Technology has infiltrated every profession, and accounting is no exception. Using technology at your accounting firm will give you an upper hand over the competition. The way we do business has with changing technological trends.

In this blog, I have covered some information on accounting technology, its uses, evolution, impact and how it can help you improve your accounting firm.

- What technology is needed in accounting firms?

- The evolution of technology and emerging technology in the accounting profession

- Modern technologies in accounting

- What is the Role and Impact of Technology in Accounting?

- Accounting firms can increase productivity through technology

- Advantages of technology in accounting

- What tech skills should accountants learn?

- Technology and the future of accounting?

- How to improve technology in accounting firms?

- Overview – Accounting Technology Statistics

What technology is needed in accounting firms?

Faster computer systems, more advanced software and powerful internet connections have resulted in smarter, faster and cheaper solutions for our clients. Work productivity and efficiency have increased tenfold in recent years.

Workflow Management Software

Also known as project management software, it is a platform used to create, organize and manage business projects within an accounting firm.

You can stay updated on your firm’s workflow by viewing the central dashboard. It contains details of the project’s requirements, status, ownership and other things.

Do you spend a lot of time managing projects? This also applies to time spent managing your employees as you want to expand your resources to grow your business but do not have the capacity for it. This is where workflow management helps.

Benefits of workflow management software:

- Easy project creation and management

- Project transparency

- Improve team accountability

- Time tracking

- Keep a record of all tasks

Expense Management Software

Expense Management software is a software that simplifies the receipt-to-reimbursement process by automating it. With this software, firms can manage travel bookings, automate expense report submissions, streamline approvals, accelerate reimbursements, and track expense claims in real-time.

Benefits of expense management software:

- Expense policy enforcements

- Faster reimbursements to the employees

- Fewer errors and delays.

- Improved efficiency in operations

- Simplified reporting

- Better compliance

Also Read: What is payroll software? Everything you need to know

Budgeting a.k.a cash flow software

This software helps in managing incoming and outgoing funds within a business. Businesses use cash flow management software to maintain positive cash flow. It also helps forecast future cash flow through analyzing past transactions or historical financial or operational data within the software.

Benefits of cash flow software:

- One dashboard for all your finances

- Categories expenses

- Forecast expenses and bills

- Track your budget

- Saves time

Tax preparation software

Designed to help in preparing and filing income tax returns. It serves as a step-by-step guide, calculator, and organizer. The main purpose of tax preparation software is to automate the entire process. Once you enter your information and other relevant details, it automatically processes your tax liability.

Benefits of tax preparation software:

- Increased time savings

- Cost-effective

- High accuracy with minimal errors

- E-filing facility

- Easy record-keeping

The evolution of technology in the accounting profession

We know that accounting technology is the language of business. Because the language of business has gone through many technological changes through the ages. But these changes have eased the jobs of accountants. Technological advancements have increased the ability of accountants to interpret data efficiently and effectively.

Now accountants have become the most important business advisor for a corporation.

Emerging Accounting Technology

The accounting industry has been booming since the introduction of modern technologies such as automation, machine learning and adaptive intelligence. They are becoming a part of the financial team at a fast pace.

Many companies are already using the so-called new technologies. So-called because they’ve been around for a while. It’s only now that people are truly appreciating their existence.

Accounting tasks and processes that AI can do or streamline, include supplier onboarding, accounts payable, audits, procurement, purchasing, expense management, and customer queries.

Modern technology in accounting – Accounting Technology Examples

Cloud computing

One of the most significant technologies is cloud computing. It has become one of the major working trends. Cloud allows instant access to resources such as data and computing capabilities.

An important advantage of the cloud is the constant updating of information, which allows clients and accountants to analyze data and decide based on up-to-date information.

This also allows constant monitoring of data, rather than irregular analysis.

Also Read: How cloud HR software can save your time and money

Automated accounting tasks

Accounting work such as audits, tax preparation, payroll and banking, which are laborious and time-intensive, are becoming fully automatic. Applications of AI used in self-learning systems will continue to be integrated into accounting systems. Technological systems will handle repetitive and time-consuming tasks, enabling humans to work on analytical and managerial tasks.

Another example may be the use of robotic process automation (RPA) to reduce processing time for audits and contracts from months to weeks.

Block-chain technology

It can change the game of accounting and will help you stand out if you know how to use it. Block-chain technology is a computer-based recording system that uses cryptocurrencies within a user-to-user network.

Accounting is currently based on double-entry bookkeeping in which accountants and independent auditors input and verify the company’s financial information with no third party involvement.

The attractiveness of blockchain technology is in the possibility of a new type of accounting ledger. This can be continuously updated and verified without being corrupted or altered.

Automated Accounting Technology

Non-coding has advanced in accounting in recent times, which will act as a double-edged sword for convenience against the replacement of humans. There is literally no requirement for manual data entry.

Virtual controllers for automated accounting will be in high demand in the future. Time-based billing will be replaced, but knowledge and skills will remain a vital part of accounting.

Through automated accounting accountants can save more time by reducing manual data entry. This will provide them enough time to get involved in the economic decisions of the company, which will cause more profitability.

Cloud-based automated accounting will be the future that will highlight anomalies and patterns without manual work.

Optical character recognition

The introduction of OCR to tax software in 2016, has made accountants’ lives easier.

OCR applications can scan printed and handwritten documents and convert them into machine-readable electronic text. Now professionals can easily scan and convert handwritten notes or photographs into electronic documents which can be easily shared with colleagues and clients.

Integrating OCR with accounting software will allow accountants to search digitally for information they need. They can read or edit this information as required. The best part of OCR technology is that it can cut hours of doing tasks, such as enumerating receipts, tracking expenses, and eliminating paper clutter.

AI and Machine learning

A minor error can lead to a colossal blunder in accounting. Every accountant will agree to that. Introducing machine learning in accounting can substantially reduce these annoying and time-consuming errors.

Machine learning tools can develop algorithms that recognize patterns in various math-based accounting tasks, such as invoices and transactions. Once these algorithms are formed and tested, they can recognize any errors that deviate from the set pattern before accountants do any further calculations.

The ability to identify errors in calculations not only leads to accurate reporting but also saves a lot of time and energy for accountants to focus more on strategic tasks rather than on mundane tasks.

What is the Role and Impact of Accounting Technology?

Over the last few years, technology has developed at an exponential rate. It has changed our personal and professional lives.

Accounting technology is no exception to that change, as we have talked about how technology has made life simpler for accountants, saving hours of work through automation, ease of access through the cloud, and fewer errors and faults through AI and machine learning.

-

Specialized accounting software

The accounting calculation started with introducing the abacus used for basic calculations. Traditionally, for identifying, measuring and communicating financial information, a ledger, adding machine, pen and paper were used for accounting. With the advancement of technology during the end of the 20th century, the introduction of software like Microsoft Excel has eliminated the need for a desk calculator, ledger and paper.

In recent years, more and more advanced software has been built to eliminate the need for manual work and reduce headaches for accountants. Now calculations can be performed with a single click with the help of quicker input and computation of data.

Specialized accounting software has helped accountants in the following ways:

- Less manual work

- Precise calculation

- Reduced paper clutter

-

E-business

The Internet has changed the business landscape, and every business should learn to use the internet effectively. More and more professionals who understand the internet are using the internet for E-business. They use the internet for executing business processes in the organization. Electronic management helps businesses to execute internal and external communications with clients.

An organization’s application is a single point of access that can set up an internal connection through which they can distribute information to employees such as policies and programs. Professionals can also use platforms for external communications with clients, which allows only a specific part of the web application for clients to access through which they can exchange information.

Advantages of E-business

- Analyze data in real-time

- E-format data is easy to collect and use

- Unlimited storage for storing your data regardless of your accounting files

- Synchronization of files on various platforms

- It secures files from third parties.

-

Mobile accounting technology

Despite their universal presence, mobile devices are not fully used to their potential. There are certain accounting software developed for mobile devices that can be used to:

- Create and send invoices

- Download receipts

- Ability to create expense claims

- Gather signatures

All these functions and much more can be done with a couple of clicks on your mobile device. It reduces the time gap for employees by providing necessary data and files in their pockets.

Through customer management software you can improve customer support and satisfaction. Building better relationships with customers through CRM software.

With smartphone and mobile device management software you can take office anywhere.

-

More efficient client transactions

Traditionally, accountants and clients have to make time to meet and discuss documents and the client’s financial situation. If one of them gets stuck in traffic or because for some reason, the meeting gets pushed, then it can create resistance for a party and one can decide to leave the organization to another.

With the advancement in accounting technology, there is no need for clients and accountants to meet up. Clients can access most of the information through organizations’ service portals anywhere, anytime. They can also meet accountants virtually through web conferencing for any queries.

As clients can view and understand their data with ease, they are prepared to understand your strategy to improve their financials, which can optimize business operations.

- Connect with your customers conveniently

- Clients and accountants are on the same page

- Serve your clients better with a faster and more efficient process

Also Read: Customer Service Software: How does it benefit your small business?

-

Diverse roles for accountants

The most dreaded aspect of accounting for accountants is the manual work of compiling and computing data. However, this is possible with the click of a button.

The development of technology such as software and applications has changed the role of accountants. Now they have more time in hand to perform strategic tasks. They can now turn their direction from number-crunching and time-consuming task to a more specialized and strategic task.

These specialized tasks include data analysis and interpretation, financial advice, and business consulting services. They can now be involved in the company’s ongoing operations.

How can accounting firms increase productivity through technology?

The competitiveness of an organization depends on how efficient its workforce is and not on its size of it, or how effectively you recruit and retain. With technology, every organization can increase the productivity of their employees.

Look at how you can take advantage of digital technology to increase productivity at your place.

Streamlining data

There has been a move towards technology in the accounting space, which has occurred in recent times. During the times of covid-19 organizations had to shut down and employees had to work remotely with different expectations.

Accountants have to adapt to technology and change to deliver the results to their clients. The most common task an accountant takes is tax preparation, which can be easily streamlined through an efficient process with no or fewer touchpoints.

Anything from engagement letters, collection, and collating of source documents, preparation, signing, and filing of returns is possible through automation.

Smart integrations

Imagine if all the systems in an accounting firm were integrated. Each system talks to the other. This is when the magic happens.

When a client logs into the system to see your proposal and digitally signs it, it triggers the workflow, creating the task you need to complete. Once you complete the job, the system automatically knows to create an invoice which is sent to the client. Or they may automatically charge it to their credit card.

Attract and retain the best team

Implementing the best in class technology will help you attract and retain the best talent in your organization. As more and more accountants want to improve their work-life balance, there is a greater effort on remote working, flexible hours and more efficient ways to complete their tasks.

Technology has played an important role in meeting these requirements. The next generation of accountants has grown up with technology. They can access the data with a single click of a button to ensure a seamless experience. That is why they will look for firms with strong tech options.

Advantages of accounting technology

Computerized and digitalized accounting have various benefits and below are some of them.

-

Accounting technology increases automation

To ensure that all the calculations are error-free, accountants need more than pen and paper, which can take care of generating invoices automatically and handling all manual calculations.

-

Accounting technology improves data accessibility

With improved accounting software, you do not have to search for information in endless piles of paper. All information is easily accessible at any time and anywhere.

-

Accounting technology increases accuracy

These systems are designed for 100% accuracy right down to the last details. Once you enter the details, it automatically calculates and displays the output.

-

Accounting technology increases reliability

Computerized systems are more reliable than ever. They can take care of the task when you type in a command. You can count on these systems to get all of your work done in no time.

-

Accounting technology increases speed

A machine is always going to be faster than humans. Statement generation, report making and data analysis are possible with the click of a button.

-

Accounting technology improves data security

Now you can control who has access to different parts of the system, which adds extra security to the data. You can use a full backup of the database on cloud storage to restore it as and when required.

-

Accounting technology increases scalability

All these systems can scale according to the size of your business. You can store a large amount of data on cloud storage according to your requirement.

-

Accounting technology improves visuals

You may view files and databases of the clients in an electronic medium, which is easier than compared to looking at handwritten documents.

-

Accounting technology increases cost-effectiveness

Using these systems will help you file data more efficiently. You can save a lot of money on accountant’s fees, reports creation and paper filing.

What technological skills should accountants learn?

During earlier times, accountants used to spend their time in manual entries and searching for mistakes. But with new computer technologies, accountants can accomplish more in less time and shift their focus toward analytical work.

There is an increased role of technology in accounting. Employers are looking to hire accountants with greater computer literacy and improved computer skills.

Some of the specific skills employers are looking for in potential candidates are:

- Advanced Excel Skills

- Understanding of Enterprise Resource Planning Systems

- Experience with Cloud Computing

- Payroll software

- Business Intelligence software

- Data Analytics

How is technology changing the future of accounting?

Gone are the days when accountants used to crunch numbers, create ledgers, and count incoming and outgoings. Sophisticated technologies have changed the role of the accountant into a consultant.

Here are a few ways in which technology has changed the accounting domain:

Moving away from Manual

A lot of repetitive and manual tasks are now computerized. These technologies can take different data such as invoices, receipts, and timesheets, to generate reports so that accountants can analyze financial positions in real-time.

Adopting Automation

Moving away from pen and paper-based systems to spreadsheets and accounting software has many benefits. It includes a single source of information available and can be accessed from anywhere in the world. This improves communication and allows for tackling workflows.

Strategic Accounting

New technology has changed the role of accountants into more of business advisors. These changes have increased analytical growth, improved decision making and moved businesses towards growth.

How to improve technology in accounting firms?

When accounting firms are going through a transformation, they don’t need to invest in complex or expensive tech. Even some small investments can quickly pay for themselves. Here are some of the easy and cheap tips to improve technology at your accounting firms.

Update your hardware and software system

The modern accounting generation will require modern hardware and software systems to work efficiently as they have grown with the technology. They need the information to be accessible quickly.

Old and cumbersome hardware can malfunction or may experience downtime. Investing in modern equipment should increase the productivity and efficiency of your employees.

With cloud technology in place, the software is updating frequently with new features added every moment. If you are not looking at them, then you are behind.

Check whether your current software is helping you or your team to accomplish the work. Test out new software that might bring in the required features that allow your team to work on top. Or, switch to better alternatives to the same software that is outdated or not supported.

Automate and integrate various systems

As we know, accounting software is transformative for both clients and accountants. They can do tasks up to 5 times faster than completed manually, ensuring automation in each step.

The benefits of automation are enormous. You should turn to greater responsibilities for your employees through re-skilling to adapt to the ever-changing landscape of accounting.

One of the great places to manage your human resources is our software, which is an all-in-one human resource management system that includes payroll, leave management and a complete HR solution.

Upskill your personnel

Learning and development of the current workforce is important and you should not skip them, send your people to a conference or learning opportunity and ask them to summarize the learning when they return.

Connect with external experts to get feedback from your employees on what they require. It will be a better way of doing it. The software licensing agreement comes with in-depth training that can better train your employees to use the technology.

Invest in security

Most data breaches go through employees, training them and passing on information is your responsibility. Identify the person who handles the security department of your organization and ask them to tighten up the security. Today, mobile phones are the ones most vulnerable to data breaches and therefore hire someone to make mobile phones more secure.

Start with better communication

It is time to take inter-office communication to the next level. You can segment your employees based on department and project types to them share information more easily. You can find a collaboration hub like Slack that lets you and your teamwork together. In slack, you can organize multiple channels so that departments can split up to improve communication.

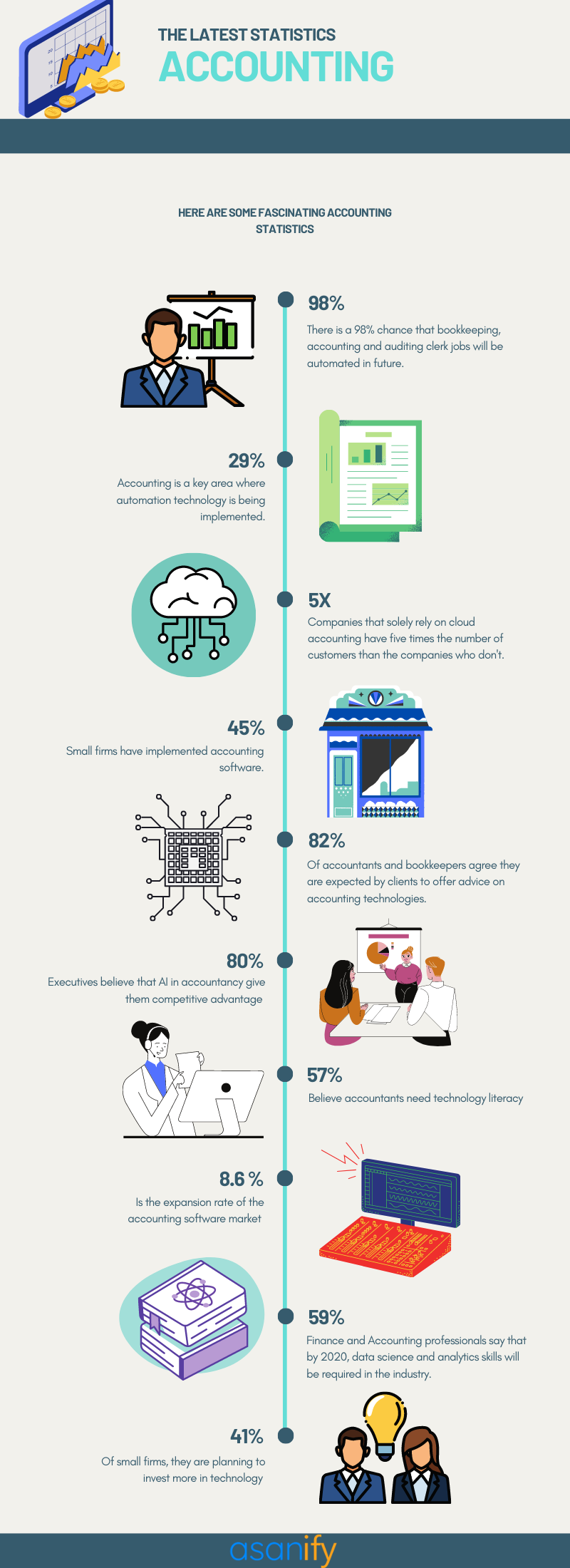

Overview – Accounting Technology Statistics

Not to be considered as tax, legal, financial or HR advice. Regulations change over time so please consult a lawyer, accountant or Labour Law expert for specific guidance.

![You are currently viewing Latest tips on how to Improve Accounting Technology at Your Firm [2022]](https://asanify.com/wp-content/uploads/2022/04/blog-covers-2240-×-1500px-21-1.webp)

![Read more about the article Holiday List 2023 Download PDF [India] Government and State Holidays](https://asanify.com/wp-content/uploads/2023/01/blog-covers-2240-×-1500px-47-2-300x174.webp)