

In this type, you define the amounts for different salary components and then add up their total as Gross Salary. For example, the, Basic of Rs. 5,000 and DA as Rs. 5,000 = Gross of Rs. 10,000.

- Bottom-up

In this type, you define total gross and then divide the amount between different components. For example, Gross = Rs. 10,000; Basic is 40% of gross and DA is 60% of the same.

Importance of salary structure

Human resources are the driving factor for an organization’s success. It is important for businesses to attract and keep the right talent to drive their performance. Right remuneration is one of the biggest factors in attracting top talent.

A well-designed pay structure is key to the growth and success of any company. It is not just an engagement factor but also an attracting factor for sure. If it is unfair/poor or not managed correctly, it can lead to disastrous results.

Structuring the salary is hence very important, as it determines the in-hand pay, gross salary, net salary, allowances, etc. If an employee does not have the details of the components of his salary, then he/she cannot calculate the final in-hand pay and also see investments made in EPF.

It helps employees better manage their salary and thus proves to be very critical.

Business benefits of salary structure

- Fairness

Creating a logical pay structure also ensures that you are treating all your employees fairly. Employees can then understand that a fair process exists to determine both the job level and pay.

- Transparency

Sharing your pay structure determining compensation with existing employees increases trust and confidence amongst current and also future employees

- Motivation

When employees know alleys are open to progress their career and salaries, there is a sense of motivation amongst the employees. This also ensures that productive discussions can be carried out with them.

- Engagement

Employees feel far more engaged within the organization when these key components are structured properly. They will feel fairly treated and will understand how progress in their career will lead to change in compensation. This is highly motivating for employees when they know what their role compensation is in their organization, and a good salary structure affected this.

- Support Management

While hiring a new employee, one of the most challenging parts for managers is to discuss the salary structure with the employee. A great salary framework builds confidence and supports management in making better decisions.

- Pay Budgets

Knowing how your employees fit into different pay structures also allows for a smooth distribution of your pay budget and getting the maximum out of it.

How do you create a Salary Structure in India?

Creating a pay structure involves three ingredients to be put in place.

Foremost is external benchmarking that allows you to build a structure that is highly competitive in the market.

Second, you need an internal job evaluation that allows fairness and transparency in leveling the different jobs, in different functions with different skill sets and responsibility.

And finally, your existing current pay data will tell you about the overall cost and affordability.

Studying and deeply evaluating each of these three ingredients will ensure that you have a strong, transparent, and competitive salary structure.

Salary structure format

Typical salary structure format is given below especially for India

|

Name |

|||

|

Designation |

|||

|

Location |

|||

|

Date of Joining |

|||

|

Salary breakup |

|||

|

Cost to Company: |

10,00,000.00 |

||

|

Components |

Per annum |

Per month |

Taxable / Non-taxable |

|

Basic |

4,50,000.00 |

37,500.00 |

Tax |

|

2,25,000.00 |

18,750.00 |

Tax |

|

|

Medical |

15,000.00 |

1,250.00 |

Non-Tax |

|

Special Allowance |

1,20,000.00 |

10,000.00 |

Tax |

|

Conveyance allowance |

36,000.00 |

3,000.00 |

|

|

Gratuity |

75,000.00 |

6,250.00 |

Non-Tax |

|

Reimbursements |

25,000.00 |

– |

Paid annually/Tax |

|

PF Employer |

54,000.00 |

– |

|

|

Total |

10,00,000.00 |

76,750.00 |

|

|

ESI Deduction |

– |

||

|

PF Employee |

54,000.00 |

4,500.00 |

|

|

Labor welfare fund |

60.0 |

5.0 |

|

|

Net In-hand Salary |

72.245.00 |

||

Ideal pay structure

We have drafted an ideal pay structure for you in the table below, which can build a salary structure format with all the basic components included in it.

| Components | Recommendation |

| Basic | 40-50% of CTC |

| DA | 5 % of CTC |

| HRA | 50% of Basic + DA if metro and 40% if non-metro |

| Conveyance | Rs. 1600 per month |

| Medical | Rs. 1250 per month |

| LTA | 10% of basic (no benchmark) |

| ESIC (Employer Contribution) | 4.75% of Gross salary |

| ESIC (Employee Contribution) | 1.75% of Gross salary |

| Special | Balancing component |

| PF (Employer contribution) | 12% of Basic + DA |

| PF (Employee Contribution) | 12% of Basic + DA |

| Professional Tax | State-wise |

| Labor welfare fund | State-wise |

Salary Structure in India Excel

We now know how important it is to have a robust and transparent salary structure as it helps employees in understanding their current position and benefits. It also gives them visibility on how their compensation will grow as they move ahead in their career graph.

You need a salary calculator for estimating additions and deductions comprising all the components that we have discussed above.

Employee salary sheet can help you calculate salary for all the employees in a few easy steps.

Before we create an employee salary structure in an Excel sheet, we need to remember some important formulas for salary calculation.

Formula

CTC = Gross Salary + PF + Health Insurance

Gross Salary = Basic + Dearness Allowance

Basic = 40% to 60% of CTC

Allowances = HRA + Medical + Conveyance + Travel + Special Allowance

HRA = 50% of Basic in metro cities

HRA = 40% of Basic in non-metro cities

Deductions = Professional Tax + TDS + EPF (employee contribution)

TDS = 10% of gross salary.

EPF = 12% of (Basic + DA)

Net salary or take home salary = Basic + Allowance – Deductions

Basic formulae for calculating salary are:

Salary = Basic + HRA + LTA + Medical allowance + Conveyance + Statutory Bonus + Provident Fund + Income Tax + Insurance

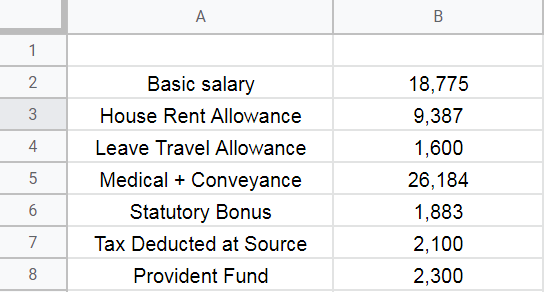

Rahul has the following salary components and we need to calculate Net salary and Gross salary:

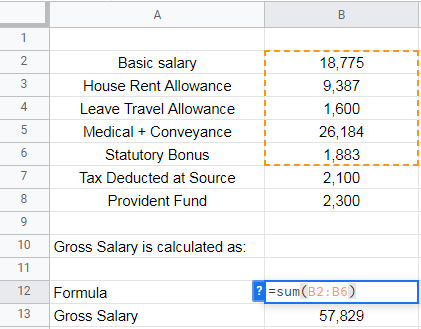

Calculation of Gross Salary:

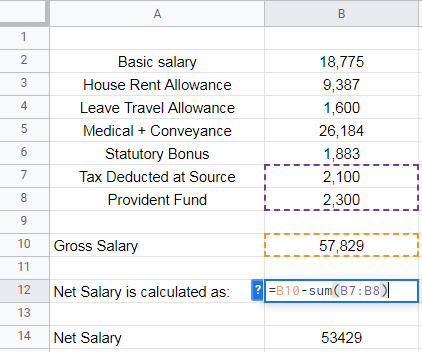

Calculation of Net Salary in Salary structure:

Also Read: How to Run your Payroll in Excel?

New salary structure 2022

Salary structure format as per the labour law

The take-home salary of an employee working in a private organization will be reduced with effect from April 2022, as companies have had to change their salary structure under the new wage rules.

According to the new wage rules, allowances must not exceed 50% of the total compensation. The basic pay of an employee will be 50% or more of the total salary from April 2022.

Most companies keep the non-allowance part of the salary less than 50% so that they have to contribute less to EPF and Gratuity. Also, there is a lesser burden on employees. But due to implementing the new wage code, they have had to now increase the basic pay to 50% or more. This will reduce the take-home salary of employees, but will increase the PF and Gratuity contributions.

Employees’ tax liability will decrease as the company will add PF contribution to the employees’ CTC

Salary Structure Calculator in India

Asanify offers HR and Payroll Accountants an online salary calculator to calculate the net salary of the employees based on their CTC.

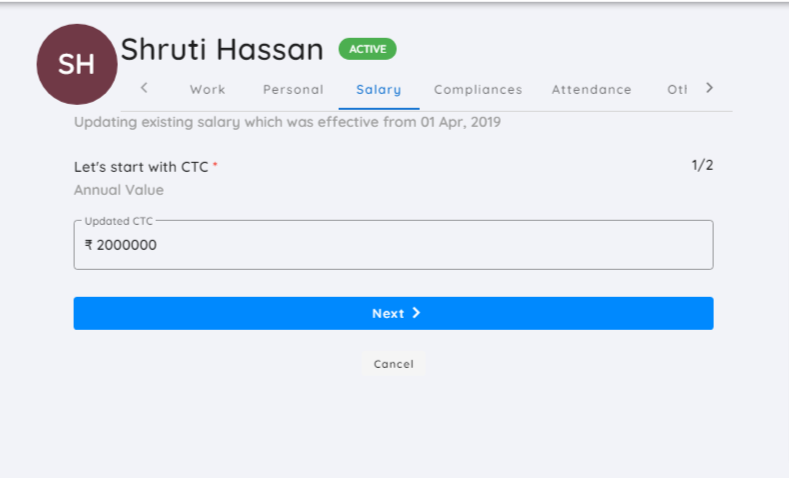

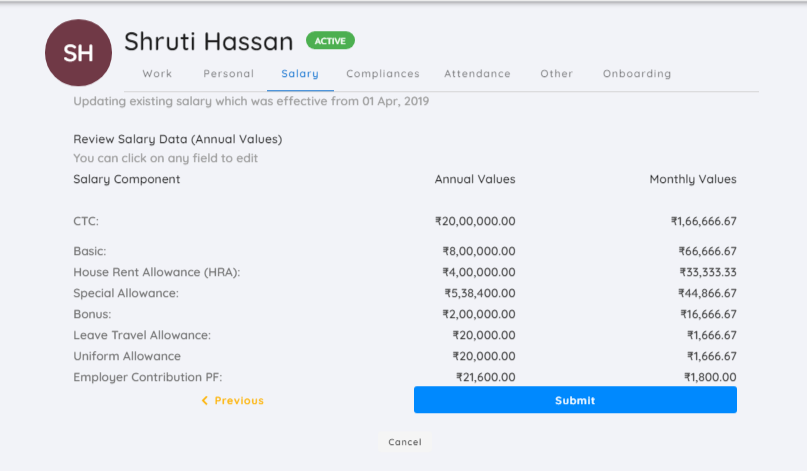

You can calculate an employee’s salary in three easy steps:

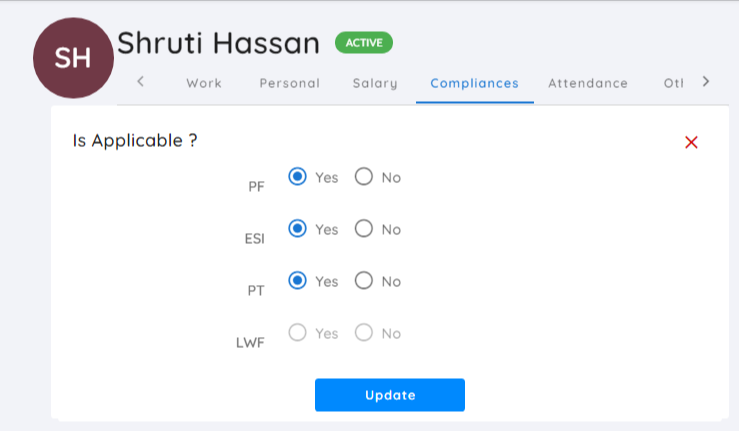

1) Enter the Annual CTC amount for a specific employee

2) Select Compliance Settings as per your organization’s applicability

3) While you are there, you can view the salary structure according to the details provided by you

Asanify® HR platform auto-calculates salary, manages end to end payroll, and generates Payslips for Employees

How do you structure your salary to save tax?

This section will help you in setting up a salary structure that can help you reduce your tax liability. Here we will cover the various allowances which will give you tax exemptions and deductions to reduce your taxable income.

Understanding your salary slip

| Sr. no. | Sub-head of income | Taxability |

| 1 | Basic Pay | It is always taxable |

| 2 | Dearness Allowance | It is always taxable |

| 3 | Bonus | It is always taxable |

| 4 | Child Education Allowance | Rs. 100 per month per child, maximum two children, I.e. Rs.2400 (2*12*100) |

| 5 | Hostel Allowance for children | Rs. 300 per month per child, maximum two children, i.e. Rs.7200 (2*12*300) |

| 6 | HRA Exemption | HRA exemption is the least of the following –

Proper planning can reduce this to zero |

| 7 | Leave Travel Allowance | Employees can claim LTA if they go on vacation and claim tax benefits on their travel expenses.

The exemption shall be available as per section 10 (5) of the Income Tax Act. |

| 8 | Uniform Allowance | This allowance is exempt from the spending made in a financial year by an employee.

For better tax planning and a better salary structure |

| 9 | Telephone Allowance | This allowance is exempt from the spending made in a financial year by an employee. For better tax planning and a better salary structure. |

| 10 | Book Allowance | This allowance is exempt from the spending made in a financial year by an employee.

For better tax planning and a better salary structure |

| 11 | Recognised Provident Fund | Employer’s contribution up to 12% is not taxable

Employees can claim their contributions as a deduction under section 80 C |

Now let’s compare two salaries, with a CTC of Rs. 10 lakhs, under two different salary structures.

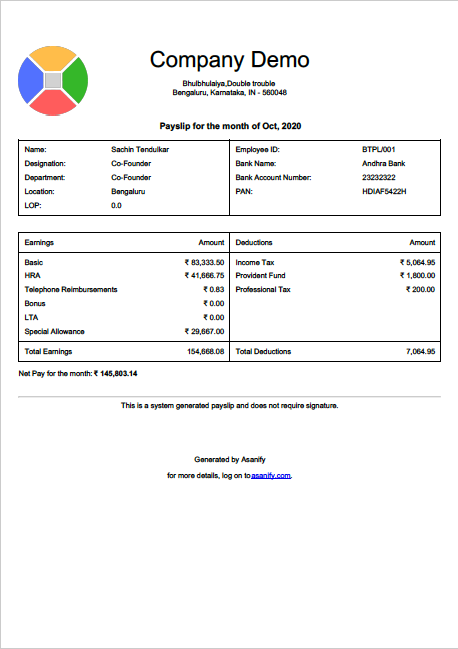

Check Out – Online Payslip Generator: How to Create Payslip Online?

How to structure your salary to save tax in 2022?

| Salary structure 1 | Salary structure 2 | |

| Basic Salary | 5,00,000 | 4,00,000 |

| HRA | 3,00,000 | 2,00,000 |

| Provident Fund @12% | 60,000 | 48,000 |

| Standard Deductions (conveyance allowance + medical allowance) | 40,000 | 40,000 |

| Leave Travel Allowance | 30,000 | 30,000 |

| Other Allowances | 70,000 | 2,82,000 |

| Total | 10,00,000 | 10,00,000 |

| Exempt HRA | 2,50,000 | 2,00,000 |

| Standard Allowance | 40,000 | 40,000 |

| Leave Travel Allowance | 30,000 | 30,000 |

| Other Allowances | ||

|

26,400 | |

|

10,000 | |

|

5,000 | |

|

2,400 | |

|

7,200 | |

|

16,000 | |

|

12,000 | |

| Total Taxable Salary | 6,80,000 | 6,51,000 |

| Less: Professional Tax | 2,500 | 2,500 |

| Net Salary | 6,77,500 | 6,48,500 |

| Deductions under section 80C | 1,50,000 | 1,50,000 |

| Total taxable income | 5,27,500 | 4,98,500 |

| Tax on income | 18,720 | 12,920 |

| Savings on tax | – | 5,800 |

You can save tax by restructuring your salary by reflecting exempt allowances. This is the best way to save your tax.

Salary structure as per the Income Tax Act

| Fixed Salary Component | CTC up to 5 lakhs | CTC from 5 lakhs to 10 lakhs | CTC above 10 lakhs | PF | PT | ESIC | LWF |

| Basic | 40-50% of CTC | 40% of CTC | 40% of CTC | Yes | Yes | Yes | Yes |

| HRA | 50% of basic | 50% of basic | 50% of basic | No | Yes | Yes | Yes |

| Education Allowance | 200 fixed | 200 fixed | 200 fixed | Yes | Yes | Yes | Yes |

| LTA | 15% taxable | 15% taxable | 15% taxable | Yes | Yes | Yes | Yes |

| Special Allowance | Balancing figure | Balancing figure | Balancing figure | Yes | Yes | Yes | Yes |

| Telephone and internet Reimbursements | 1000 fixed | 2000 fixed | 3000 fixed | No | No—but for unclaimed amount, PT applies. | No | No |

| Car and driver reimbursements | NA | NA | Fuel: 10000 fixed

Driver: 8000 fixed |

No | No—but for unclaimed amount, PT applies. | No | No |

| Meal coupons | NA | 2000 fixed | 2000 fixed | NA | NA | NA | NA |

| Books and periodicals | NA | 1000 fixed | 2000 fixed | No | No—but for unclaimed amount, PT applies. | No | No |

| PF employer | Rs 1800 per month | Rs 1800 per month | RS. 1800 per month | NA | NA | NA | NA |

| ESIC employer | 3.25% of gross salary. | NA | NA | NA | NA | NA | NA |

Frequently Asked Questions

Q1: What components make up a typical salary structure in India?

A standard salary structure in India includes basic salary, allowances, bonuses, provident fund, and gratuity.

Q2: How is Basic Salary different from Gross Salary?

A2: Basic Salary is a fixed amount, while Gross Salary includes Basic Salary plus allowances and bonuses, providing a comprehensive view of total earnings.

Q3: What are common allowances in Indian salary structures?

A3: Housing allowance, transport allowance, medical allowance, and special allowances for specific job-related needs are common in Indian salary structures.

Q4: How is Income Tax calculated on salary in India?

A4: Income Tax is computed based on income slabs, with exemptions for certain components like HRA (House Rent Allowance) and deductions under sections like 80C.

Q5: What is the significance of Provident Fund (PF) in the salary structure?

A5: Provident Fund is a mandatory savings scheme, where both employees and employers contribute, providing financial security post-employment.

Q6: Are there differences in salary structures across industries in India?

A6: Yes, salary structures vary across industries based on factors such as demand for skills, market trends, and company policies.

Q7: How does Variable Pay impact salary structures?

A7: Variable Pay, like performance bonuses, can fluctuate based on individual or company performance, offering a chance for higher earnings.

Q8: What is the role of ESOPs (Employee Stock Ownership Plans) in salary packages?

A8: ESOPs provide employees with ownership in the company, aligning their interests with the company’s success and fostering a sense of ownership.

Q9: Can salary structures be negotiated during job offers or appraisals?

A9: Yes, negotiation is common during job offers or appraisals, especially for components like CTC (Cost to Company) and specific allowances.

Q10: How can employees optimize their salary structures for better financial planning?

A10: Understanding the components, utilizing tax-saving options, and aligning financial goals can help employees optimize their salary structures for improved financial planning.

Not to be considered as tax, legal, financial or HR advice. Regulations change over time so please consult a lawyer, accountant or Labour Law expert for specific guidance.