TDS stands for Tax Deducted at Source. The government introduced it to collect income tax from the source of an individual’s income. TDS is a measure against tax evasion. Hence, the tax from individuals is collected right before they are handing their respective income, rather than a later date. As an HR or finance professional you need to know every nook and cranny in the world of TDS. In this post, you can get an elaborate summary on TDS, its slabs, how to calculate it, when and how to deduct and deposit it, and steps to generate forms related to TDS. Read on, in order to get a comprehensive, all-you-need-to-know guide on calculating TDS on salary.

In this blog:

- What is TDS?

- What is the new tax regime?

- How is TDS calculated?

- What is an investment declaration?

- When is TDS deducted and deposited?

- Which sections can be claimed under TDS deduction?

- What is Form 24Q?

- What is Form 16?

- How to generate Form 16?

- What is central surcharge and cess?

- How can you show income tax calculations to employees?

- Wrap-up

- Income tax calculation FAQs

What is TDS?

When employees earn a salary, they are liable to pay income tax. Income tax is the tax levied on salaried individuals or entities. Also, the income may come from employees’ salary, pension, or from their savings account. The amount varies according to the amount of income or profits. Generally, it is calculated as a percentage of the income at hand. In other words, it is the tax rate times taxable income.

Additionally, TDS is a part of the income tax that every salaried employee has to pay, TDS comes under section 192 of the Income Tax Act, 1961. Further, the employees’ salary is categorized as “income” under the head “salary”. Thereafter, the employer deducts tax from this tab before handing over the employees’ respective salaries.

TDS is one of the key payroll compliances along with ESI, Provident Fund (PF) and Professional Tax (PT)

The concept of income tax was first introduced in India after the Sepoy Mutiny of 1857

How is salary defined?

A salary refers to the payment which an employee receives from an employer. Likewise, the employment contract can disclose terms for the same. A salary is also the earnings of an individual in exchange for his services to the organization, as agreed in the contract. Hence, any individual sharing an employer-employee or payer-payee relationship falls under a salaried class of people. Although, fees for someone’s professional services (lawyer, doctor, etc.), are not salary.

Also Read: Understanding salary structure in India

What to calculate TDS on?

You can calculate TDS on an employee’s total income, minus his claimable exemptions. Salary is calculated as the Cost to Company (CTC). Further, salary has two categories into basic salary and prerequisites. CTC includes both. Prerequisites or perks refer to house rent, medical, travel, dearness, special and other allowances. Thereafter, an employee can claim exemptions only for the first three. Also, there are caps to the amount for exemptions.

What is the new tax regime?

Asanify’s explanation on FY21 New Tax Regime and selection:

For FY21, the budget has recommended a new regime for tax saving. Consequently, almost all of the tax deductions from the existing tax slab are not applicable under the new tax slabs. Read on to know how the income tax slab 2020 is different from existing tax slabs in India.

New Tax Regime Rate

| Slab (Rs. In Lacs) | Tax Rate |

| Up to 2.5 | Nil |

| 2.5 to 5 | 5% |

| 5 to 7.5 | 10% |

| 7.5 to 10 | 15% |

| 10 to 12.5 | 20% |

| 12.5 to 15 | 25% |

| Above 15 | 30% |

Under the New Regime following deductions are not available:

- Standard Deduction (Rs. 50,000)

- Profession tax

- LTA Exemptions

- HRA Relief

- Interest paid on Housing Loan – Self-Occupied House OR Vacated House.

- All Chapter VI-A deductions (like Section 80C, 80CCC, 80CCD, 80D, 80DDB, 80E, 80EEA, 80EEB, 80G, 80GG etc.)

In this case, the only exemption available under the New Regime is the Employer’s Contribution to NPS under Sub-Section (2) of Section 80CCD.

Further, there is no Proposed or Actual Investment Declaration under the New Regime.

Existing Regime

Under the Existing/ Old Regime, the income tax calculations and exemptions will remain the same as were for last Financial Year 19-20.

| Slab (Rs. In Lacs) | Tax Rate |

| Up to 2.5 | Nil |

| 2.5 to 5 | 5% |

| 5 to 10 | 20% |

| Above 10 | 30% |

Should you get the new tax regime?

An employee may opted for PF (PF employer contribution goes to 80C deductions) and claim rent deductions (and claim HRA component in CTC). As a general rule of thumb, in these cases the existing regime may save you more taxes.

Note: Kindly calculate the specific taxes applicable basis projected investments and then decide.

You have to decide one specific regime at the beginning of the year and you may not change the selection later during the year for income tax calculation purposes. Note, however, that while filing the returns, the employees may select a different regime.

Asanify helps client employees select the regime basis projected income tax calculations on actual salaries and current investment declarations so that the choice is clear. Get started for FREE now.

How is TDS calculated?

The basic salary is completely taxable in line with the above-mentioned tax slabs. The steps for TDS calculation are as follows:

Step 1: Calculate gross monthly income

Firstly, calculate gross monthly income by adding basic salary, allowances, and prerequisites.

Step 2: Calculate exemptions

In the same way, calculate total exemptions by adding employee’s allowances.

Step 3: Deduct exemption from income

Thirdly, deduct total exemptions from gross monthly income.

Step 4: Calculate yearly income

Furthermore, find out the yearly income on which you have to deduct tax, multiply the above-deducted amount by 12.

Step 5: Include other incomes

Add or subtract other incomes (for instance, house rent) or losses (from house loan interest or others) from the yearly taxable income.

Step 6: Deduct investments

Deduct total annual investments from the gross yearly taxable income so far.

Step 7: Apply tax regime rules

Lastly, find the tax bracket in which this gross yearly taxable income lies. Calculate as per the rates given in the slab. For example, if the gross yearly taxable income is coming to INR 6,00,000, then INR 10,000 is a fixed amount in this income bracket. Similarly, you have to add 20% of the amount by which the income exceeds the lower limit of the bracket. Hence, it comes down to INR 30,000 {10,600 + 20% of 6,00,000-5,00,000)} annually, or INR 2,500 per month.

Instead of taking the load on your own, it is now possible to digitally calculate the amount of TDS on salary.

What is an investment declaration?

The investment declaration procedure takes place at the beginning of a fiscal year. As a result, employees have to declare all legal investments for the year. If such investments fall under government schemes, they can be exempted from TDS on salary. Investment declaration is necessary not only to ensure rightful taxations but also to give employees an opportunity for higher at-hand salary.

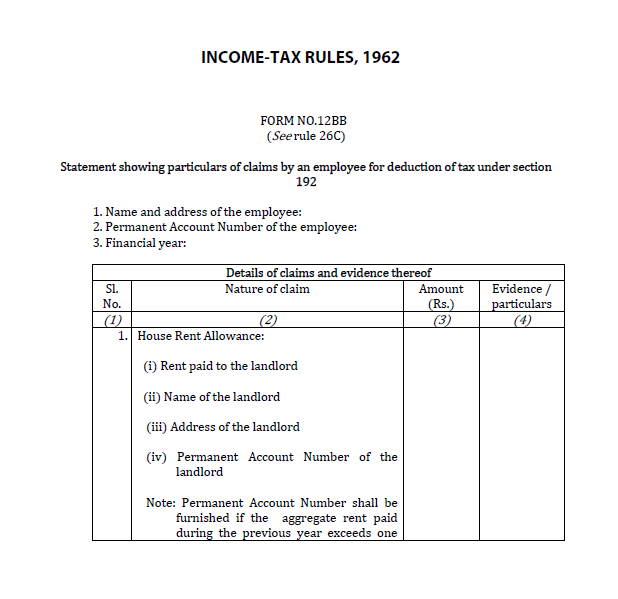

How do I fill out an investment declaration form?

The form needed for the investment declaration is Form 12BB. An employee can state his claims for tax exemptions concerning a rebate on investments or expenses, in the statement of the form. Moreover, form 12BB is to be submitted at the end of the fiscal year. Further, all investments declared under this form should be backed with documentary evidence by the salaried employee.

The details required to fill form 12BB are as follows:

Personal details– name, address, account number, and financial year.

- House rent allowance (HRA) details- Employees get HRA as a part of their salaries. It helps employees get tax exemptions in regard to annual, rental accommodation. For HRA details in Form 12BB, you need the amount of rent paid, name, address, and PAN number of landlord.

- Leave travel allowance (LTA) details- LTA is the allowance an employee gets for travel charges while on leave. But such allowance is only available on domestic travel. Furthermore, expenses incurred by shopping, dining, etc., are not covered here. For form 12BB, you need details of travel bills like boarding passes, tickets, hotel expenditure, and so forth.

- Details of deduction of interest on borrowings– interest payable/paid during the fiscal year, and name, address, and PAN of the lender.

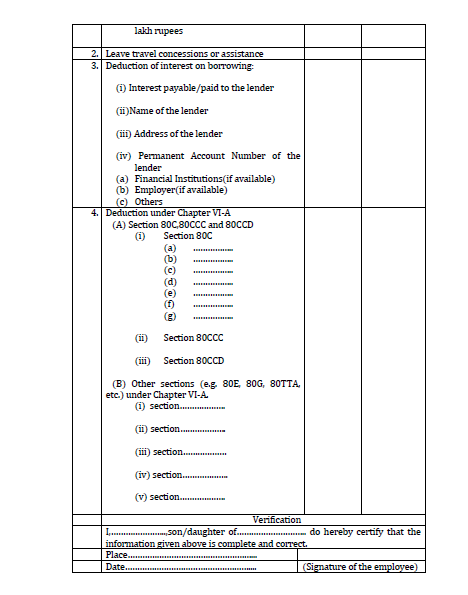

- Details of deduction under chapter VI-A – medical insurance, donation, and more.

- Verification details- employee’s name, location, date of filing form, and parents’ names.

Sample form

The following is how an investment declaration under form 12BB looks like:

Generating form

In essence, to generate form 12BB, you can simply download or print the filled out form. On the other hand, if you have a payroll software which manages your company’s compliances, follow these simple steps:

- Go to the income tax compliance head

- Click on ‘Generate form 12BB’

- You can either generate the form for an individual or all employees in the organization

- Additionally, you can also export and save the data on the forms for a reference in the form of soft copy

When is TDS on salary deducted and deposited?

You have to deduct TDS every month from an employee’s salary. Make this deduction before handing over the tax deducted salary to the payee. You can deduct TDS on the date of the bill received or the date of payment (whichever is earlier). TDS on salary is deposited on or before the 7th of each month. For quarterly deposits, the deadline is the last date of each quarter.

Which sections can be claimed under TDS deduction?

As mentioned above, these deductions are only applicable under the old regime. The following 14 sections are claimable for deductions in the amount of TDS:-

| Section | Deduction | Maximum deduction allowed (annually) |

| 80C of the Income Tax Act | Deduction from total taxable income is claimable | INR 1,50,000 |

| 80CCC of the Income Tax Act | Deduction of premium paid for annuity plan of any | INR 1,00,000 |

| 80CCD of the Income Tax Act | Deduction of employees’ contribution to pension account and employer’s contribution to NPS account | INR 2,00,000 |

| 80D of the Income Tax Act | Deduction of premium paid for medical insurance | INR 25,000 for self and immediate family and INR 50,000 if parents are above 60 years old |

| 80DD of the Income Tax Act | Deduction of rehabilitation fees for dependent handicapped relative | INR 75,000 for disability ranging from 40% to 80%1, and INR 25,000 for more than 80% disability |

| 80DDB of the Income Tax Act | Deduction of medical expenditure on self or dependent relative | INR 40,000 and INR 1,00,00 for senior citizens |

| 80E of the Income Tax Act | Deduction of interest on education loan aimed at higher studies | No maximum limit, but deduction is allowed up to 8 years since the first payment of interest |

| 80EE of the Income Tax Act | Deduction of interest on home loan for first-time homeowners | INR 50,000 |

| 80G of the Income Tax Act | Deduction of donation for social causes or charity | 10% of the donation made |

| 80GG of the Income Tax Act | Deduction of paid house rent, when HRA is not received | INR 60,000 |

| 80GGB of the Income Tax Act | Deduction of contribution to political parties | Nil |

| 80RRB of the Income Tax Act | Deduction of income from the royalty of patent | INR 3,00,000 |

| 80TTA of the Income Tax Act | Deduction of interest income from a savings bank account | INR 10,000 |

| 80U of the Income Tax Act | Deduction of tax for physically challenged individual | INR 1,00,000 INR 1,25,000 for severe disability |

What is section 87A?

Apart from the above mentioned tax deductions, an employee can also claim certain rebates. One such is the rebate under Section 87A of the Income Tax Act, 1961. Section 87A provides for a relief under income tax provisions. In other words, it reduces tax liability for taxpayers. As per section 87A, an employee earning below a certain amount per annum, has the benefit of paying lower taxes. Hence, said employee’s taxable income should be within INR 5,00,000 per annum. The rebate is limited to INR 12,500. That is to say, if an employee’s due tax is less than INR 12,500, he will not have to pay any tax at all.

What is Form 24Q?

Since you have to submit quarterly statements termed as TDS returns (which are part of income tax returns), to the Income Tax department, there is a form to file income tax returns. This is Form 24Q. The PDF for the form can also be accessed online on the Income Tax website, for income tax e-filing. Overall, you have to enclose all details about employees’ salaries and TDS on those salaries.

Classification of Form 24Q

Form 24Q is further classified into two annexures-

- Annexure-I: You have to file this at the end of every quarter. Annexure I shows the TDS break-up against each particular challan. Such challan has to include details like the BSR code of branch and, challan’s serial number and date of deposition. Side by side, you also need to provide details of the employee.

- Annexure-II: You need to file Annexure-II only at the end of the last quarter of the financial year. That is the end of March (31st). Here, you have to show the total salary break-up of an employee. As a result, these have to consist of his income from other sources, deduction claims, tax liabilities, and more.

When is TDS return due date for FY 20-21?

TDS return under Form 24Q should be filed at the end of every quarter. The deadlines for the same for financial year 20-21 are as follows:-

| Quarter | Due Date |

| April-June | 31st July |

| July-September | 31st October |

| October-December | 31st January |

| January-March | 31st May |

Interest on Form 24Q

Interest can be calculated in the following ways-

- If TDS is deducted- 1% monthly, starting from the due date till the actual date of deduction

- If TDS is not deducted- 1.5% per month, starting from the actual date of deduction till the actual date of payment

Penalty for late submission

You must file the return on time. Otherwise, you shall be charged with a late fee on failure to file form 24Q on time. As per section 234E, you are liable to pay a penalty of INR 200 per day for as long as the failure continues.

What is Form 16?

The certificate which is issued by the government under Section 203 of the Income Tax Act, is named Form 16. Equally, the certificate shows TDS from income under the head ‘salary’. You are required to fill and generate this form after deducting TDS on the salary of employees. By the same token, it is a detailed account of the amount paid to the employees and details on the same.

What are the parts under Form 16?

Form 16 is categorized into two parts-

- Part A- It contains details of TDS on salary. Information such as the employee’s name, address, TDS, PAN, and TAN (Tax Deduction Account Number) number is provided here.

- Part B- This is issued by the employer as an adjunction to part A. Details such as employees’ salary break-up, allowances, deductions, reliefs, and more are included here.

How to generate Form 16?

In order to generate Form 16, you have to follow certain procedures. It follows generating Form 16-A, followed by 16-B, merging the two forms and digitally signing them. Hence, follow the step-by-step instructions given below for the easy generation of Form 16.

Generate Form 16-A

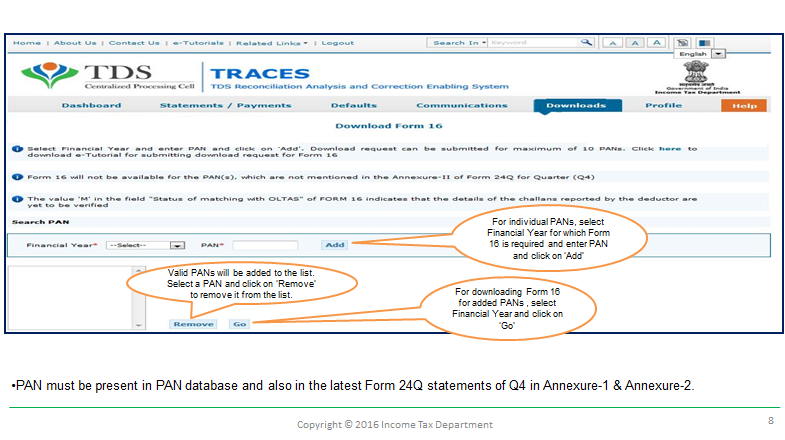

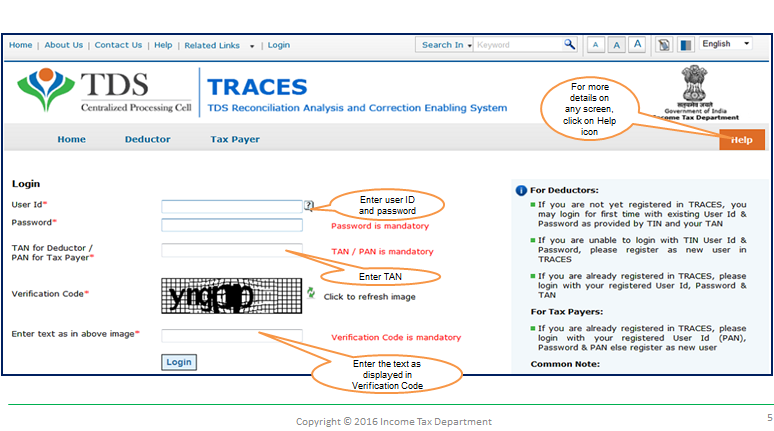

Step 1: Log in

Firstly, log in to TRACES. This is the official government website for generating Form 16. You can log in with your user ID, password, and TAN number.

Step 2: Check status

Now check the status of your Form 24Q for TDS return. You need to do this because you want to generate your Form 16 for this. For this click on ‘Statement Status’ under the Statement/Payment tab. In addition to that, select the form type and financial year. You will only be able to generate Form 16 when the status of Form 24Q shows processed (with or without default).

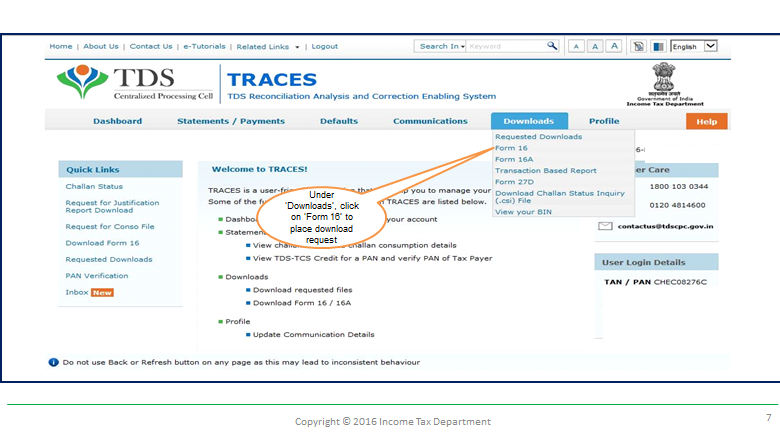

Step 3: Click on Form 16

After that, under the Download tab, click on ‘Form 16’.

Step 4: Select details for download

Together with the previous step, select the financial year for which you want to download Form 16-A.

Step 5: Choose download options

Choose either one of the following download options:

- Search Pan Download- if you want to download Form 16-A for selected employees

- Bulk Pan Download- if you want to download Form 16-A for all employees

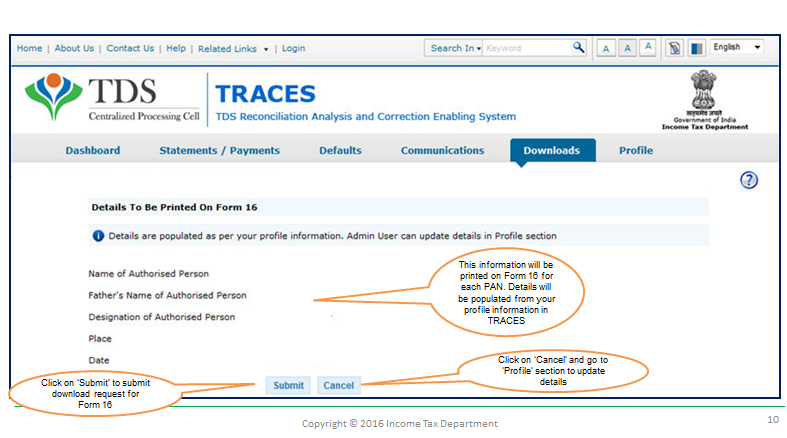

Step 6: Submit and proceed

Now, the details of employees will appear on the screen. Click on ‘Submit’ to continue with the process. In case any of the details are wrong, click on ‘Cancel’. After that, you can update the details in the Profile section.

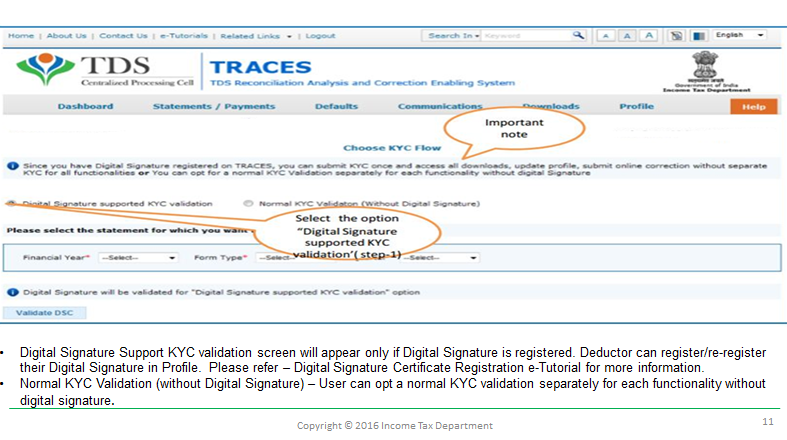

Step 7: Fill KYC details

Next, to fill the KYC details choose any of the following options:

- Digital supported KYC- if you have a digital signature registered with TRACES.

- Normal KYC validation- if you don’t have any registered signature on TRACES.

Consequently, an authentication code will generate. It will be valid for the same calendar day for the same financial year and quarter.

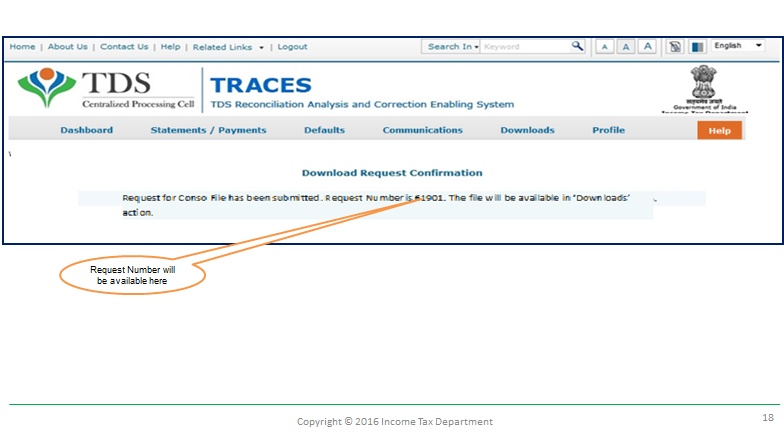

Step 8: Note the unique number

Consequently. a unique request number will generate. You can use this to track the status of the request later.

Note- You can only download the form when said status says ‘Available’.

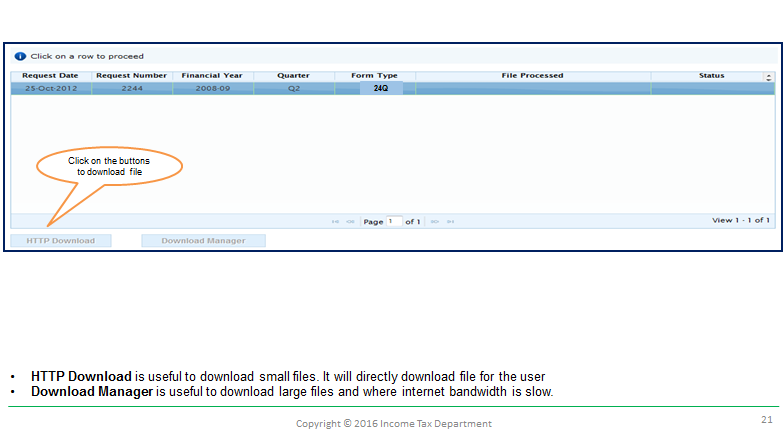

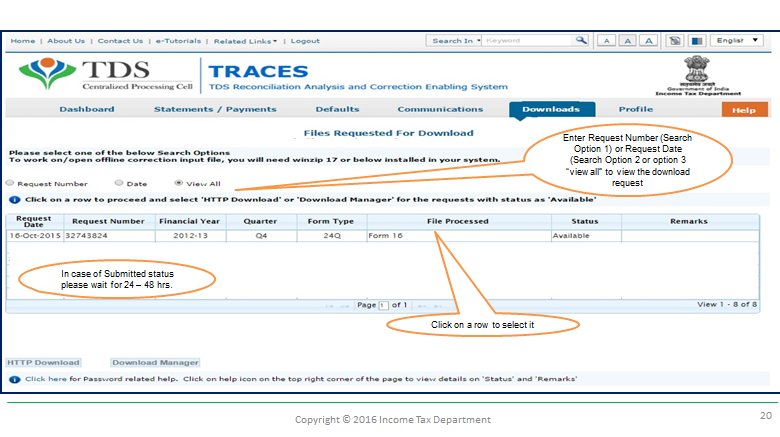

Step 9: Request download

Then click on the ‘Request Download’ option under ‘Download’.

Step 10: Choose the download option

Select any of the following download options:

- HTTP- for a small number of files

- Download Manager- for a large number of files

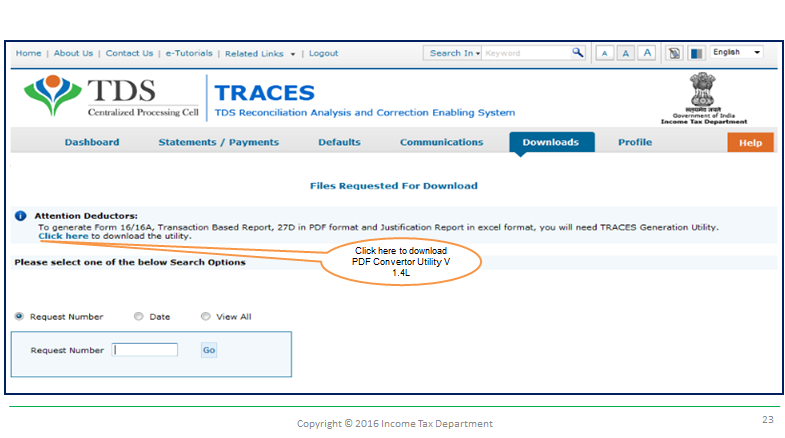

Step 11: Install PDF converter

Coupled with this, you can now convert the downloaded form to PDF format with the help of Form 16 PDF converter utility 1.4L.

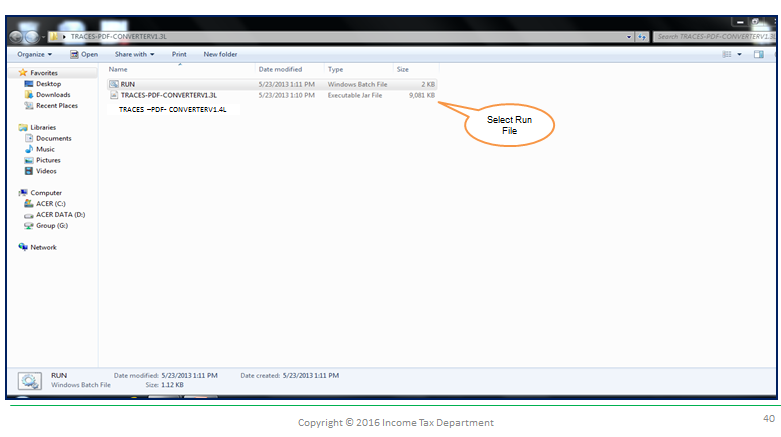

Step 12: Run converter

In order to generate Form 16-A in PDF format, run the setup of the PDF converter.

Generate Form 16-B

Step 1: Download signed form

To begin with, download a digitally signed Form 16 application. This is available in the income tax site.

Step 2: Download Smart Excel

Likewise, you have to download a Smart Excel software and a Merger Utility software for Form 16.

Step 3: Fill details

Thirdly, in Smart Excel, fill out details such as deductor details, form 16 details, tax deductions, TDS details, prerequisites, and salary annexure.

Step 4: Generate PDF

Fourthly, generate a PDF for Form 16.

Merge forms

Thereafter, merge the two forms- 16-A and 16-B using the merging software.

Digitally sign the form

Lastly, you have to digitally sign Form 16 to complete the generation procedure.

After that you can send the respective forms to the recipients over email. You can also download or print the forms.

What is central surcharge and cess?

Both income tax surcharge and cess are taxes levied by the central government. Likewise, they are both a form of tax on tax. Read on, to get a detailed idea about these, and what tax on tax refers to.

Income tax surcharge

Income tax surcharge is a tax levied on tax. That is, it is the tax levied on an employee’s tax which already deducted from his basic salary. However, surcharge is only applicable to individuals earning more than INR 50 Lacs. Hence, individuals earning above INR 50 Lacs per annum, but less than INR 1 crore per annum, are liable to a surcharge of 10% on their payable tax. Similarly, the rate is 15% for individuals earning over INR 1 crore per annum.

Health and Education Cess

A cess is a form of tax which is levied by the government. The central government generally charges it to develop certain departments of national concern like education, health, or other services. Thus, as the name suggests, the health and education cess aims at the welfare of health and education departments of the country. Among the varied cess taxes, this one is mandatory for all salaried individuals. Moreover, it is applicable on the tax payable, and not the taxable income. Hence, at present, the government levies a 4% tax on an individual’s tax as health and education cess.

How to show income tax calculations to employees?

As an admin, you may have to face queries on tax calculations. At times, employees can have a hard time understanding the TDS deducted from their salary. As a result, it is upto you to answer their queries and show them the break-up and components under tax calculation. For this purpose, installing a cloud HR software can do the needy. A good cloud HR helps employees with curated self-service options. Likewise, Asanify assists its employees at tax calculations and payroll related queries. Get started for free!

Wrap-up

If you are looking for a complete guide to go about TDS on salary, you have come to the right place. In this blog, you will get an insight on what TDS on salary is. Secondly, there are 7 easy steps to show how you can calculate TDS on salary for the employees of your organization, as well. Also, we discuss what an investment declaration is. Besides that, the blog speaks about the process to follow for deduction and deposition of TDS on salary. Again, you will get an insight on the forms related to filing TDS returns and certificates. Finally, head over to FAQs in order to find answers to some common queries.

Income tax calculation FAQs

As shown above, under Section 192 of the Income Tax Act, 1961, every employer paying a salaried income to an employee is responsible for deducting tax on salary. The said salary should be more than the basic exemption limit as per the Income Tax slabs.

Yes, TDS on salary is refundable in case the employer has taxed more than actual liability. Also, it can be claimed when investments projected at the beginning of the year are less than actual investments at the end of the year. In order to claim the difference amount, you have to file an income tax return. Therefore, details such as bank name, account number, IFS code, etc., are required for the refund.

Firstly, Form 16-A is one of the two parts of Form 16. But in contrast to Form 16 which only entails salary income, Form 16-A includes TDS on salary as well. Moreover, all details from Form 16-A can be seen in Form 26AS. On the other hand, only details of TDS deducted by employer, from Form 16 can be viewed in Form 26 AS. Form 26AS is a form to file returns. However, you need both Form 16 and Form 16-A. It is so because, these certify TDS on salary.

TDS return is filed in order to provide a quarterly statement to the Income Tax department. This is by and large to do away with tax evasion and keep a check on system TDS on salary by companies.

This situation may arise if an individual changes his job in the middle of a financial year, if he works other part-time jobs, or if he is simultaneously employed under multiple employers. Hence, if an individual is employed with multiple employers simultaneously, his tax will be calculated on the total income from all the employers. In such a scenario, the individual has to furnish Form No. 12B to any one of the employers. Besides, he has to provide details in the form like salary due or receiving from other employers. Henceforth, the employer in possession of Form No. 12B is responsible for deducting tax.

Simply put, TDS (Tax Deducted at Source) is the amount deducted by an employer from an employee’s salary, before handing him the paycheque. TDS is a part of income tax. It is levied by the Central government. Jemce, the same tax slabs are applicable on all states of India. It is calculated on the gross salary of an employee, after deducting allowances. Since it is collected before handing over the salary to an employee, it is called tax deducted at “source”.

Since, you pay salary to your employees every month, you have to deduct TDS (Tax Deducted at Source) on a monthly basis as well. You have to deduct TDS each time/month you hand your employees their salary. As a result, it is not possible to deduct your employee’s total annual TDS at the end of the year.

Not to be considered as tax, legal, financial or HR advice. Regulations change over time so please consult a lawyer, accountant or Labour Law expert for specific guidance.